Coming Out of the Rain to Realize Gains

April 9, 2018

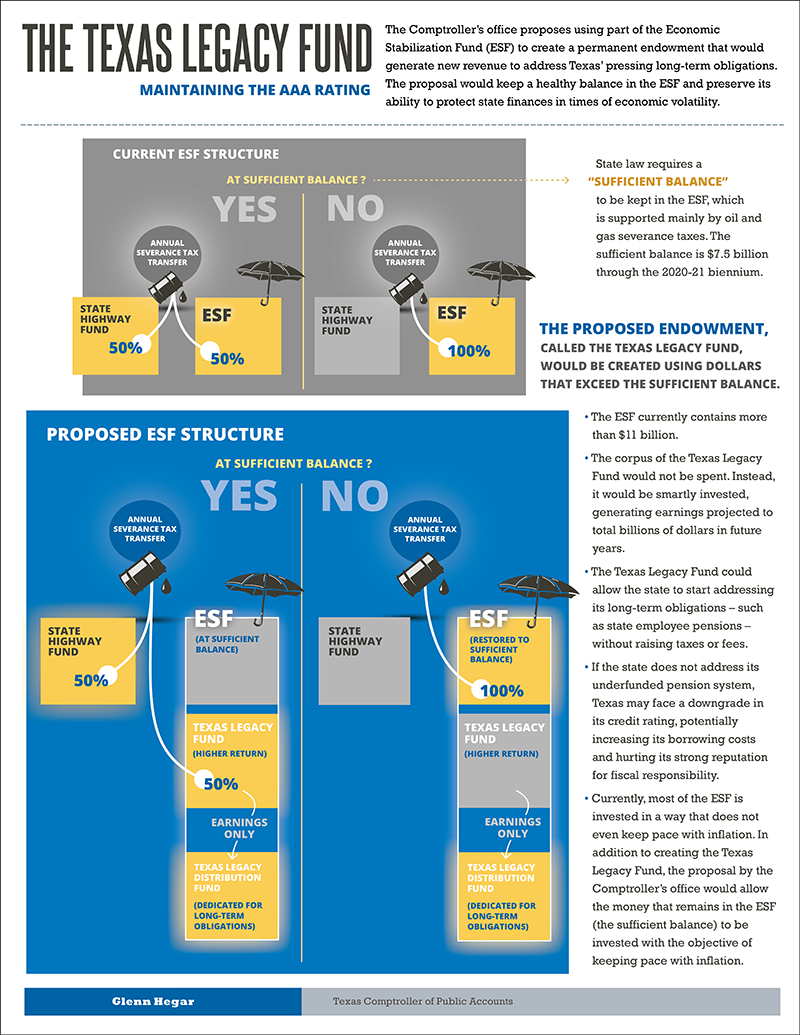

There’s a healthy conversation going on in Austin circles about the best way to responsibly manage Texas’ $11 billion Economic Stabilization Fund, or rainy day fund.

I’ve made some common-sense proposals about ways to grow the fund — while safeguarding it from inflation and market volatility — and earn some extra money for long-term budget needs.

It’s a subject we’ve needed to discuss for years, and I welcome the debate. But when my positions are mischaracterized, I must respectfully disagree.

On March 31, the San Antonio Express-News published a staff editorial critical of my proposals for the rainy day fund, and I set the record straight in an April 6 opinion piece explaining that “Investing More of the Rainy Day Fund Isn’t Risky.”

In case you missed the piece, I encourage you to read it and learn more about a rarely discussed risk to the rainy day fund — inflation — and why prudent investments could mitigate that risk and pave the way for solid future returns.

If left unchecked, long-term obligations the state faces, such as retiree health care and employee pensions, could lead to a downgrade in Texas’ bond rating — and a significant increase in the state’s cost of borrowing money. I argue better returns from the rainy day fund could be used to address at least some, though certainly not all, of these obligations.

Texas has a unique economic resource in the rainy day fund, yet present state law prevents us from getting the maximum benefit from it. I urge all Texans, taxpayers and legislators to recognize the fund’s potential — as a source of investment revenue, not just a piggybank. The Comptroller’s office currently manages and invests about $60 billion of taxpayer money, with admirable results during both flush and lean economic times. With the same care, the rainy day fund could serve as a key resource for the state, even when it’s not raining.

As always, I encourage you to keep up with our office via Twitter and Facebook.

Thank you for all you do for Texas, and God bless,

Glenn Hegar