Frequently Asked QuestionsChapter 312

Tax Abatements

What is a tax abatement?

A tax abatement is an agreement between a local government and a property owner to exempt part of the taxes owed in return for improvements to the property. Abatements are governed by Tax Code, Chapter 312. Local taxing units can use abatements to attract development to their jurisdictions.

Why do local governments grant tax abatements?

Tax abatements reduce the cost to property owners of new development. This can help new businesses move to the region or help existing businesses expand. In return, the local government gets increased property values that will raise the tax base and, possibly, provide new jobs.

What are the benefits of a tax abatement?

While tax abatements are short-lived, they can have a significant future impact:

- They reduce unemployment. A new business creates jobs. People employed by the business may use their income to build homes and buy goods and services, cars and other personal necessities.

- They strengthen other businesses. Established businesses benefit when a new business opens. The increase in patrons allows other businesses to grow by investing in capital improvements and hiring new employees.

- They increase tax revenue. When an abatement is offered, a city still benefits from increased tax revenues. Employees of a new business spend their money at local stores (which boosts sales tax receipts) and often build new homes (which increases property tax receipts). These things occur without the need to increase tax rates.

- Tax receipts continue to grow long term after the abatement expires. Once a business is well-established within a community, the improvements and facilities that are added can be taxed. The tax rate and revenue from developed property is higher than on undeveloped property. This creates a long-term source of revenue for the city.

- They provide a flexible economic development tool. Abatements can be viewed as a flexible option compared to other economic development tools since infrastructure improvements or risky building ventures could become fixed costs. Without the abatement, it may be financially unfeasible for retailers to build on a certain area, due to features like underground pipelines, stormwater storage or floodplain.

Which local governments can grant tax abatements?

Any local government that collects ad valorem tax can grant an abatement, but typically only a city or county can grant the first abatement on a particular property.

What type of property can be abated?

Abatements can be granted for taxable real property, personal property or both.

Are there any prerequisites for granting abatements?

Yes. Each taxing unit must pass a resolution stating its intention to grant abatements and establish guidelines and criteria that will govern the abatement agreements. Abatements can only be granted for property within a reinvestment zone.

Are there reporting requirements for tax abatements?

Yes. Any appraisal district that includes a tax abatement reinvestment zone or abated property must submit reports about the zone and the abatement agreements to the Texas Comptroller of Public Accounts.

Guidelines and Criteria

What should a taxing unit include in the guidelines and criteria?

The taxing unit should include:

- the criteria a property must meet to be eligible for a tax abatement;

- the terms of the agreement the taxing unit will offer; and

- any other investments the property owner will be required to make.

How long are the guidelines and criteria effective?

They are effective for two years from the date they are adopted. After they expire, the taxing unit will have to readopt them or adopt new guidelines and criteria if the taxing unit wishes to continue to grant abatements.

Can the guidelines and criteria be amended or repealed?

Yes, but while they are in effect, they can only be amended or repealed with a three-fourths vote by the taxing unit's governing body. After they have expired, the taxing unit can adopt different guidelines and criteria.

Since ISDs can create a reinvestment zone but cannot give an abatement, are they required to submit the guidelines and criteria plus the resolution to the Comptroller? Do the guidelines and criteria contain more than the rules for abatements and if so, what else are they to contain/cover?

The chief appraiser is required to report guidelines and criteria governing tax abatement agreements. School districts may not enter into tax abatement agreements after Sept 1, 2001. Guidelines and criteria or an abatement resolutions are only reported for agreements executed before Sept 1, 2001.

What is the effect of a tax abatement that is granted by a county if the county’s tax abatement guidelines and criteria are out of date (for instance, they did not renew the guidelines every two years) Is the abatement void?

312.002(c) suggests that the guidelines last only two years unless new ones are approved. If an abatement is given during the validly existing guidelines, then the abatement is valid regardless. This is confirmed in 312.203 when discussing the expiration of reinvestment zones. The last sentence provides, “The expiration of the designation does not affect an existing tax abatement agreement made under this subchapter.”

Reinvestment Zone

Who can designate a tax abatement reinvestment zone?

The governing body of a city or a county can designate an area as a reinvestment zone.

How do cities and counties designate reinvestment zones?

After holding a public hearing and finding the area meets statutory requirements, a city or county designates a reinvestment zone by ordinance or order.

Where can cities and counties designate reinvestment zones?

A city can designate a reinvestment zone within the city limits, in the city's extraterritorial jurisdiction or both. A county can designate a reinvestment zone within the county, but only outside city limits.

Does a city or county have to designate its whole jurisdiction as a reinvestment zone?

No. A reinvestment zone can be as large as the city or county or as small as one property. Cities and counties can designate multiple reinvestment zones in different sections of their jurisdictions.

What are the criteria an area must meet to be designated a reinvestment zone?

A city or county must find that designating an area as a reinvestment zone would:

- contribute to the retention or expansion of primary employment; or

- attract major investment in the zone that would benefit the property included in the zone and would contribute to the economic development of the city or county.

Cities must also find that the improvements sought are feasible and practical and would benefit the land included in the zone and the municipality after a tax agreement expires.

What must the ordinance or order designating the zone include?

It must describe the boundaries of the zone and the eligibility of the zone for residential tax abatement or commercial-industrial tax abatement.

Can a property be located in a reinvestment zone designated by a city and in a reinvestment zone designated by a county?

Yes, if it is in the city's ETJ.

How long does a reinvestment zone last before expiring?

A zone that has been designated for tax abatements expires five years after the date of the designation.

Can a reinvestment zone be renewed when it expires?

Yes, a zone may be renewed for another five years each time it expires.

Is there a proper format or standard to name a reinvestment zone?

Yes, the Comptroller requires all taxing units to properly name a reinvestment zone or enterprise zone in the correct format. This format applies to all taxing jurisdictions that create a new reinvestment zone.

Refer to Reinvestment Zone Nmaing Standards for details.

Is a Neighborhood Empowerment Zone (NEZ) (Local Government, Chapter 378) the same thing as a reinvestment zone (Tax Code, Chapter 312)? Do NEZs have a reporting requirement?

The Chapter 312 reporting requirements do not apply to a NEZ agreement.

A Chapter 378 agreement can abate municipal taxes on property in the Neighborhood Empowerment Zone (“NEZ”). It is different from a Chapter 312 agreement. Chapter 378 NEZ agreements and agreements under Chapter 312 share a couple of similarities, which are: NEZ agreements have the same 10-year duration limit as Chapter 312 agreements and when the municipality adopts a NEZ, the resolution must include a finding that the requirements under Section 312.202 as applied to the NEZ are satisfied.

Public Meetings/Public Notices

When must a city or county give notice of its intent to adopt an abatement agreement?

Once a reinvestment zone is designated, the governing body of a city or county may enter into a tax abatement agreement with the property owners for a period not to exceed 10 years. Once the agreement is approved by the governing body at a regularly scheduled meeting, it may be executed after notice to other taxing units.

At least 30 days public notice of the meeting on the approval of a tax abatement agreement is required. The notice should be given in the manner prescribed by the Open Meetings Act. Among other requirements, the notice must contain: 1) the property owner's name and the applicant's name in the agreement; 2) the name and location of the reinvestment zone subject to the agreement; 3) a general description of the nature of the improvements or repairs in the agreement and 4) the estimated cost of the improvements or repairs.

Must a city or county hold a public hearing before granting an abatement?

The governing body must convene at a regularly scheduled meeting (i.e. open to the public) to vote on approving a tax abatement agreement. By an affirmative majority vote, the governing body may approve a tax abatement agreement upon finding that the agreement terms and property meet the applicable guidelines and criteria governing tax abatement agreements.

What notice is required for a public hearing about a reinvestment zone?

Once guidelines and criteria have been adopted, the governing body of a city or county may designate an area as a reinvestment zone after a public hearing.

A seven-day newspaper notice of the public hearing is required, in addition to a seven-day written notice to other taxing units in the proposed area before a public hearing may be conducted. The newspaper must be in general circulation in the city or county. Notice to the other taxing units is presumed delivered when properly addressed to the appropriate presiding officer for each taxing unit and placed in the mail or sent via registered or certified mail with a return receipt received.

The governing body of a city or county conducts the public hearing to determine whether the area for designation qualifies as a reinvestment zone. At the hearing, interested persons are entitled to speak and present evidence for or against the designation of the reinvestment zone.

Must a local taxing unit publish public notice and hold a public meeting to adopt guidelines and criteria?

Before the designation of a reinvestment zone, a city or county must first establish guidelines and criteria governing tax abatement agreements, which must be available for both new and existing facilities/structures. The governing body of a taxing unit must hold a public hearing regarding the proposed guidelines at which the public is given the opportunity to be heard. The guidelines and criteria are effective two years from adoption and can be changed with a three-fourths vote of the governing body. A taxing unit with a website must post the adopted guidelines and criteria online.

If notice to taxing entities is provided 7 days prior to a hearing, along with a copy of a proposed agreement, does the County have the ability to continue negotiating terms of the agreement during those 7 days? Do local taxing units have the ability to make changes to the agreement after they have provided the taxing entities a copy prior to execution?

If the proposed agreement is changed during the 7 days leading up to the meeting, there won’t be sufficient time to send a copy of that agreement to the taxing units. It’s the intent of the statute that municipalities/counties send taxing units where the property is location notice of the municipality/county’s intention to enter into an agreement and a copy of the proposed agreement (i.e. the agreement that will be considered for approval at the meeting.) in accordance with Section 312.2041(a).

While written to address municipalities, does the “Notice of Tax Abatement Agreements to Other Taxing Units” (Section 312.2041) extend to counties as well?

Yes. It is covered in Subchapter C. Tax Abatement in County Reinvestment Zone, Section 312.402(a-2), which provides that “[t}he execution, duration, and other terms of an agreement entered into under this section are governed by the provisions of Sections 312.204, 312.205, and 312.211 applicable to a municipality. Section 312.2041 applies to an agreement entered into under this section in the same manner as that section applies to an agreement entered into under Section 312.204 or 312.211.”

Abatement Agreement

What are the steps for approving an abatement agreement in a city or county?

What property can a local government abate?

A local government can abate:

- residential or commercial/industrial real property that is subject to ad valorem taxation in a reinvestment zone if the owner or leaseholder agrees to make improvements to the property;

- a property owner's real property or tangible personal property that is located on the real property; and.

- property subject to ad valorem taxation, including a leasehold interest, improvements or tangible personal property located on the real property that belongs to the owner of a leasehold interest in tax-exempt real property

Can anyone receive an abatement?

No. Abatements cannot be granted on property owned or leased by a member of the city council, the zoning board, or the city's planning board or a member of the county commissioners court.

How much value can a local government abate?

Each year of an abatement agreement, a local government can abate up to 100 percent of the property value minus the value of the property the year the agreement was executed.

How many years can a property be abated?

A property can be abated up to 10 years per agreement.

Can a local government grant another tax abatement to the same property?

Only if the new agreement is for new improvements that will be made to the property.

What is the process for granting and approving an abatement?

A local government must send written notice to the presiding officer of the governing body of every other taxing unit that taxes the property. The notice must include a copy of the proposed abatement agreement and be sent at least seven days before the agreement is executed.

To be effective, a tax abatement agreement must be written and it must be approved by majority vote of the members of the governing body of the taxing unit at a regular meeting.

The abatement typically begins on Jan. 1 of the year after it is executed unless the agreement stipulates a later start date.

SEC. 312.2041, SEC. 312.207, SEC. 312.007What specific terms does a tax abatement include?

A tax abatement agreement must:

- list the kind, number and location of all improvements to the property that will be made;

- allow local government employees to access and inspect the property to ensure the terms of the agreement are met;

- limit the uses of the property during the abatement period to uses that encourage development;

- provide for the recapture of tax revenue if the owner fails to make the agreed upon improvements;

- contain each term agreed to by the owner of the property;

- require the property owner to certify annually that the owner is in compliance with the terms of the agreement; and

- provide that the governing body of the local government may cancel or modify the agreement if the property owner fails to comply.

A tax abatement agreement may also include:

- improvements or repairs the local government will make to streets and utility services, as long as the fees for those improvements are not reduced;

- an economic feasibility study;

- a map showing existing uses and conditions of property in the zone;

- a map showing proposed improvements and uses in the zone;

- proposed changes to local ordinances; and

- provision for the recapture of tax revenue, along with penalties and interest, if the owner fails to meet other terms of the agreement.

Does each tax abatement agreement have to have the same terms?

All the agreements made in a zone must have the same terms for value abated and duration. Different reinvestment zones can have different terms.

Which entities can grant abatements?

Any taxing unit, except a school district, that has jurisdiction over a property can grant an abatement. If the property is:

- in the city limits, the city must grant an abatement before another taxing unit is allowed;

- outside the city limits and the city's ETJ, the county must grant an abatement before any other taxing unit can; or

- within the city's ETJ, any taxing unit can grant an abatement first.

If the county commissioners court sets the tax rate for another taxing unit, the court can offer an abatement on behalf of that taxing unit for a property the county has already abated.

SEC. 312.204, SEC. 312.206Do other taxing units have to offer the same terms as a city or county?

No. Once a city or county grants an abatement, another taxing unit can offer an abatement to the property owner with the same or different terms.

Can an abatement agreement be changed?

Yes. Any time before the abatement expires, the local government can modify the terms of the agreement, assign it to a new owner of the property or cancel the agreement entirely.

Can abated taxes be recaptured?

Yes. If the property owner fails to make the agreed upon improvements, the taxing unit can recapture tax lost because of the abatement. If the agreement includes the required provision, a taxing unit can also recapture taxes if the property owner fails to create an agreed upon number of new jobs or fails to meet any other provision of the agreement.

Reporting

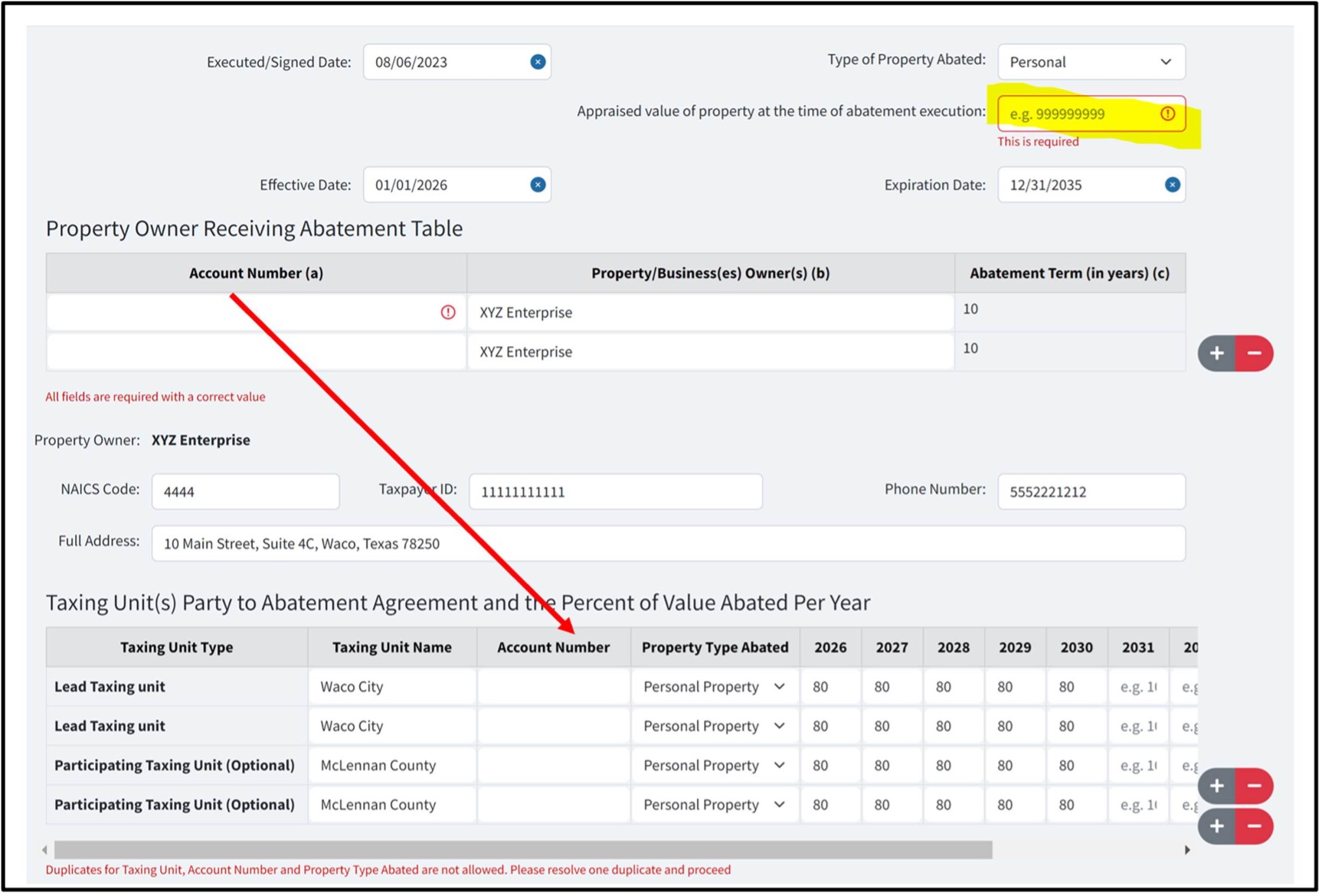

How do CADs report the value of future property in the eSystems online New Abatement Agreement form?

When an agreement between the taxing unit and a business is executed pertaining to the abatement of a property that will be built in a future year (2+ years), the CADs are unable to report the value of the “abated tangible personal property” (see yellow highlighted section below) because the property is yet to be built.

Because no such personal property exists, this means the CAD cannot yet assign an account number for the tangible personal property (red arrow seen below).

Sample Scenario

XYZ enterprise has been granted a 10-year abatement for construction of wind turbines. These turbines will be constructed on 25 acres that belong to landowner Joe Smith. Joe has agreed to lease his land to XYZ for placement of wind turbines. There is no abatement given to Joe. Primary use of the land will remain agricultural. The appraisal district’s account number for the land is 1-00000-0241-03-01800. Legal description of the land is: Abstract 241, Section 3, Tract 18.

Two Solutions:

Note: The response provided in the New Abatement Agreement online form will need to be updated on the Modified Abatement Agreement online form.

Solution 1 – Recommended Response

For future construction of personal property improvements without assigned account numbers at the time of reporting, provide the account number associated with the location of the future improvements on the online New Abatement Agreement form. This property is not included in the abatement but provides the location of the future improvements. You also can report the appraised value of the abated property at the time of the abatement execution as $0.

Account Number: 1-00000-0241-03-001800 Parent; or R123478

Parent Appraised Value of Abated Property at Time of Abatement Execution: $0

Include the location’s account number with the word “Parent” at the end. When the property is added to your appraisal roll, update the account number field in the online Modified Abatement form with the account number associated with the abatement.

Solution 2 – Alternate Response

Because there is no personal property yet on the land at the time of the agreement’s execution and won’t be for more than a year, a possible response would be for the CAD to report zeroes in the account number fields and in the appraised value of the abated property at the time of abatement agreement on the online New Abatement Agreement form.

Account Number: 00000

Appraised Value of Abated Property at Time of Abatement Execution: $0

When the property is added to your appraisal roll, update the account number field in the online Modified Abatement form with the account number associated with the abatement.

Who is required to submit reports to the Comptroller?

The chief appraiser of each appraisal district containing a reinvestment zone or executing a tax abatement must report information about the zone and the abatement to the Comptroller. However, the taxing units must provide the relevant information.

What reports are required?

Refer to Reporting Requirements for required documentation.

What does the Comptroller do with the information submitted?

The Comptroller compiles information about reinvestment zones and abatements and submits a report to the Legislature and the governor before each legislative session. Information about all reinvestment zones and abatements are publicly available in the searchable databases found here on Comptroller.Texas.Gov.

What information about abatements is available to the public?

The searchable Local Development Agreements Database contains information about abatements and is available to the public. More searchable databases can be found here on Comptroller.Texas.Gov.

The Comptroller's Data Analysis and Transparency Division can answer questions by phone at 800-531-5441 ext. 5-0664 or by email. Additional information can be obtained by submitting a written request to open.records@cpa.texas.gov.

Post Abatement Property Value Reports

Who must report post abatement property values?

Chief appraisers of appraisal districts with tax abatement agreements.

What is the purpose of post abatement property value reporting?

The purpose of the reports is to ensure the abatement permanently increased property values rather than giving a temporary boost or resulting in a business that is willing to leave the community.

How is the report filed?

The Post Abatement Property Value Report is filed using eSystems. For more information, refer to Submitting Required Reports.

Should the report be filed for cancelled or terminated tax abatement agreements?

No.

What is the deadline for filing the Post Abatement Valuation Report, and how often must it be submitted?

The first annual report is due one year after the expiration of the tax abatement agreement, and the second and third reports the following years.

What happens if the Post Abatement Valuation Report is filed early? (Example: a tax abatement agreement expired on Jan. 1, 2020 and the form is submitted on May 1, 2020)

An early submission of the Post Abatement Valuation Report won't be considered. In accordance with the statute, the chief appraiser must file the form when it is due.

If two or more taxing units execute separate tax abatement agreements on the same property, can a single Post Abatement Valuation Report be filed for all agreements?

No. File the Post Abatement Valuation Report for each tax abatement agreement expiring on or after September 1, 2020.

What happens if the current year's appraised value of a property is not available?

Report the preceding year's appraised value if the current year's appraised value is not available at the time the Post Abatement Valuation Report is filed.

How does a chief appraiser report the appraised value of multiple properties that were subject to a tax abatement agreement?

The Post Abatement Valuation Report allows multiple properties associated with a tax abatement agreement to be included in one submission. To add another property to the form, select “Yes” to the last question, which asks whether there are additional properties/lots associated with the agreement, and then input your answers to the questions for that property. Continue to answer “Yes” to the last question until you have added all properties associated with the agreement.

Other

Does the Comptroller's office provide assistance to local governments regarding tax increment finance?

Yes. The Comptroller does offer guidance and technical assistance to city's interested in tax increment finance.

Need Help?

For additional information, contact the Data Analysis and Transparency Division via email or at 844-519-5672.