Property Tax Today

Quarterly Property Tax News

Volume 14 | Oct 2020

Property Tax Today features content regarding upcoming deadlines, action items and information releases.

Please let us know what you would like to see in future editions by sending property tax questions and/or suggested topics to ptad.communications@cpa.texas.gov. We will gladly address property tax matters under our authority.

Message from the Comptroller

Glenn Hegar

Texas Comptroller

In July, I revised the Certification Revenue Estimate (CRE) to project a fiscal 2021 ending shortfall of $4.58 billion due to the COVID-19 pandemic and recent volatility in oil prices. This revised estimate carries unprecedented uncertainty, as it assumes the state will effectively manage the outbreak and that some restrictions on businesses and individuals will be lifted.

The pandemic impacted all tax revenues, particularly hotel, motor vehicle sales, severance and mixed beverage taxes. While yearly revenues released last month were slightly ahead of our projections in the CRE due to surprisingly strong July sales tax collections, those gains were largely reversed in August, likely due to rising infection rates. We may see further declines in that sector due to decreased consumer spending as enhanced federal benefits are expiring or being reduced.

I encourage you to view our downloadable, easy-to-understand primer for more information on the data points that drive the CRE.

The Property Tax Assistance Division (PTAD) stayed busy over the summer months. PTAD staff certified the final 2019 Property Value Study results to the commissioner of education on Aug. 17, released the preliminary Methods and Assistance Program (MAP) reports to appraisal districts on Sept. 17 and worked diligently to update truth-in-taxation (TNT) information.

As we leave summer behind and move toward the holidays, PTAD has already begun working with legislators and their offices in preparation for the upcoming legislative session. This session will likely bring budgetary and logistical challenges resulting from the ongoing pandemic, but our office looks forward to working with the 87th Texas Legislature in the service of all Texans.

2019 PVS Final Results

On Aug. 17, 2020, the Comptroller's office certified the 2019 final taxable value findings to the commissioner of education as required by Government Code Chapter 403. The 2019 PVS final taxable value findings are available on PTAD's Property Value Study and Self Reports webpage.

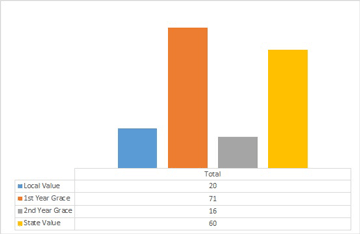

The chart above shows the current breakdown of the 2019 PVS final findings. In this cycle, 71 school districts qualified for year one of the grace period; 16 qualified for year two of the grace period, 60 received state value and 20 had local value that was greater than state value. These figures may be subject to change based on the conclusion of several ongoing protests.

MAP Reviews

Our office released the preliminary 2020 MAP reports on Sept. 17, 2020. We issue preliminary reports based on preliminary data received, documentation reviewed and interviews conducted by the MAP reviewer. PTAD may make changes to reports after the release of the preliminary reports based on newly received data, documentation or other information. Appraisal districts must submit all remaining data for their final 2020 MAP reports by Nov. 2, 2020.

Appraisal districts scheduled for 2021 MAP reviews will receive a preliminary data request list in early November with a mid-December due date.

TLO Comments

Taxpayer liaison officers (TLOs) in counties with populations exceeding 120,000 (as defined by the 2010 U.S. Census) must submit to the Comptroller's office a list of verbatim comments and suggestions received from property owners, agents or chief appraisers about the model appraisal review board (ARB) hearing procedures or any other matter related to the fairness and efficiency of the ARB. Please submit comments and suggestions received pertaining to these matters only in the appropriate Excel spreadsheet template (XLS) no later than Dec. 31, 2020.

Chief Appraiser Eligibility

All chief appraisers must notify the Comptroller's office in writing no later than Jan. 1 of each year as to whether they are eligible to be appointed or serve as chief appraiser. To be eligible to serve, a chief appraiser must either be a certified Registered Professional Appraiser (RPA) or have the appropriate professional designation [Member Appraisal Institute (MAI), Assessment Administration Specialist (AAS), Certified Assessment Evaluator (CAE) or Residential Evaluation Specialist (RES)]. A chief appraiser who is not an RPA but who has an MAI, AAS, CAE or RES designation must obtain an RPA certification within five years of appointment or beginning of service as chief appraiser.

All chief appraisers must notify the Comptroller's office in writing no later than Jan. 1 of each year as to whether they are eligible to be appointed or serve as chief appraiser. To be eligible to serve, a chief appraiser must either be a certified Registered Professional Appraiser (RPA) or have the appropriate professional designation [Member Appraisal Institute (MAI), Assessment Administration Specialist (AAS), Certified Assessment Evaluator (CAE) or Residential Evaluation Specialist (RES)]. A chief appraiser who is not an RPA but who has an MAI, AAS, CAE or RES designation must obtain an RPA certification within five years of appointment or beginning of service as chief appraiser.

Chief appraisers must submit written notification by emailing completed Form 50-820, Notice of Chief Appraiser Eligibility (PDF) to ptad.communications@cpa.texas.gov.

Tax Bills

Taxing units usually mail their tax bills in October. Tax bills are due upon receipt, and the deadline to pay taxes is usually Jan. 31. Taxes become delinquent, with penalty and interest charges added to the original amount, beginning on Feb. 1. Failure to receive a tax bill does not affect the validity of the tax, penalty or interest due, the delinquency date, the existence of a tax lien or any procedure the taxing unit institutes to collect the tax.

More information regarding payment of taxes, including deadlines, consequences for failure to pay and instances when a waiver of penalty or interest may apply, is located on PTAD's Paying Your Taxes webpage.

Payment Options

Information regarding payment options is located on PTAD's Payment Options webpage. Tax collection offices are required to offer certain, but not all, payment options. Contact your local tax collection office to determine which local payment options may be available, such as:

- credit card payment (Tax Code Section 31.06)

- deferral (Tax Code sections 33.06 and 33.065)

- discounts (Tax Code Section 31.05)

- escrow agreement (Tax Code Section 31.072)

- installment payment (Tax Code sections 31.031 and 31.032)

- split payment (Tax Code Section 31.03)

- partial payment (Tax Code Section 31.07)

- work contract (Tax Code sections 31.035 – 31.037)

AG Opinions

The Office of the Attorney General (AG) issued the following opinions:

- Opinion No. KP-0319 (PDF) (July 1, 2020)

Absent an election granting it authority, the Jackson County County-Wide Drainage District does not possess authority to levy, set the rate and collect a flood control tax. - Opinion No. KP-0326 (PDF) (Aug. 10, 2020)

A court would likely conclude that appraisal district board members are appointed and are not required to complete the certified cybersecurity training program mandated by Government Code Subsection 2054.5191(a-1). - Opinion No. KP-0329 (PDF) (Aug. 25, 2020)

Tax Code Section 6.054 prohibits an appraisal district employee from also serving as trustee on the board of an independent school district that is a participating taxing entity in the appraisal district.

Action Items

Below are action items for the fourth quarter of 2020. You can find a full list of important property tax law deadlines for appraisal districts, taxing units and property owners on PTAD's website.

- Oct. 16 – Farm and ranch survey responses due

- Nov. 2 – Final MAP documents for 2020 reports due

- Dec. 31 – Taxpayer liaison officer comments received due

- Jan. 1 – Chief appraiser eligibility forms due

If one of the deadlines is on a Saturday, Sunday or a legal or state holiday, the act is timely if performed on the next regular business day.

Reappraisal Plans

Appraisal district boards of directors should have developed and adopted reappraisal plans no later than Sept. 15. Copies of the approved plan must be distributed to the governing body of each taxing unit participating in the appraisal district and to the Comptroller's office within 60 days of the date of approval. You may email the Comptroller's copy to Charlotte Thomas in the Property Tax Assistance Division.

2019 Tax Rates

The 2019 tax rates and levies for school districts, cities, counties and special districts are posted on PTAD's website.

Property Tax Institute

Mark your calendars for the mornings of Dec. 8-10!

The 2020 Property Tax Institute Conference is going virtual this year. The conference will include morning sessions, from 8 a.m.-noon, on property tax matters relevant to appraisal district and tax office personnel. More information is soon to come.

Contact the Lyndon B. Johnson School of Public Affairs staff at 512-471-0820 for other questions.

Farm and Ranch Survey

The 2020 Texas Farm and Ranch Survey is available online and was sent by regular mail to agricultural appraisal advisory board members requesting 2019 data. As a reminder, submit survey responses by Friday, Oct. 16, 2020. If you have any questions, please contact Joe Holcomb.

Property Taxes in Disaster Areas and During Droughts

Information on statutory relief for property owners in governor-declared disaster areas is located on our Property Taxes in Disaster Areas and During Droughts webpage, including:

- Tax Code Section 11.135 for continuation of residence homestead exemptions for uninhabitable or unusable property while it is being reconstructed; and

- Tax Code Section 11.35 for a temporary exemption for property damaged during a disaster.

Form 50-312, Temporary Exemption Property Damaged by Disaster (PDF) is available on our Property Tax Forms webpage. Property owners must apply for the temporary exemption no later than 105 days after the governor declares a disaster area.

Adopted Rules

Property Tax Administration Rule §9.3006, Notice of Estimated Taxes Required to be Delivered by County Appraisal Districts, and the accompanying Form 50-313, Notice of Estimated Taxes (PDF), became effective Sept. 21, 2020.

Property Tax Administration Rule §9.4011, Appraisal of Timberlands, and the accompanying Manual for the Appraisal of Timberland (PDF) was filed with the Secretary of State for adoption on Oct. 7, 2020, and will be published in the Texas Administrative Code on Oct. 23, 2020, and becomes effective Oct. 27, 2020.

The effective rule is available on the Property Tax Assistance Division's Property Tax Rules webpage or as published in the Texas Administrative Code on the Texas Secretary of State's website.

Well Done!

This quarter we turn our spotlight to Brenda Mejia of the Maverick County Appraisal District for her efforts during the MAP review process. A MAP reviewer noted that Brenda made the process of working virtually as seamless as possible by providing quick, effective responses with a positive, upbeat attitude. Way to go Brenda and Maverick CAD!

We are also recognizing Chief Appraiser Michael Amezquita and Bexar Appraisal District for being voted top workplace among midsize employers in San Antonio. After finishing 12th last year, the district collected feedback and started implementing changes based on information received. Way to go Michael and Bexar!

Congratulations!

Congratulations to PTAD Information and Customer Service Supervisor Stephanie Mata for being elected to the Institute of Certified Tax Administrators (ICTA) Board of Directors as a board member at-large. ICTA is an internal division of the Texas Association of Assessing Officers (TAAO), designed to establish and maintain the highest standards of performance and education for its members. Congratulations, Stephanie!

Please be advised that the information in this newsletter is current as of the date of its publication and is provided solely as an informational resource. The information provided neither constitutes nor serves as a substitute for legal advice. Questions regarding the meaning or interpretation of any information included or referenced herein should be directed to legal counsel and not to the Comptroller's staff.