A Chance to Guarantee Texas’ Legacy

June 20, 2018

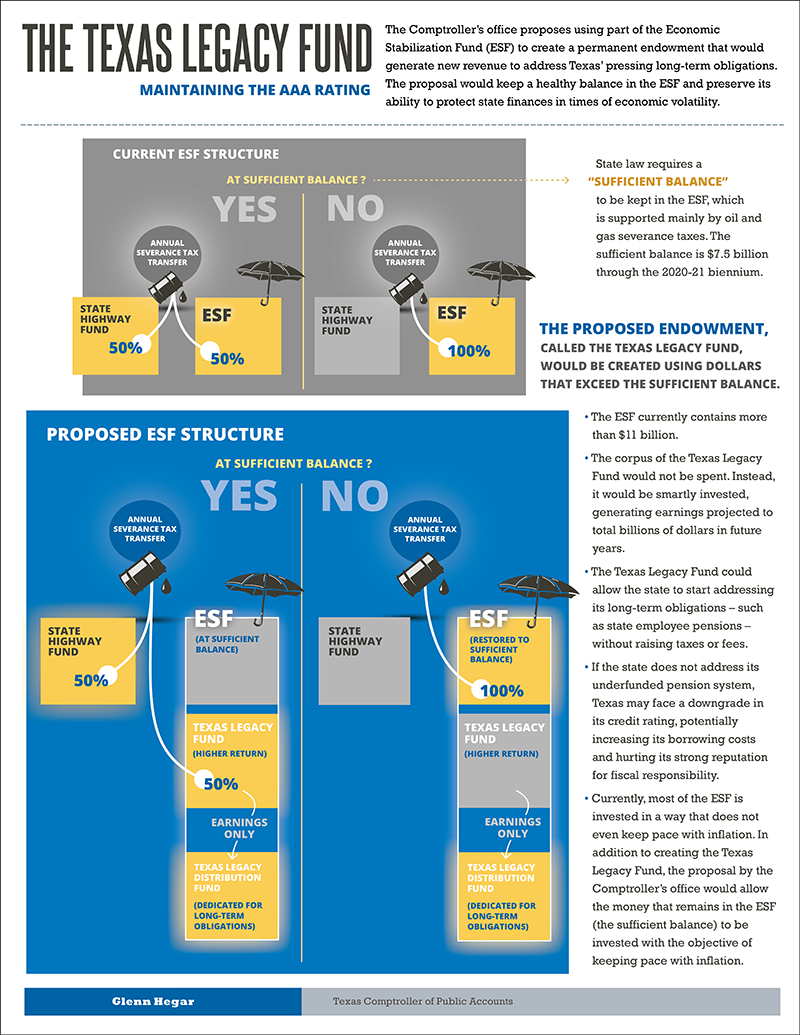

In previous columns, I’ve discussed our proposals for a better way to invest part of the state’s $11 billion Economic Stabilization Fund (ESF) — what folks usually call the “Rainy Day Fund.” At present, state law requires us to keep much of the revenue in the ESF invested in a way that isn’t even beating the inflation rate.

We’ve designed a prudent way to protect these funds against inflation while earning more for important state purposes. The additional earnings could be put to good use in what we’ve dubbed a “Legacy Fund”: a permanent endowment that would generate revenue to help the state cope with the rising costs of long-term obligations we face, such as employee pensions, retiree health care and infrastructure maintenance and expansion.

While it’s a new idea for Texas, I think it’s important to note that other states have similar programs.

In 2010, for instance, North Dakota voters approved the creation of a Legacy Fund for their state as “a perpetual source of state revenue from the finite natural resources of oil and natural gas.” The fund receives 30 percent of the state’s oil and gas tax revenue. And with a more aggressive investment strategy in place, its returns have been spectacular.

As of March 31 of this year, North Dakota’s Legacy Fund had earned more than $1 billion on $4.3 billion in principal. And the principal can’t be touched without a two-thirds vote by both houses of the state’s assembly. It’s generating returns we can only dream about under current law.

In fact, at this point we’re the only major energy-producing state without an endowment fund taking advantage of recent gains in oil and gas tax revenue. A 2016 study by Pew Charitable Trusts noted that, of nine states receiving more than 5 percent of their total revenue from severance taxes, only Texas and Oklahoma didn’t have a fund of this kind.

In April of this year, though, Oklahoma legislator John Montgomery tweeted out a message: “We have a chance to beat Texas at something.” And it looks like they will. The 2018 Oklahoma legislative session approved an “Oklahoma Vision Fund” to complement its rainy day fund. If approved by voters in November, the Vision Fund will receive a small share of oil and gas tax revenue to act as an endowment for the state. These funds will be invested primarily in stocks and similar securities, again producing the kind of investment returns we simply can’t obtain without a change in Texas law.

My point is that a Texas Legacy Fund isn’t a leap in the dark. There are solid precedents for what we’ve proposed. And I believe it’s a necessary step if we’re to maintain the solvency of our state government and the health of our economy.

As always, I encourage you to keep up with our office via Twitter and Facebook.

Thank you for all you do for Texas, and God bless,

Glenn Hegar