Special to the 86th Legislature: Biennial Revenue Estimate and Texas Legacy Fund

Jan. 7, 2019

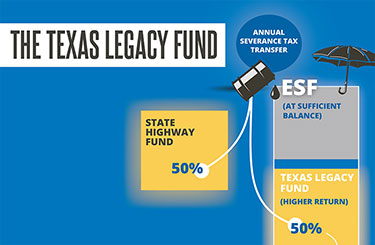

The Texas Legacy Fund

“It was like burying the money in a hole on the Capitol lawn.”

That was Texas Comptroller Glenn Hegar’s reaction upon discovering that state law required his office to hold billions of dollars within the Economic Stabilization Fund (ESF) without investing the money to keep pace with inflation. The Legislature has since allowed the Comptroller’s office to invest part of the ESF so that it can earn enough to cover inflation.

The Comptroller’s office is proposing a more significant change: creation of the Texas Legacy Fund. A portion of the ESF would be used to establish an endowment that could generate more revenue to address Texas’ long-term financial obligations. The proposal would maintain a healthy balance in the ESF and preserve its ability to protect state finances in times of economic volatility.

- A Chance to Guarantee Texas’ Legacy

- Coming Out of the Rain to Realize Gains

- Investing More of the Rainy Day Fund isn’t Risky

- Why it’s Urgent for Texas to Restructure its Rainy Day Fund

- Restructure the Rainy Day Fund for Growth, Better Security

- A Better Way to Use the State's Rainy Day Fund

- The Economic Stabilization Fund: A Texas Legacy

Texas Comptroller Glenn Hegar Releases Biennial Estimate

(AUSTIN) — Texas Comptroller Glenn Hegar released the Biennial Revenue Estimate (BRE) today, showing the state is projected to have approximately $119.1 billion in revenue available for general-purpose spending during the 2020-21 biennium.

The revenue estimate represents an 8.1 percent increase from the amounts available for the 2018-19 biennium. Hegar warned, however, that substantial supplemental appropriations could affect revenue available for the 2020-21 biennium. Read more »

Download the 2020-2021 Biennial Revenue Estimate (PDF)

May 2019 Update to the Biennial Revenue Estimate (PDF)

The Making of the Biennial Revenue Estimate

Months of intense work go into the making of the BRE. It’s one of our constitutional responsibilities, and it’s an essential part of Texas’ budget process.

A Deep Dive Into the Texas Budget

There’s more than meets the eye when it comes to the state’s budget. Special issues of Fiscal Notes examine growing financial demands and the forces that drive Texas’ budget.

Biennial Revenue Estimate

A CLOSER LOOK

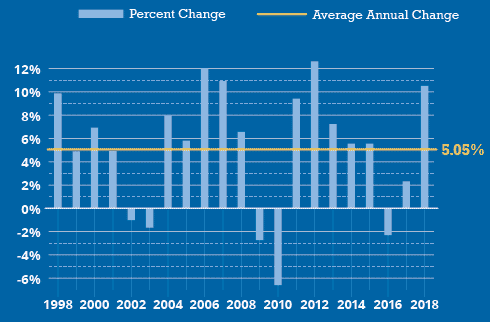

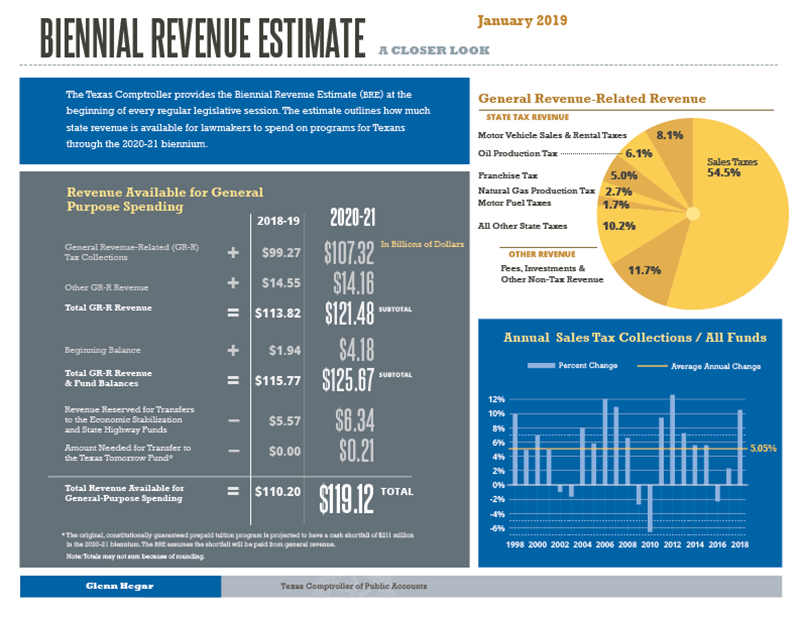

The Texas Comptroller provides the Biennial Revenue Estimate (BRE) at the beginning of every regular legislative session. The estimate outlines how much state revenue is available for lawmakers to spend on programs for Texans through the 2020-21 biennium.

Revenue Available for General Purpose Spending

In Billions of Dollars

| Revenue | 2018-19 | 2020-21 | |

|---|---|---|---|

| General Revenue-Related (GR-R) Tax Collections | $99.27 | $107.32 | |

| Other GR-R Revenues | plus$14.55 | plus$14.16 | |

| Total GR-R Revenues | equals$113.82 | equals$121.48 | SUBTOTAL |

| Beginning Balance | plus$1.94 | plus$4.18 | |

| Total GR-R Revenue & Fund Balances | equals$115.77 | equals$125.67 | SUBTOTAL |

| Revenue Reserved for Transfers to the Economic Stabilization and State Highway Funds | minus$5.57 | minus$6.34 | |

| Amount Needed for Texas Tomorrow Fund* | minus$0.00 | minus$0.21 | |

| Total Revenue Available for General-Purpose Spending | equals$110.20 | equals$119.12 | TOTAL |

* The original, constitutionally guaranteed prepaid tuition program is projected to have a cash shortfall of $211 million in the 2020-21 biennium. The BRE assumes the shortfall will be paid from general revenue.

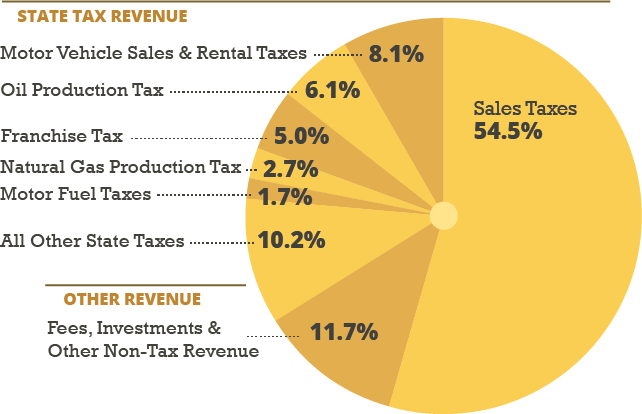

General Revenue-Related Revenues

| Revenue Source | Percent of Total |

|---|---|

| Sales Taxes | 54.5% |

| Motor Vehicle Sales and Rental Taxes | 8.1% |

| Oil Production Tax | 6.1% |

| Franchise Tax | 5.0% |

| Natural Gas Production Tax | 2.7% |

| Motor Fuel Taxes | 1.7% |

| All Other State Taxes | 10.2% |

| Other Revenue | 11.7% |

View Larger

View Larger