Texas School Finance: Doing the Math on the State’s Biggest Expenditure

Published January 2019

Appendix I: A Legislative History of Texas School Finance

Article VII, Section 2 of the Texas Constitution establishes the Permanent School Fund (PSF), an endowment fund consisting of assets such as state lands, equity holdings and mineral rights, to provide a continuous source of funding for Texas public education.

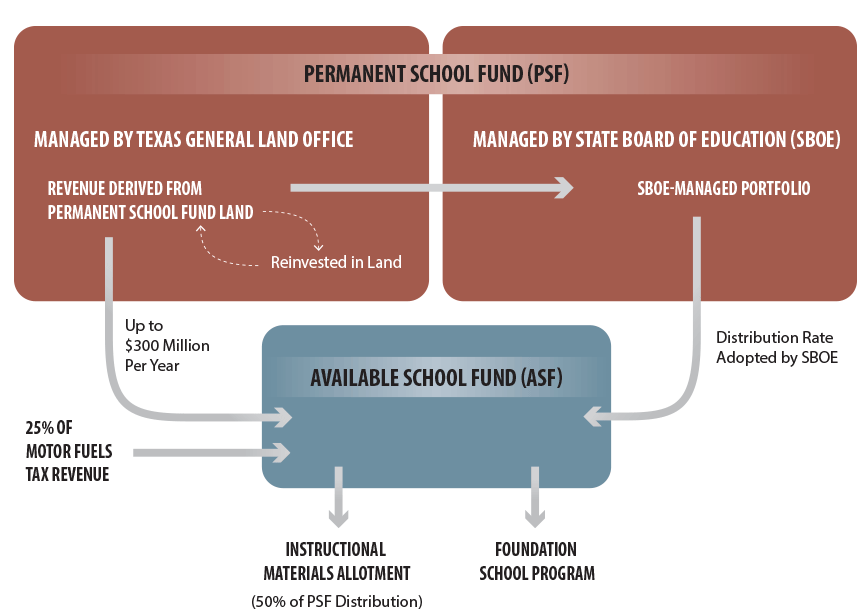

A separate Available School Fund (ASF) set out in Article VII, Section 5, is used to finance instructional materials and per-student distributions to school districts. The ASF consists of PSF investment returns and certain tax revenue; Exhibit 18 illustrates how funding flows between the two funds.51

Exhibit 18

FUNDING FLOW OF PERMANENT SCHOOL FUND AND AVAILABLE SCHOOL FUND

The Permanent School Fund (PSF) is a permanent endowment established by the Texas Constitution for the support of public schools, consisting of securities, state lands, mineral rights and royalties. The PSF is jointly managed by the General Land Office, which administers state lands, and the State Board of Education, which oversees a portfolio of securities that generate revenue for the PSF.

Revenues generated by the PSF flow into the Available School Fund (ASF), as does 25 percent of the state’s motor fuels tax revenue. The ASF supports the Foundation School Program and the Instructional Materials Allotment.

Source: Legislative Budget Board

The Gilmer-Aikin Laws, approved by the 51st Texas Legislature in 1949, were the earliest legislative efforts to establish a comprehensive public school finance system for the state. These laws created the Minimum Foundation Program — now the Foundation School Program (FSP) — a formula-based allocation system which today supports the operating costs of more than 1,200 Texas school districts through a combination of state ASF distributions and local property tax revenue.52

Since then, Texas legislators have enacted a series of major changes to the school finance system. The following timeline describes key legislative changes that shaped the current school finance system.

House Bill 72

68th Legislature, Second Called Session, 1984

- Increased state aid to school districts by 26 percent, from $3.6 billion to $4.5 billion annually

- Required the basic allotment to be calculated using the number of students in average daily attendance (ADA) rather than the number of personnel employed at a school district

- Adjusted a school district’s basic allotment based on certain factors:

- Price differential index: adjustment for variations in purchasing power among districts

- Small district adjustment: adjusted for variations in school district size and student population

- Special allotments:

- Special education allotment

- Compensatory education allotment

- Bilingual education allotment

- Experienced teacher allotment

- Vocational education allotment

- Established mechanisms to equalize wealth among school districts:

- Equalizing mechanism: State aid = adjusted basic allotment – local share (higher in wealthier school districts)

- Enrichment equalization allotment: encouraged property-poor school districts to increase local tax rates to enhance their curricula

- Equalization transition entitlement: Temporarily mitigated costs of equalization for qualifying high-wealth school districts that experienced reductions in state aid53

Senate Bill 1019

71st Legislature, Regular Session, 1989

- Established a two-tiered school finance system

- Tier I – Basic entitlement:

- Funding to support basic, accredited educational programs

- Increased basic allotment for each student in ADA from $1,350 to $1,500

- Replaced price differential index and small district adjustment with the cost of education index

- Eliminated experienced teacher allotment

- Tier II – Enrichment entitlement:

- Funding to supplement Tier I and enrich basic educational programs

- Eliminated equalization mechanisms from HB 72

- Established a guaranteed yield formula

- Enabled school districts to gain additional state aid by setting their local tax rates above mandatory minimum

- Guaranteed a minimum yield of state and local revenue on each penny of Tier II tax54

Senate Bill 1

71st Legislature, Fourth Called Session, 1990

- Redefined ADA to be calculated each month of the regular school year, rather than the best four weeks of eight weeks’ worth of attendance

- Increased basic allotment from $1,500 to $2,128

- Increased local fund assignment (LFA), the portion of Tier I entitlement for which school districts are responsible, from 33.3 percent in 1989-1990 to 43 percent in 1992-199355

Senate Bill 351

72nd Legislature, Regular Session, 1991

- Created county education districts (CEDs)

- Consolidated the tax bases of school districts located in the same county that had a combined property wealth not above a certain amount

- Collected and pooled property taxes and then redistributed tax revenue to each member school district on an equalized basis

- Established a third FSP tier of pooled tax revenue for member school districts with tax efforts above the state guaranteed funding limit

- Increased basic allotment from $2,128 to $2,60056

Senate Bill 7

73rd Legislature, Regular Session, 1993

- Eliminated CEDs

- Established a recapture system to distribute some revenue according to property wealth

- Required school districts with wealth per student exceeding the equalized wealth level ($280,000) to reduce their effective wealth in one or more of the following ways:

- Merge with lower-wealth school districts

- Detach territory and annex it to another school district

- Purchase ADA credit from the state

- Contract for the education of students from other school districts

- Consolidate tax base with another school district57

House Bill 1

75th Legislature, Regular Session, 1997

- Established the instructional facilities allotment

- Provided financial assistance to eligible school districts to pay debt service on bonds issued for the construction of academic facilities, in addition to any interest and sinking taxes in effect58

House Bill 10

79th Legislature, Regular Session, 2005

- Appropriated $735 million from the Economic Stabilization Fund to the Texas Education Agency for the purchase of textbooks and the operation of school districts under the FSP59

House Bill 1

79th Legislature, Third Called Session, 2006

- Compressed local maintenance and operations tax rates to 88.67 percent of the former rate

- Authorized school districts to increase their M&O tax rates up to 17 cents above their compressed tax rates (CTRs)

- Expanded Tier II entitlement from one level of enrichment funding to three levels:

- Level 1 — funding based on each penny of tax effort between a school district’s LFA tax rate and its CTR

- Level 2 — funding based on each cent of tax effort above a school district’s CTR to a maximum of 6 cents

- Level 3 — funding based on each cent of tax effort beyond a school district’s CTR plus 6 cents

- Every cent of increase above a school district’s CTR plus 6 cents was equalized at Austin ISD’s property wealth per student in weighted average daily attendance (WADA) and recaptured above an equalized wealth level of $319,50060

House Bill 3646

81st Legislature, Regular Session, 2009

- Decreased M&O compression rate from 88.67 percent to 66.67 percent

- Collapsed Tier II entitlement from three levels of enrichment funding to two:

- Level 1 — funding based on the first 6 cents of tax effort above a school district’s CTR

- Provided the most substantial amount of enrichment funding per WADA

- Not subject to recapture

- Level 2 — funding based on each cent of tax effort above a school district’s CTR plus 6 cents

- Provided less enrichment funding per WADA than Level 1

- Subject to recapture

- Established a permanent Existing Debt Allotment

- Guaranteed $35 per ADA per penny on I&S taxes to pay existing bond debt on instructional and non-instructional facilities61

- Level 1 — funding based on the first 6 cents of tax effort above a school district’s CTR

House Bill 1

82nd Legislature, Regular Session, 2011

- Reduced public education funding by an estimated $5.4 billion

- Set Aug. 31, 2017 as the expiration date for Additional State Aid for Tax Reduction62

Senate Bill 1

83rd Legislature, Regular Session, 2013

- Increased public education funding by an estimated $3.6 billion63

House Bill 21

85th Legislature, First Called Session, 2017

- Established the Texas Commission on Public School Finance:

- 13 members

- Duties include addressing policy issues in public education and recommending improvements to current school finance system

- Expired Jan. 8, 2019

- Provided additional state aid to qualifying charter schools

- Created grant programs for school districts with financial hardships and for students with certain intellectual disabilities

- Established a six-year transition plan to combine the small and mid-size district adjustments into a single small district adjustment64

Quality and Effectiveness

In addition to shaping public school finance, the above legislation addressed aspects of school quality and effectiveness. The 1949 Gilmer-Aikin Laws, for instance, established the first minimum salary requirement for all Texas public school teachers and guaranteed students basic educational opportunities for at least 175 days per year for 12 years.

House Bill 72 (68th Legislature, Second Called Session, 1984) attempted to attract and retain high-quality teachers by increasing salaries, creating a merit-based career ladder and requiring competency exams. The law also attempted to improve student accountability by requiring school districts to restrict the number of allowable absences, employ discipline management programs and administer exit exams to graduating students.

Senate Bill 1 (71st Legislature, Fourth Called Session, 1990) devoted entire articles to amending state law relating to school accountability, efficiency and performance incentives.