A Better Way to Use the State's Rainy Day Fund

April 17, 2017

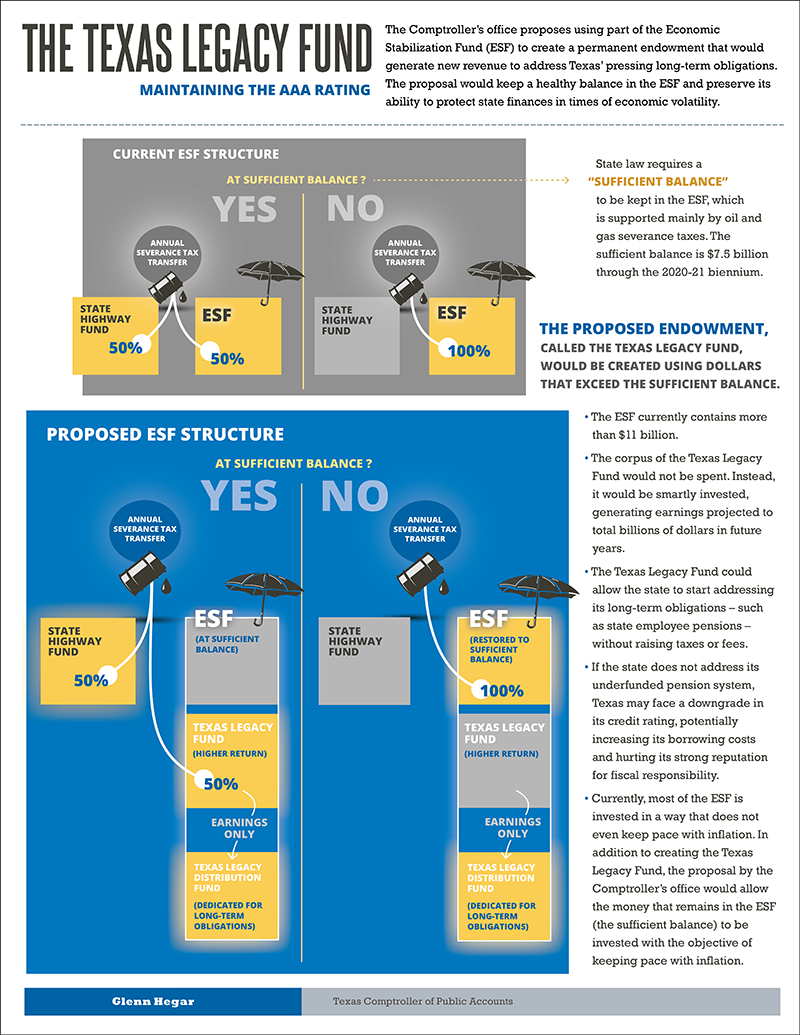

Most Texans know about our state's Economic Stabilization Fund (ESF) — the famous "rainy day fund," the largest of its kind in the U.S., with a current balance exceeding $10 billion.

The ESF is funded primarily with oil and natural gas production taxes. Back in 1987, when the Legislature passed the constitutional amendment creating the fund, no one dreamed it would grow to its current size. At the time, all forecasts predicted a steady decline in Texas energy production, and that was largely the case for many years. But then came the fracking boom.

Unfortunately, state law creating the fund was written with a relatively small ESF in mind, one kept in highly liquid, low-yield investments that could be tapped immediately. But the end result is that today, Texas has billions earning a little more than 1 percent in interest. That isn't even keeping pace with inflation. To put it very mildly, it's not the best use of these funds.

That's why we've devised a better way. It would maintain the original intent of the ESF — as a reserve to support state services in an economic downturn — while allowing us to generate considerably more revenue for important public purposes.

We're proposing to split the ESF into two tiers. Tier 1, the Texas Stabilization Fund, would be required to maintain a balance equal to 8 percent of general revenue spending and would be managed in a conservative way that still protects its purchasing power against inflation. It would maintain a healthy reserve for protection against any disruption in state finances.

As long as the Texas Stabilization Fund contains the required reserve balance, any additional new dollars headed for the ESF would flow into a second tier, the Texas Legacy Fund, which would operate similar to a permanent endowment for the state. This Fund would achieve a higher rate of financial return that would yield additional investment revenue to address the state's long-term balance sheet needs.

I've spoken and written about these issues since I became comptroller — commitments for paying off state debt, deferred maintenance, state employee pensions and other obligations that are growing steadily, year after year. They've been allowed to persist despite the very real chance they could snowball, ultimately threatening the state's budget and credit rating.

I recently wrote an op-ed on this topic for the Texas Tribune. I'll also be discussing this idea before a meeting of the House Appropriations Committee on the afternoon of April 17; you can watch the hearing live on the House video page.

As always, stay connected to Texas economic issues via our website, Twitter or Facebook.

Thank you for all you do for Texas, and God bless,

Glenn Hegar