Auditing Fundamentals

Chapter 5 – Audit Procedures

- Introduction

- Representation/Nexus in Texas

- Reporting Categories

- Audit Process Flowchart

- Analysis of Reporting Method

- Common Sales Tax Reporting Methods

- Internal Control Overview

- Total Sales (Gross Sales)

- Examination of Records

- Sales Tax Verification

- Sales Tax Verification, Example

- Fixed Asset Sales

- Deductions

- Certificates

- Resale Certificates

- Exemption Certificates

- Direct Payment Exemption Certificate

- Alcoholic Beverage Exemption Certificate

- Consular Tax Exemption Cards

- Prior Contract Exemption Certificate

- Divergent Use

- Sixty-Day Letter

- Sixty-Day Letter, Example

- Letter of Assignment

- Letter of Assignment - Example

- Sales to Destinations Outside of Texas

- Cash Discounts

- Cash Discounts, Examples

- Returned Merchandise

- Credit for Tax Paid

- Multistate Tax Credit

- Bad Debts

- Tax Erroneously Collected

- Taxable Purchases

- Internal Control Questions to be Analyzed and Evaluated for Taxable Purchases

- Audit Procedures for Taxable Purchases

- Multi State Tax Credit, Examples

- Alternative Auditing Methods

- Account Information Card

- Audit Lead - Form 00-828

- Bankruptcy

- Insolvent Taxpayers

- Successor Liability - Liability Incurred by Purchase of a Business

Introduction

The primary purpose of the sales tax audit is to confirm that the taxpayer has reported the correct amount of tax. Reported amounts from the sales tax history must be analyzed when examining the taxpayer's records.

Representation/Nexus in Texas

Nexus is the establishment of representation in the State of Texas, making a taxpayer responsible for collecting sales or use tax. The due process clause of the United States Constitution requires some definite link, some minimum connection between the state and the person, property, or transaction it seeks to tax. This link, referred to as representation, is determined to be sufficient by an analysis of the benefit derived. The analysis indicates whether the taxpayer has received some economic gain or advantage from his association with the state.

According to Section 151.107 Texas Limited Sales, Excise, and Use Tax Act and Sales and Use Tax Rule 3.286, Seller's and Purchaser's Responsibilities, a retailer has representation or is engaged in business in Texas if the retailer:

- Maintains, occupies, or uses in Texas permanently, temporarily, directly or indirectly or through a subsidiary or an agent, a physical facility, including an office, place of distribution, sales or sample room, warehouse or storage place, or other place of business;

- Has a representative, agent, salesman, canvasser, or solicitor operating in the state under the authority of the retailer for the purpose of selling, delivering, or taking orders for a taxable item. This includes salespersons, agents, canvassers, solicitors, repairmen, installers, inspectors, etc.;

- Utilizes independent salespersons in direct sales of taxable items;

- Operates a delivery vehicle in this state;

- Derives receipts from a lease of tangible personal property located in this state;

- Promotes a flea market, trade day, or other event involving the sales of taxable items;

- Allows a franchisee or licensee to operate under its trade name if the franchisee or licensee is required to collect Texas sales or use tax;

- Conducts business in this state through employees, agents, or independent contractors.

These types of documentation may support the claim of nexus:

- Shipping documents

- Vehicle logs

- Sales invoices

- Gasoline tickets

- Territorial assignment sheets

- Documentation of a place of operation by the taxpayer

- A written statement from the taxpayer

- Delivery directions

- Travel notes

- Expense vouchers

- Itinerary sheets or logs

Once representation/nexus has been established, an out-of-state seller continues to be legally required to collect tax on sales made into Texas for a period of 12 months after the seller ceases to be engaged in business in Texas.

Reporting Categories

Reporting categories are broken out as follows on the sales tax return:

- Total Sales

- Taxable Sales

- Taxable Purchases

- Amount Subject to State Tax

- Amount Subject to Local Tax

- Amount Subject to City Tax

- Amount Subject to Transit (MTA/CTD Tax)

- Amount Subject to County/SPD Tax

Even though the category 'Deductions' does not appear on the sales tax return, this amount is calculated by the computer and appears on the Audit History.

Total Sales - Taxable Sales = DeductionsAudit procedures used in each audit situation will be adapted to the individual taxpayer's system of accounting and recordkeeping. Since different reporting methods are used by taxpayers to complete sales tax returns, it is important that the auditor understand the method utilized by the taxpayer. The auditor should complete an analysis of the accounting system and devise specific audit procedures applicable to the audit. Certain procedures must be performed on each and every audit:

- Sales tax reconciliation,

- Gross Sales (Total Sales) reconciliation,

- Examination of purchases, etc.

Audit Process Flowchart

View alternate text for Audit Process Flowchart.

Analysis of Reporting Method

During the entrance conference, the taxpayer or the taxpayer's representative should explain the reporting method utilized. Ask open-ended questions to obtain an overview of the entire operation of the business and also identify probable problem areas of tax liability or credit. Consider the following areas:

- The step-by-step process by which the information is obtained and summarized to prepare the return - includes the records used to prepare the return

- Any work papers used to prepare the return

- General ledger accounts that have been used by the taxpayer in reporting. Check for related accounts when the Chart of Accounts is reviewed.

- Changes in personnel who prepared the return. Obtain the name and position of anyone who prepares a specific portion of the return.

- The possibility of using computer audit assistance should be considered if any areas of the return or recordkeeping are computerized. Examine the computer section of the Audit Questionnaire.

- Availability of resale/exemption/direct payment exemption certificates for tax-free sales.

- Checking to see what items are being claimed as Deductions.

- Are Deductions being reported or are they 'netted'?

- Are Taxable Purchases being reported? If so, what items are being included?

- Unusual areas - changes in reporting method, fluctuations in reported amounts, etc.

- Testing one or two reports to verify that the procedures as explained are used to prepare the return.

- Checking to see if the reporting method has been changed. If so, check the different methods used and document the changes on the Audit Plan.

Common Sales Tax Reporting Methods

Two common methods frequently used by taxpayers for reporting sales tax are:

- Netting non-taxed sales with Gross Sales

- Backing into Taxable Sales

Examples:

The taxpayer's records indicate the following monthly amounts:

| Gross Sales (Nontaxable & Taxable) | $5,000,000 |

| Non-taxed sales | 2,000,000 |

| Sales Tax Accrued (@ 8%) | 240,000 |

Example #1:

The corresponding amounts would be reported on the monthly sales tax return using the 'netting method' are:

| Gross Sales | $3,000,000 |

| Taxable Sales | $3,000,000 |

When this method is utilized by the taxpayer, Gross Sales reported will usually be incorrect and should generally not be used for projections. If adjustments to reported Gross Sales and Deductions net to zero, the adjustments should not be made.

Example #2:

The corresponding amounts would be reported on the monthly sales tax return by 'backing into' Taxable Sales are:

| Gross Sales | $5,000,000 |

| Taxable Sales (240,000 ÷ .08) | $3,000,000 |

When reported taxable sales are backed into, any differences between Taxable Sales on the books and reported Taxable Sales should be analyzed.

Internal Control Overview

The taxpayer's system of internal control must be analyzed and evaluated to determine the reliability of the records being examined. The depth of the audit examination is determined in great part by the reliability of the taxpayer's internal control system.

Characteristics of Good Internal Controls

Some characteristics of good internal control are listed below. Each system must be analyzed for specific strengths and weaknesses.

- A clearly defined responsibility for each function

- An adequate system of authorization

- Adequate supervision of duties

- Adequate documentation

- Adequate protective measures (i.e., locked rooms for inventory, etc.)

- Segregation of duties

- Internal verification

Total Sales (Gross Sales)

Total sales consist of all taxable and nontaxable sales during the reporting period for each outlet. Taxable and nontaxable sales include:

- All sales, leases, and rentals of tangible personal property. Sales of intangibles such as stocks and bonds would not be included.

- All labor and service charges.

- Sales tax collected should not be included in reported total sales.

Internal Controls

Generally, verification of Gross Sales includes:

- Reviewing the chart of accounts for revenue accounts.

- Reviewing the taxpayer's method of reporting sales.

- Reconciling recorded and reported amounts.

- Determining which accounts make up Gross Sales.

- Determining how cash sales are handled.

- Determining how bad debts are handled.

Reconciliation of Recorded and Reported Sales

A reconciliation of sales should be performed by comparing reported sales, per the sales tax return, with audited sales, per books and records. This reconciliation may be completed by report period or by year.

Reported Gross Sales should also be compared to:

- Federal Income Tax returns

- Franchise Tax Gross Receipts - now part of the taxpayer's Audit History

- Financial Statements

Any differences found between reported and audited sales should be analyzed taking into consideration the taxpayer's reporting method. Determine if the differences result from taxable or nontaxable sales. Audit adjustments should be made for unreported taxable sales and included in an exam of 'Adjustments to Gross Sales'.

If the reconciliation does not result in any differences, then document this fact in the audit plan.

Preliminary Review (Short Testing)

Preliminary reviews (short tests) should be done before a thorough examination of records is performed. Short tests will provide the necessary information to determine whether to perform detail or sample audit procedures. Short tests highlight key areas that may need a more detailed examination. Before relying on taxpayer's records, perform short tests of the following:

- Trace postings in sales journals to general ledgers

- Trace recording of daily sales totals or invoices to sales journals

- Trace recording of sales invoice information to sales journals

- Verify sales journals footings (totals)

- Scan for unusual entries in journals and ledgers such as debits to the sales tax accrual account

- Verify recording accuracy and records flow

- Verify tax charged and rate of tax

- Verify that tax is being collected and allocated to the correct local jurisdictions

Document in the Audit Plan the steps and findings of the short tests. If short tests reveal that summary records accurately reflect the taxpayer's method of accounting, then use the taxpayer's summary records. If not, then an examination of the original source document may be necessary.

REMINDER: Short tests are not used to reconcile reported totals, only to reconcile the steps used to arrive at those totals.

Examination of Records

General Ledgers

Examine general ledger accounts for debits and credits which may represent unreported taxable sales or services such as:

- Sales of merchandise at cost credited to purchase or inventory accounts

- Sales of by-products credited directly to profit and loss, surplus or expense accounts

- Sales of furniture, equipment or other capital assets credited to equipment, depreciation, gain or loss or other accounts

- Sales of taxable services such as:

- Amusement services

- Cable television services

- Laundry, cleaning and garment services (Personal Services)

- Motor vehicle parking and storage services

- Repair, remodeling, maintenance and restoration of tangible personal property except for:

- Aircraft

- A ship, boat, or other vessel other than a taxable boat or boat motor

- The repair, maintenance, and restoration of a motor vehicle

- Repair, maintenance, creation, and restoration of a computer program, including its development and modification not sold by the person performing the repair, maintenance, creation, or restoration service

- Real property services

- Debt collection services

- Information services

- Data processing services

- Insurance services

- Telecommunication services

- Credit reporting services

- Real property repair and remodeling

- Security services

- Telephone answering services

- Internet access services

- Utility distribution

General Journal

Examine the general journal and note entries which may indicate unreported taxable sales or services.

Consider all data pertaining to general journal entries in determining if an entry represents an unreported taxable sale or service. This data may include:

- Correspondence

- Contracts

- Invoices and other documents.

Cash Receipts Journal

Examine the cash receipts records to determine whether receipts from cash sales have been credited to the proper sales or revenue accounts. Be careful not to duplicate taxable sales or services found in other records.

Accounts Receivable Ledger

Examine the accounts receivable from the owners, partners, officers or employees of a firm for evidence of taxable sales or services not otherwise recorded in the sales or revenue accounts. Examine partners' drawing accounts and employees' advance accounts.

Purchase Journal

Entries may be made in the purchase journal for sales at cost or returned merchandise. Inventory withdrawals which should have been reflected in the inventory accounts may also appear as credits in the purchase journal. Examine these postings for taxable sales or services.

Sales Invoices and Journals

Sales invoices are source documents and usually represent the original record of a transaction. It is a necessary part of audit procedure to examine a representative number of these invoices to determine:

- How the transactions are recorded on the invoices

- If tax was properly assessed

- How the invoices are filed - By invoice number? By customer's name? By days? By months?

NOTE: Many taxpayers have multiple sets of invoices. For example, one set of sales invoices may be filed in numerical while another set may be filed in customer folders.

Invoices are used to verify:

- Postings

- Tax accruals

- Deductions

- Types of transactions

Postings

Tracing the postings of sales invoices is the first step in verifying the accuracy of the books of original entry. The sales invoice is traced directly to the sales or revenue journal for accuracy of posting relative to amount and classification. Trace source documents through to summary records and check for errors and omissions.

Determine if:

- They are consistent

- There is a posting from each source for each month or accounting cycle

- There are sources of postings that might reveal operations not disclosed in pre-audit research or discussions with the taxpayer

Tax Accruals:

The tax assessed on the invoice is important because the tax accrual account is based on the tax rate times the taxable value. This is especially important on audits of taxpayers who derive total sales, taxable sales or deductions based on the amount of tax accrued.

Deductions:

Note what type of deductions the taxpayer is claiming because they may lead to a detail of certain accounts. Ensure that the taxpayer is in possession of all necessary resale, exemption, and direct payment exemption certificates.

Type of Transactions:

For the sale of tangible personal property or taxable services, examine invoices to determine if charges are consistently separated or billed as a lump sum. This information is also important to know when examining purchases.

If there is a lump sum charge which includes both taxable and nontaxable amounts, the entire charge is taxable. To be excluded from the taxable amount, the nontaxable items must be separately stated on the invoice or other billing document.

Federal Income Tax Returns

A comparison of sales reported for federal income tax purposes with state sales and use tax returns is a good audit practice. This may not be feasible if the taxpayer files a consolidated federal income tax return. However, the taxpayer should have working papers showing how these figures were obtained.

Reconcile the differences if a taxpayer has acceptable records but gross receipts recorded in the books and reported on sales and use tax returns do not agree with gross receipts on the federal income tax returns. Material differences should be analyzed. Determine if the difference is the result of taxable or nontaxable sales. Also review Schedule D of the federal income tax return for any fixed asset sales.

In making this reconciliation, differences may be due to:

- Timing

- Accounting basis - reporting on cash basis for income tax purposes and using an accrual basis for sales and use tax purposes or vice versa

- Netting - Gross Sales shown on the sales tax returns may actually be the net of sales minus deductions

Sales Tax Verification

Sales tax collected versus sales tax reported should be reconciled in detail for every audit. Gross Sales should not include sales tax collected but:

If a taxpayer does not separate tax and selling price (Gross Sales figure includes tax), determine if:

- Total amounts, (including tax) of sales invoices are entered into the sales revenue account including exempt sales, and

- The sales price and tax rung up on the cash register is recorded in the sales revenue account.

Then determine Gross Sales by:

- Reducing the Gross Sales figures (tax included) by the amount of tax-exempt sales to arrive at total Taxable Sales (tax included).

- Dividing total Taxable Sales (tax included) by one plus the appropriate tax rate to arrive at total Taxable Sales (tax excluded).

Add total Taxable Sales (tax excluded) and tax-exempt sales to obtain a Gross Sales figure. See the following Example. Compare the Gross Sales figure to the amount reported on the tax return.

EXAMPLE

The Bar-B-Q Restaurant is located inside the city limits of a taxing city and within a taxing MTA (total tax rate is 8.25%). The total amount of sales tickets is entered in the cash receipts journal. The restaurant occasionally caters church functions, and these exempt sales are marked in the cash receipts journal. Figures from a cash receipts journal show:

Total Sales (tax included) $113,250

Less: Exempt Sales < 5,000>

Equals: Total Taxable Sales 108,250

(tax included) -------

Total Taxable Sales (tax excluded)

equals $108,250 divided by 1.0825 $100,000

Add:

Total Taxable Sales (tax excluded) $100,000

Plus: Exempt Sales 5,000

Equals: Gross Sales $105,000

Analyze Sales Tax Accrual Accounts

Compare Tax Accrued to Tax Reported

Verify tax accrual account (also called sales tax payable account) by comparing tax accrued to tax reported for the audit period. If differences exist, determine the reason for the difference, and, if necessary, prepare a schedule and make an adjustment in the audit. Differences may occur due to:

- Other credits in the sales tax accrual account (i.e., discounts)

- Returned merchandise sales for which credit memos have not been recorded in the sales journal and/or tax accrual account

- Tax on taxable purchases being posted to the tax accrual account

Note: If the taxpayer does not maintain a tax accrual account, examine available summary records.

Analyze Debit Entries

Analyze debit entries to determine if:

- Excess tax is being written off to a miscellaneous income account

- Debit entries exist for bad debts, discounts, returned merchandise and refund claims - verify tax refund claims to determine if the customers have received them

- Debit entries are due to customers not remitting tax - verify that the taxpayer has valid resale/exemption certificates to support them

Credits and Refund Claims

During the course of an audit, a tax reconciliation is normally performed for the audit period. However, when refunds or credits have been allowed in an audit or refund period, the tax reconciliation must be expanded to include the most current report filed. This procedure is necessary in order to verify that the refund or credit has not been taken in subsequent report periods.

Fixed Asset Sales

Examine summary records for the sale of fixed assets:

- Review general ledger fixed asset accounts for credit entries

- Review Schedule D of the taxpayer's federal income tax return

- Examine gain or loss accounts in the general ledger

- Trace sales to journal entries, cash receipts, and source documents to determine if tax was collected and reported or if the sale was exempt

Deductions

Verification of Deductions is an important area of an audit. Although not specifically reported by the taxpayer, Deductions are the difference between Gross Sales and Taxable Sales.

Items included in Deductions:

- Deductions supported by valid certificates (resale, exemption, direct payment exemption)

- Deductions based upon sales destination (items shipped out-of-state)

- Deductions for sales and services specifically exempt by sales tax law and rules

- Deductions for adjustments to sales when sales tax has been paid (returned items)

Normally, the review and reconciliation of Deductions is made at the same time as that for Gross Sales. Whenever feasible, adapt the audit procedure to the method used by the taxpayer to report Deductions. The scope of the examination of Deductions will depend on the conditions encountered. Deductions consist of the total nontaxable sales claimed by the taxpayer. Most claimed Deductions are supported by resale and exemption certificates and exemptions by law.

Conduct a detail examination if:

- Claimed Deductions consist of relatively few items

- All transactions can be examined in a reasonable amount of time

Consider a sample examination if:

- Gross Sales are numerous

- Gross Sales are of similar unit value

- Claimed Deductions are numerous

Consider a stratified sample if:

- There is a large variation of price for units sold

- There is only an occasional large sale

Certificates

Deductions can be supported by various certificates which relieve the seller from liability for collecting the tax if the seller accepts the certificates in good faith. Among the first audit procedures should be the examination of the taxpayer's certificate file. Are the certificates updated and current?

Types of certificates include:

- Resale Certificate* (Rule 3.285)

- Exemption Certificate (Rule 3.287)

- Direct Payment Exemption Certificate* (Rule 3.288)

- Alcoholic Beverage Exemption Certificate* (Rule 3.289)

- Prior Contract Exemption Certificate (Rule 3.319)

*Valid taxpayer numbers are required on these certificates.

If a certificate is accepted by the seller at the time of sale, then the certificate should be considered as accepted in good faith unless there is something obviously wrong on the face of the certificate (not a valid 11-digit number on a resale certificate, for example). Account Information Cards should be submitted on the purchasers who have submitted questionable certificates.

When deciding if a certificate is sufficient in content and if a seller acted in 'good faith' in accepting the certificate, these questions should be considered:

- Was the merchandise sold to a retailer who does not sell that particular type of merchandise?

- Did the seller have knowledge that the particular item sold was to be consumed rather than resold by the purchaser?

Any certificates received by the taxpayer after the audit entrance conference date are subject to verification by the auditor.

Resale Certificates

A resale certificate is a document which is presented to the seller at the time of purchase. A purchaser who is purchasing an item that he will sell, lease, or rent within the geographical limits of the U.S. may issue a resale certificate to his supplier in lieu of paying the sales and use taxes.

A purchaser who buys only items for resale from a seller may issue a 'blanket' resale certificate to a seller. The certificate describes the general nature of the taxable items purchased for resale, and it is valid until revoked in writing by the purchaser.

Texas and out-of-state retailers may issue resale certificates. In addition Mexican retailers may also issue resale certificates. To be valid a resale certificate must contain:

- The name and address of the purchaser

- The purchaser's 11-digit Texas sales tax permit number. If the application is pending, the resale certificate is valid for only 60 days. After that date a new resale certificate should be issued which lists the permanent permit number

- An out-of-state permit number or the registration number assigned to the purchaser by the purchaser's home state

- Mexican retailers must show their Federal Taxpayers Registry (RFC) number on the certificate and also give a copy of their Mexican registration for to the seller

- A description of the item(s) to be purchased, leased, or rented

- The signature of the purchaser and the date

- A description of the items generally sold, leased, or rented by the purchaser in the regular course of business

- The seller's name and address

In addition, the following statements must be included as part of the resale certificate:

- I, the purchaser named above, claim the right to make a nontaxable purchase (for resale of the taxable items described below or on the attached order or invoice) from

- The taxable items described above, or on the attached order or invoice, will be resold, rented, or leased by me within the geographical limits of the United States of America, its territories and possessions, or within the geographical limits of the United Mexican States, in their present form or attached to other taxable items to be sold

- I understand that if I make any use of the items other than retention, demonstration or display while holding them for sale, lease or rental, I must pay sales tax on the items at the time of use based upon either the purchase price or the fair market rental value for the period of time use

- I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that I know, at the time of purchase, are purchased for use rather than for the purpose of resale, lease, or rental and, depending on the amount of tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree

If a person from the United Mexican States issues a valid resale certificate or a Border States Uniform Sale for Resale Certificate, along with a copy of their Mexican Registration Form to the seller, export documentation is not needed.

All blanks on a resale certificate should be completely filled in. Pay particular attention to the description of the property being purchased to be resold. Compare the description on the resale certificates with the description on the sales invoice to determine if the certificate applies.

Miscellaneous Notes Regarding Resale Certificates:

- Copies of sales tax permits or taxpayer numbers alone do not qualify as resale certificates.

- FAX copies of signed resale certificates are acceptable, but the certificates must be dated at the time of the sale.

- If resale certificates are not obtained at the time of the sale, the seller has 60 days from the date written notice is received from the Comptroller to present them.

- A purchaser may issue a resale certificate when it is not known whether the item will be resold or used. Sales tax must be paid at the time of purchase when a purchaser knows an item is not purchased for resale.

- If a purchaser issues a resale certificate knowing at the time of issuance that the item would be used in a taxable manner, the certificate is invalid and sales tax is due on the purchase price of the item.

Resale Certificate Form - 01-339 (Rev.6-04/5)

NOTE: This is only a suggested format. Besides the above format, the 'Border States Uniform Sale for Resale Certificate' which was adopted by the states of California, Arizona, New Mexico, and Texas is also acceptable.

Exemption Certificates

An exemption certificate is a document similar to resale certificates, except that a taxpayer number is not required for it to be valid.

An exemption certificate may be issued to a supplier by:

- An organization that has qualified for exemption under Chapter 151, Sections 151.309 and 151.310 of the sales tax law - refer to Rule 3.222, Exempt Organizations

- A person purchasing an item which is exempt under the provisions of Chapter 151, Subchapter H of the sales tax law: for example, purchases that qualify for the agricultural exemption, materials consumed in manufacturing an item for sale, etc.

- A purchaser of a taxable item who donates the taxable item to an organization exempted under Section 151.309 or 151.310(a)(1) or (2) of this code - any use by the purchaser of the tangible personal property or taxable service other than retention, demonstration, or display shall be subject to tax

Exemptions from sales and use tax are provided under the following general categories. It should be noted that this is not a complete list. Each rule needs to be studied to determine whether a full or partial exemption exists.

- Agricultural items (Rule 3.296)

- Aircraft and qualifying flight simulators (Rule 3.297)

- Amusement services provided by government, various non-profit educational, religious, law enforcement or charitable organizations (Rule 3.298)

- Animals sold by nonprofit animal shelters (Section 151.343)

- Certain ships and vessels (Rule 3.297)

- Clothing and footwear during limited period – Sales Tax Holiday (Rule 3.365)

- Consular exemptions (Rule 3.322)

- Containers, packaging supplies and wrapping (Rule 3.314)

- Disaster-related repair labor (Rules 3.292, 3.310, and 3.357)

- Drugs, medicines, medical Equipment, and devices (Rule 3.284)

- Exportation (Rule 3.323)

- Food and meals (Rule 3.293)

- Food Stamp purchases (Rule 3.293)

- Gas and electricity (Rule 3.295)

- Gold, silver, and Sesquicentennial commemorative metals (Rule 3.336)

- Governmental entities (Rule 3.322)

- Gratuities (Rule 3.337)

- Information services and data processing services – 20% of the value (Rules 3.342 & 3.330 and Section 151.351)

- Internet access service – the first $25 of a monthly charge (Rule 3.366)

- Inter-corporate services (Section 151.346)

- Interstate commerce – vessels and aircraft (Rule 3.297)

- Items taxed by other laws (Section 151.308)

- Labor to restore, repair , or remodel historic sites (Rule 3.357 and Section 151.3501)

- Manufacturing items (Rule 3.300)

- Newspapers, magazines, publishers, sacred writings (Rule 3.299)

- Occasional sales (Rule 3.316)

- Official state coin (Section 151.340)

- Previously taxed items – tax already legally paid to another state (Section 151.303)

- Prior contract exemptions (Rules 3.319, 3.376 and 3.426)

- Property used in the production of motion pictures or video or audio recordings and broadcasts (Section 151.3185)

- Religious, educational, and public service organizations (Rule 3.322)

- Repair, remodeling, maintenance and restoration of a motor vehicle, airplane or commercial vessel (Rule 3.297 and 3.290)

- Repair, remodeling, maintenance and restoration of residential real property (Rules 3.291 and 3.357)

- Rolling stock, train fuel, and supplies (Rule 3.297)

- Sales by or to Indian tribes (Section 151.337)

- Services by employees of property management companies (Rules 3.356 and 3.364)

- Services performed on products being manufactured are exempt if they are for the purpose of 'making the product more marketable' and are performed prior to the product's distribution for sale (Rule 3.300)

- Taxable items for use under a contract to improve realty of an exempt organization (Rule 3.291, 3.357, and 3.347)

- Timber items (Rule 3.367)

- Transfers of common interests in property (Rule 3.331)

- Water (Section 151.315)

An exemption certificate must contain:

- The name and address of the purchaser

- A description of the item to be purchased, leased, or rented

- The specific reason the purchase is exempt from tax

- The signature of the purchaser and the date

- The seller's name and address

- A statement that the purchaser will be liable for payment of the sales and use taxes which may become due for failure to comply with the provision of the Tax Code

An exemption certificate is not required if the purchase is:

- Made by the federal government

- The State of Texas and its agencies or political subdivisions

- Exempt by statute, such as sales of water

Miscellaneous Notes Regarding Exemption Certificates:

- Check for certificates which are qualified

- Certificate states that only certain purchases are exempt

- Certificate states that purchases are exempt with the exception of certain items

- Exemption certificate on file pertains only to a specific job number

- Out-of-state governmental agencies and foreign governments do not qualify for exemption from sales tax.

- An exemption certificate cannot be issued to support a tax-free sale/purchase of tangible personal property exported outside the United States.

- A multi-state exemption certificate can be issued to a provider of a taxable service when the purchaser of the service derives benefits from that service for locations both in Texas and out-of-state. The purchaser issuing the certificate assumes all responsibility for accruing tax for the appropriate jurisdictions and remitting the tax to the Comptroller.

- Sellers of auto parts, farm supplies, and similar items need only one exemption certificate from each farmer or rancher claiming the agricultural exemption. This certificate will satisfy the seller's responsibility for all sales made to those individuals. However, each invoice must indicate if the purchase is for a farm exemption.

- FAX copies of signed certificates are acceptable, but the certificates must be dated at the time of the sale.

- If certificates are not obtained at the time of the sale, the seller has 60 days from the date written notice is received from the Comptroller to present them.

- If the purchaser issued an exemption certificate knowing at the time of issuance that the item would be used in a taxable manner, the certificate is invalid and tax is due on the purchase price of the item.

An exempt organization search is available on the Windows on State Government Web site under Texas Taxes/Filing and Paying Taxes.

Exemption Certificate Form - 01-339 (back)

NOTE: This is only a suggested format.

Direct Payment Exemption Certificate

Direct payment exemption certificates are issued by authorized taxpayers who have obtained a direct payment permit and remit all taxes directly to the Comptroller. In order for a taxpayer to obtain a direct payment permit, the taxpayer must purchase at least $800,000 of taxable items annually for use by the entity and not for resale. The taxpayer must be able to show the Comptroller that the accounting methods used clearly distinguish between taxable and nontaxable purchases and between purchases for own use and purchases for resale.

Once the taxpayer receives a direct payment permit, he should use a direct payment exemption certificate for purchases for his own use and a resale certificate for purchases for resale. The direct payment permit holder must report his purchases monthly on the Direct Payment Return (Form 01-119). Purchases cannot be reported on the Sales and Use Tax Return because a timely filing discount is not allowed for direct payment permit holders. This is part of the Taxpayer's Agreement (Item 1 on the application) signed by the taxpayer.

A lump-sum contractor may not accept a direct payment exemption certificate, because the contractor is considered the ultimate consumer of the materials incorporated into the lump-sum job. However, a real property repairman/remodeler may accept a direct payment certificate for a lump-sum job for remodeling or repair of nonresidential real property. The direct payment permit holder would then be required to accrue and remit the taxes due on both the materials and labor.

Direct payment permit holders may not issue direct payment exemption certificates to persons providing nontaxable services. When a direct payment permit holder is doing business with a person who may be selling taxable items as well as nontaxable services, the direct payment exemption certificate must indicate that it does not cover any nontaxable services that may be provided.

When scheduling unsupported Deductions the auditor should:

- Review the list of direct payment permit holders

Note: A searchable database is available on our website.

- Verify all direct payment exemption certificates received after the entrance conference date

- Determine if the Deductions are sales to direct payment permit holders

- Verify the effective date of the Direct Payment Permit by running CICS inquiry MTSUMM or XISUMM

Reporting Methods

The direct payment permit holder agrees to accrue and remit the applicable state and local taxes on all items used in Texas. If the items are for use in Texas, taxes are due upon first storage in Texas.

Normally, taxes are due based upon date of purchase. However, if a storage facility contains taxable items purchased under a direct payment certificate and at the time of storage it is not known whether the taxable items will be used in Texas or out-of-state, then the direct payment permit holder may elect to report the taxes when:

- The taxable items are first stored in Texas or

- When the taxable items are first removed from storage for use in Texas

The method of reporting the taxes must be consistent. Items taken outside Texas for use solely outside the state are exempt from tax.

If taxes are reported based on first storage and the items are later used out-of-state without any prior uses in Texas, credit may be taken by the direct payment permit holder.

Local Taxes

Local taxes are based on the location where the taxable items are first used, stored, or consumed.

Example 1:

Direct payment holder with locations within Texas and out-of-state purchases taxable items from a supplier located in Chicago, Illinois and stores the items in a warehouse in Austin, Texas.

When to report: If purchased for use in Texas, tax is due when brought into Texas.

If at the time of purchase it has not been determined whether the items will be used in Texas or out-of-state, tax is due when first stored or when first removed from storage for use in Texas. Direct payment holder must select one method and use it consistently.

| Taxes Due (based on first storage): | State - Use City - Austin Use Transit - Austin MTA Use |

If any of the items are later used out-of-state without any prior use in Texas, credit may be taken by the permit holder.

Example 2:

Direct payment holder, with locations within Texas and out-of-state, purchases taxable items from a supplier located in Houston, Texas and stores the items in a warehouse in Austin, Texas.

When to report: If purchased for use in Texas, tax is due based upon date of purchase.

If at the time it has not been determined whether the items will be used in Texas or out-of-state, tax is due when first stored or when first removed for use in Texas. Direct payment holder must select one method and use it consistently.

| Taxes Due (based on first storage): | State - Use City - Austin Use Transit - Austin MTA Use |

If taxes are reported based on first storage and any items are later used out-of-state without any prior use in Texas, credit may be taken by the permit holder.

Sales to Direct Payment Permit Holders

Sales to direct payment permit holders require special treatment in the audit of the vendor as the direct payment permit holder is responsible for accruing and remitting the tax directly to the Comptroller rather than paying the tax to the seller. During the vendor's audit, the auditor must determine that the sale is to a direct payment permit holder and also verify the effective date of the permit to make sure it is applicable for all of the transactions being examines. The auditor should then follow these guidelines.

| If the seller… | then… |

| collected tax on a sale to a direct payment permit holder | verify that the tax has been remitted. |

| collected tax on a sale to a direct payment permit holder but never remitted the tax | assess the tax in the vendor's audit as tax collected not remitted. |

| has not charged tax and does not have a completed certificate on file | advise the vendor to get a certificate as soon as possible. Include the sale(s) in the vendor's audit. |

| collected state tax but not the appropriate local taxes | verify that the state tax has been remitted. Schedule the local tax in the vendor's audit. |

If the seller is a lump sum contractor, he cannot accept a Direct Payment Certificate from his customer in order to purchase materials for a job tax-free. The contractor must pay the tax on the materials because he is the ultimate consumer – the direct payment permit holders cannot authorize any other entity to use their permit. A seller may accept a Direct Payment Certificate for non-residential restoration, remodeling, and repair and for any sale of taxable services.

Optional Percentage-Based Reporting

Since October 1, 1999, the Comptroller may authorize direct payment permit holders, through a formal contract, to use a percentage-based reporting method. Once approved, the authorized percentage must be used for a three-year period unless the Comptroller revokes the authorization before that period. This percentage-based reporting is available on to direct payment permit holders and applies only to the purchases that the taxpayer is authorized to make under the Direct Payment Permit.

Qualifying taxpayers wishing to report Taxable Purchases utilizing the optional percentage-based reporting must make a written request to the Manager of Audit Division. Initially, the percentages to be reported will be computed through an Audit or Managed Audit of the taxpayer. Subsequent audits of the taxpayer will consist of verifying the reported percentages.

The preliminary meeting between the auditor and the taxpayer's representative(s) will consist of analyzing the various identifiable segments of the taxpayer and the various categories of purchases – assets, expenses, and other. A determination will be made which purchases will be detailed and which will be sampled. For purchases to be sampled, the various Accounts of Interest will be identified. Regardless of whether an Audit or a Managed Audit is being performed on the taxpayer, all sampling procedures must meet Comptroller guidelines. The appropriate transactions may be categorized by:

- Dollar amount

- Type of taxable item purchased

- Purpose for which taxable item will be used, or

- Other standards appropriate to the taxpayer's operations

After the above procedures are completed, a Formal Approval to proceed is granted by the Comptroller, and a Formal Contract between the Comptroller and the taxpayer is executed. An Audit Plan Summary, which includes the procedures to be applied to each identifiable business segment, is developed jointly with the taxpayer. The necessary fieldwork is then completed. If this is a Managed Audit and the taxpayer is performing the fieldwork, Comptroller approval, as outlined in the Audit Plan Summary, is required during the various steps of the fieldwork. All schedules submitted by the taxpayer must be in the format specified by the Comptroller.

The Comptroller reviews the fieldwork, finalizes the schedules, and provides preliminary results to the taxpayer. The Comptroller issues the Letter of Authorization by attaching Exhibit A to the Sales & Use Tax Compliance Agreement. Exhibit A would consist of the various Accounts of Interest and the percentages that will be reported as taxable.

For more information on Percentage-Based Reporting for Direct Payment Permit holders, please refer to Audit Memo AP 75. For more information on Managed Audit policy and procedures, please refer to Audit Memos AP 111 An exhibit of the Sales and Use Tax Compliance Agreement is shown below.

Sales and Use Tax Compliance Agreement

Optional Reporting Method: Percentage-Based

Company Name

And

The State of Texas

Comptroller of Public Accounts

This Tax Compliance Agreement is made this ______ day of ________________, _____, between

____________________________________ and the Comptroller of Public Accounts of the State of Texas and will be effective from

___________________ and ending ______________________.

RECITALS

Whereas, Taxpayer is permitted under the Texas Tax Code, Chapter 151, with direct payment permit number ___________________ and

has use tax responsibilities to the Comptroller under that permit number during the period of this Agreement pursuant to the Texas Tax

Code, Subchapter I, Chapter 151, Section 151.419.

Whereas, Taxpayer has requested authorization to report their tax obligations under the Texas Tax Code, Chapter 151, using an optional

reporting method - percentage based, as authorized by the Texas Tax Code, Subchapter I, Chapter 151, Section 151.4171.

Whereas, Section 151.4171 defines 'Optional Reporting Method: Percentage-Based' to mean a method by which a taxpayer categorizes

purchase transactions according to standards specified in the letter of authorization, reviews an agreed-on sample of invoices in that category

to determine the percentage of taxable transactions, and uses that percentage to calculate the amount of tax to be reported.

Whereas, Comptroller may, as authorized by Section 151.4171(b), permit the holder of a direct payment permit to use a percentage-based

reporting method under Section 151.4171.

I.

PROCEDURES AND GENERAL PROVISIONS

Comptroller and Taxpayer hereby agree as follows:

1. Taxpayer currently is reporting all taxes imposed under Tax Code, Chapter 151, on purchases of taxable items for its own use under

direct payment permit taxpayer number ______________________. All terms and provisions found within this Agreement apply solely to

purchases Taxpayer is authorized by law to make under this direct payment permit, and no other. This Agreement constitutes an Addendum

to Taxpayer's Direct Payment Permit Agreement executed by Taxpayer pursuant to Section 151.419.

2. The Comptroller has audited Taxpayer for tax due on purchases for the period of _______________ through _________________,

using sampling procedures that both parties agree reflect as closely as possible the normal conditions of Taxpayer's business as required by

the Texas Tax Code, Subchapter A, Chapter 151,('Section 111.0042'). This sampling procedure was found to be appropriate because the

Taxpayer's records are so detailed, complex, or voluminous that an audit of all detailed records would be unreasonable or impractical. This

audit of the Taxpayer determined the correct amount of tax that should have been reported for the sample period based on the law and rules

in effect at the time the audit was performed. The sample procedures were applied to the Taxpayer's ________________________________

and to the total purchases related to each ____________________________________ based on general ledger accounts listed on Exhibit A,

exclusive of General Ledger Account(s) for__________________________________________.

3. Because the sampling procedures, as applied to the general ledger accounts listed in Exhibit A, used in the sample audit produced

reasonable results and indicated a stable and consistent percentage of taxable purchases compared to total purchases, the Comptroller and the

Taxpayer agree that the percentage of taxable purchases determined by the sample audit for (Identifiable Business Segment) listed on

Exhibit A will be appropriately applied to the periods covered by this Agreement, ________________ through _________________. This

Agreement only covers the general ledger accounts listed in Exhibit A and expressly excludes Taxpayer's General Ledger Account(s)

for_________________________________________________. Taxpayer's tax reporting and compliance responsibilities under this direct

payment permit will be met by Taxpayer reporting as taxable amounts on its periodic reports an amount equal to the total purchases for the

general ledger account multiplied by the appropriate taxable percentage listed on Exhibit A as determined by the sample audit. If the

Taxpayer changes its accounting system, business practices and/or operations, it must notify the Comptroller. Failure to notify the

Comptroller of such changes within forty-five (45) days will give the State the right to cancel this Agreement immediately upon written

notice to Taxpayer.

4. The Comptroller will audit Taxpayer's general Ledger Account Number(s) using any method that it finds to be appropriate under

the guidelines found within the Tax Code and rules.

5. If, as a result of a preliminary review of the Taxpayer's records, the State determines that the cost of a more detailed audit of the

Taxpayer's records will be unreasonable in relation to the benefits derived and the procedures described in this Agreement continue to

produce a reasonable result, the Comptroller and the Taxpayer agree that this Agreement may be extended so long as the percentages stated

on Exhibit A remain representative of the normal conditions of the Taxpayer's business and will be bound, subject to the exceptions noted

herein. If an extension of this Agreement is warranted, the percentages stated on Exhibit A will be utilized for reporting purposes, as

mutually agreed upon by both the State and the Taxpayer, and so noted by an addendum to this Agreement. The State retains the right to

audit the Taxpayer's records to determine if the business practices and operations of the Taxpayer have changed.

6. Although the parties intend to be bound to the percentages stated on Exhibit A for assessment and refund purposes, if the State

determines, in its reasonable discretion, that any individual transaction or account, due to extraordinary circumstances, is not representative

of the Taxpayer's business operation for the periods covered by this Agreement, the transaction or the account will be eliminated from the

Agreement upon written notice to Taxpayer and can be separately assessed in the audit by the State or can be subject to a refund to

Taxpayer, whichever is applicable. The terms of this Agreement, however, will remain in force for all other transactions and accounts not

eliminated as extraordinary.

7. The percentages stated on Exhibit A were determined to be correct in reporting Taxpayer's purchases based on the law and rules in

effect at the time the audit was performed. If the State, in its reasonable discretion, determines that there have been significant changes in

applicable law, including changes in interpretation of existing laws and rules, which render the percentages on Exhibit A no longer

representative of Taxpayer's taxable purchases, the State shall have the right to terminate this Agreement immediately upon written notice to

the Taxpayer. This Agreement does not relieve the Taxpayer of its responsibility to report in accordance with changes in law and

interpretations of law and rules.

8. Except as otherwise provided herein, this Agreement may be terminated by either party, provided a written notice of sixty (60) days

is given to the other party prior to the termination date. Upon termination under this paragraph, the Taxpayer and the State agree that a

representative sample of transactions will be mutually selected and examined to determine that the factors for tax reporting and compliance

for periods within the term of this Agreement were representative of Taxpayer's business activity. If this examination reveals that the factors

for tax reporting are not representative of Taxpayer's business operations, the State shall have the right to separately assess the Taxpayer, or

can be subject to a refund to the Taxpayer, whichever is applicable.

9. Taxpayer represents and warrants that it has not given, offered to give, and does not intend to give at any time hereafter, any

economic opportunity, future employment, gift, loan, gratuity, special discount, trip, favor or service to any public servant or state employee

in connection with this Agreement.

10. This Agreement may be amended only upon written agreement between Comptroller and Taxpayer, but in no case shall this

Agreement be amended or construed so that it conflicts with the laws of the State of Texas or rules or regulations adopted by Comptroller

under those laws.

11. This Agreement shall be governed by and construed in accordance with the laws of the State of Texas. The venue of any suit

brought for any breach of this Agreement is fixed in any court of competent jurisdiction of Travis County, Texas.

12. Any correspondence related to this Agreement directed to the Comptroller should be sent to the Manager of Audit Division. Any

correspondence related to this Agreement intended for Taxpayer should be directed to: _________________________________________.

13. Comptroller and the State of Texas shall not be liable for any damages or any other amounts to Taxpayer or any other entity or

person resulting from any termination or cancellation of this Agreement for any reason.

Authorized Signatures

Comptroller of Public Accounts Taxpayer

By:____________________________ By:____________________________

Martin Hubert Name:__________________________

Deputy Comptroller Title:_________________________

Date:__________________________ Date:__________________________

Direct Payment Exemption Certificate Form

State of Texas

Direct Payment Exemption Certificate

Limited Sales, Excise, and Use Tax

Direct payment authorization number: __12345678903______________________

The undersigned hereby claims exemption from the payment of state, city, county, MTA, and/or CTD sales and use

taxes upon its purchases of taxable items from:

Seller: ___ABC Services, Inc._____________________

Street address: __1212 Gibson Lane________________

City, state, zip code: ___Houston, Texas 77043_______

This certificate will remain in effect until the seller is otherwise notified.

Description of items purchased. If this space is left blank, this certificate covers everything on the attached order, invoice, or billing.

______________________________________________________________________________________________

______________________________________________________________________________________________

This certificate does not cover:

(1) Purchases of taxable items to be resold.

(2) Sales or rentals to any purchaser other than the permit holder.

(3) Sales or rentals of motor vehicles subject to the motor vehicle sales and use tax (Chapter 152) and interstate motor carrier sales and use tax (Chapter 157).

(4) Materials or supplies used, transferred, or consumed by a provider of a nontaxable service.

The permit holder agrees not to permit others (including its contractors and repairmen) to use the undersigned's direct payment authorization to purchase materials tax-free. This certificate is not valid for lump-sum new construction projects to improve real property.

The undersigned agrees to accrue and pay the tax to the Comptroller of Public Accounts as required by statute.

Permit holder: _XYC Corporation______________

Authorized signature: _Pablo Ximenez, Treasurer__

Date of purchase: ____June 22, 2006__________

NOTE: The above form is only a suggested format.

Alcoholic Beverage Exemption Certificate

A resale certificate is not required on the sale of liquor, wine, beer, or malt liquor from a licensed manufacturer, wholesaler, or distributor to a retailer licensed under the Texas Alcoholic Beverage Code (Rule 3.289). These sales are presumed to be for resale.

An Alcoholic Beverage Exemption Certificate may be issued to the supplier by a holder of a mixed beverage permit, late hour mixed beverage permit, or daily temporary mixed beverage permit issued by the Texas Alcoholic Beverage Commission. The holders of mixed beverage permits may not necessarily be permitted for sales tax.

The certificate may be issued to suppliers in lieu of sales tax on the purchase of alcoholic beverages, ice, mixes, and nonalcoholic beverages if the receipts from their resale of these items are taxable under Tax Code, Chapter 183 (Mixed Beverage Tax).

Alcoholic Beverage Exemption Certificate Form

I, the undersigned, hereby claim an exemption from payment of taxes under the Tax Code, sec. 151.308(8), (9), for the purchase

of the taxable items described below or on attached order or invoice to be purchased from ____________________

______________________________________________________________________________________________

I claim this exemption because I hold _____________________(type of permit)_________________________________

_______________________________, _________________(number of permit)_______________________________

issued by the Texas Alcoholic Beverage Commission. I understand that I will be liable for payment of the limited sales and use

tax if I use the items covered by this certificate in any manner or for any reason other than in a sale which is subject to the gross

receipts tax as levied under Texas Tax Code, Chapter 183.

Executed this ___________ day of ____________________, 20___.

Purchaser ___________________________________________________

Business Address ___________________________________________________

Address ___________________________________________________

___________________________________________________

___________________________________________________

Consular Tax Exemption Cards

The foreign diplomat should present his consular tax exemption card to the vendor when purchasing taxable merchandise.

A consular tax exemption card is issued by the U.S. Department of State, is not transferable, and may not be used by others, including spouses.

For audit purposes, check individual invoices for the signature of the consular official and the consular exemption number which appears on the back of the card.

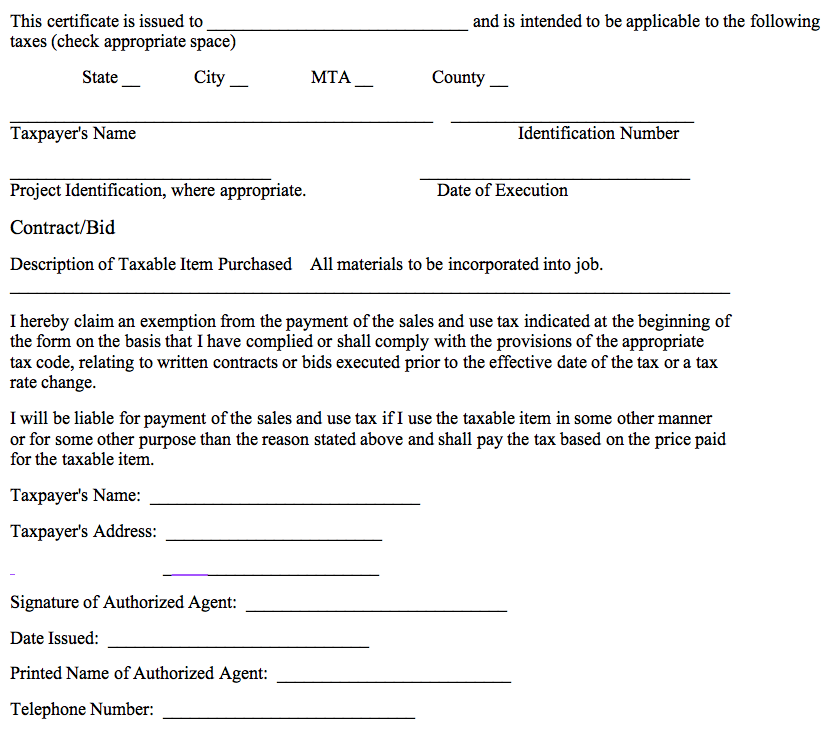

Prior Contract Exemption Certificate

A contract that is legally binding and entered into prior to a law change or tax increase may be exempt due to a prior contract exemption. Prior Contract Exemption Certificates must be furnished by a contractor to the vendor for all purchases which qualify for the prior contract exemption.

Prior Contract Exemption applies to:

- Contracts for taxable items entered into prior to the date of a tax rate increase

- Contracts for taxable items entered into prior to a tax base increase

For example, the taxable items purchased, leased, or rented were not subject to sales tax prior to the contract signing date. - Any contract entered into prior to the date the city, county, MTA/CTD tax takes effect in any city, county/SPD, MTA/CTD which may affect the contract, if the contract is not subject to change or modification by reason of the tax

- An obligation of a bid submitted prior to the date the city, county, MTA/CTD tax takes effect in any city, county/SPD, MTA/CTD which may affect the contract, if the bid may not be withdrawn, modified, or changed by reason of the tax

- Annexation of the job site into a city having city tax in effect

- A cancellation clause in a contract will not cause the loss of a prior contract exemption

Refer to Rule 3.319 - Prior Contracts - for more detailed information - Any change orders that constitute additions to the original contract will not be included in the prior contract exemption

The original part of the contract may still retain its prior contract exemption if the change orders can be separately identified. - Any renewal or exercise of an option to extend the terms of the contract will be considered a new contract, thus not qualifying for the prior contract exemption

- Also includes leases of tangible personal property that are entered into prior to a tax rate or tax base change. (Hearing #27,336)

The prior contract exemptions apply only if the Texas legislature has provided enabling legislation. The effective date and statute of limitations date on prior contracts will also be governed by the enabling legislation.

The prior contract exemption is only good for three years from the date the city, county, SPD, or MTA/CTD takes effect in any taxing jurisdiction.

Note: Currently, there is no enabling legislation which would allow for a prior contract exemption.

Prior Contract Exemption Certificate Form

Divergent Use

State and local sales or use tax is due on the divergent use of a taxable item purchased under a valid resale or exemption certificate.

If a taxable item purchased under a valid resale or exemption certificate is used in a taxable manner, the purchaser is liable for tax on the fair market rental value of the tangible personal property or the fair market value of the taxable service for the period of time used or on the original purchase price of the item. The fair market rental value is the amount that a purchaser would pay on the open market to obtain that taxable item or taxable service.

At any time the person using the tangible personal property or the taxable service may stop paying tax on the fair market rental value and instead pay tax on the original purchase price. When the person elects to pay tax on the original purchase price, credit will not be allowed for taxes previously paid based on the fair market rental value.

Example:

An office supply retailer located inside the city limits of Houston, Texas withdraws a desk (cost of $1000, retail price of $1500) from a valid tax-free inventory for use in its office. The retailer adds the desk to its furniture and fixtures section of the general ledger and will depreciate the desk throughout the useful life. The desk was purchased from a wholesaler located in Dallas, Texas. The retailer owes tax on the cost ($1000) of the desk to the following taxing jurisdictions:

- State of Texas

- City of Houston

- Houston MTA

Sixty-Day Letter

By law, properly executed resale or exemption certificates should be in the possession of the seller at the time of the nontaxable transaction. Auditors should allow the taxpayer a reasonable amount of time (depending on the circumstances of the audit) to obtain the missing certificates relating to unsupported tax-free sales before the audit is finalized.

If the taxpayer did not acquire all certificates needed within the time period allowed by the auditor, Texas Tax Code §151.0054(e) allow taxpayers sixty days to obtain the missing certificates from the date the Comptroller gives written notification requiring them. A sixty-day letter will be sent by the Audit Processing Section of Audit HQ in Austin. All certificates acquired during this time are subject to verification.

The Sixty-Day Letter does not apply to:

- The United States government (Sec. §151.309(1)(2)(3)

- The State of Texas and its political subdivisions (Sec. §151.309(4)(5)

- Sales which are exempt by statute; e.g., water

- Sales which by their nature qualify for a resale or other exemption; e.g., bales of cotton

Issuing the Sixty-Day Letter

After the audit is billed, the taxpayer must request a redetermination hearing in order to be able to submit documentation, including certificates. The Audit Processing Section of Audit HQ will send an acknowledgement letter to the taxpayer in response to his Statement of Grounds. If certificates are involved, the sixty-day notification will also be included in the body of the letter. The taxpayer will then be allowed sixty days from the date the letter is received in which to provide additional documentation and/or certificates that support his Statement of Grounds.

A deduction will not be granted on the basis of certificates delivered to the Comptroller after the sixty-day period.

An example of a sixty-day letter is shown next.

60-Day Letter Example

STATE OF TEXAS

AUSTIN, 78774

September 25, 2006

Mr. Allen B. Clark, President

ABC Services, Inc.

P. O. Box 2468

Houston, Texas 77043-2468

Dear Mr. Clark:

I have received your request for a redetermination hearing on the limited sales, excise, and use tax audit performed

on ABC Services, Inc., Taxpayer No. 12345678903, for the audit period April 1, 2004 through March 31, 2006. You

have sixty (60) days from the date of this letter in which to submit any additional documentation to support your

statement of grounds. An Auditor from Houston South Audit will contact you to make arrangements to review this

documentation on the 61st day.

Your case will be reviewed by Houston South Audit, and if any relief can be granted at this initial stage you will be

advised.

If we determine the issues in dispute cannot resolved by the audit office, you have the right to meet with an

Independent Audit Reviewer (IAR), if you have not met with one previously. This can be initiated by notifying the

auditor on or before the 61st day. If you previously met with a IAR or choose not to exercise this option, your

request will be forwarded to the Comptroller's General Counsel Division. You will be notified by letter of the name

and telephone number of the hearings attorney assigned to your case.

Please do not hesitate to call Jennifer Hernandez in the Houston South Audit Office if your have any questions. You

can contact the audit office by calling 713/314-5700.

Sincerely,

James Jefferson

Audit Processing

512.936.5872, 1.800.531.5441-Ext. 65872

James.jefferson@cpa.texas.gov

Letter of Assignment

A Letter of Assignment is used when a taxpayer reports their sales activity under the wrong taxpayer number. This can happen when a sole owner incorporates but continues to report sales tax information under the sole owner's number instead of the corporation's taxpayer number. When this happens, the auditor must obtain a Letter of Assignment, and two audits must be performed. To determine the audit period of each entity, the auditor must remember that the goal is to bring all entities current.

In the situation above, if the corporation were in existence for the entire audit period, the audit of the sole owner would be a no tax change audit. All adjustments, if any, would be assessed in the audit of the corporation. The audit period of the sole owner would start at the beginning of the audit period and go through the last report filed. The audit period of the corporation would also start at the beginning of the audit period and go through the last period of the audit (the two audits may have the same audit period).

If the sole owner incorporated during the audit period but continued to report sales information under the sole owner number, the audit of the sole owner should start at the beginning of the audit period and continue through the last report period filed under the sole owner number. Adjustments, if any, should be made on the sole owner audit through the date they incorporated. Adjustments after incorporation should be included in the audit of the corporation.

If the auditor has to permit the succeeding entity, do not back date the permit within the audit period. First business date should begin one day after the ending audit period. The new entity will be non-permitted for the audit period and will default to monthly filer when the audit is uploaded. Set up CATS and WATS as monthly. Inform the taxpayer that they will be responsible for filing all appropriate returns that fall after the audit period.

In addition, the auditor needs to capture Secretary of State (SOS) file numbers of entities that may be liable for franchise tax. If the taxpayer is a Texas limited partnership, a foreign limited partnership, or a Texas professional association, then the auditor will need to go to the SOS Web site to find the file number. This file number must be entered on XUMAST. If the taxpayer is a corporation or a LLC, the needed information is already captured on XISUMM (tax code 13) for those corporations and LLCs that are registered with the Texas SOS.

The audit procedures are:

- Obtain an assignment from the entity (assignor) that reported amounts to the Comptroller for a related entity under the assignor's number

- Document the procedure in the audit plan if the audit is 'no tax change' - be sure to notify the taxpayer that the tax was reported under the wrong number

- Audit all entities in order to close the audit period for each to avoid future problems - submit TCR's and Applications to reflect the correct first sale dates and out-of-business dates of all entities

- Only additional tax due or credits due should be assessed in the audit of each entity - the tax due or credits do not include amounts reported under the incorrect taxpayer number

- A comment should be made on Agency Work Manager for both taxpayers listing the related names and taxpayer numbers for each audit, particularly for credit audits in which tax should not be refunded due to a related deficiency audit

All of the related audits should be batched together.

Letter of Assignment Example

ASSIGNMENT

To the Comptroller of Public Accounts for the State of Texas:

______________________________ erroneously reported and remitted

(assignor)

__________________________ taxes directly to the State of Texas under

(tax type)

account number _______________________________________ during the period

(assignor's acct. #)

_________________________ to ________________________ .

These taxes were the responsibility of ______________________________

(assignee)

and should have been reported and paid to the State by

__________________________ under the account number

(assignee)

___________________________ .

(assignee's acct. # or n/a)

________________________ has assigned all right, title, and

(assignor)

interest to credit or refund for the taxes erroneously reported

and paid to the State as described in this assignment to

_____________________________ . ___________________________ further

(assignee) (assignor)

states that he has not previously claimed a refund nor taken a

credit for these taxes and will not claim a refund or credit for

these taxes in the future.

Sincerely,

______________________

(name)

_______________________

(title)

________________________

(date)

Sales to Destinations Outside of Texas

The sale of tangible personal property which, under the sales contract, is shipped to a point outside Texas is exempt from the tax if:

- Merchandise is for export

An exemption can be claimed when tangible personal property is exported beyond the territorial limits of the United States. The first step in reviewing export sales is to refer to the shipping addresses on the invoices.

Proof of export may only be shown by:- A copy of a bill of lading issued by a licensed and certificated carrier which shows a delivery point outside the territorial limits of the United States

- Formal entry documents from the country of destination showing that the property was imported into a country other than the United States

- A copy of the original airway, ocean or railroad bill of lading issued by a licensed and certificated carrier which describes the property being exported and the freight forwarder's receipt showing that the forwarder took possession of the property in Texas

- Documentation provided by a licensed United States Customs Broker, certifying that delivery will be made to a point outside the United States

- A maquiladora exemption certificate issued by a Maquiladora Enterprise chartered by the Mexican government to import raw materials and component parts into Mexico for use in manufacturing items to be primarily exported from Mexico. The Maquiladora Enterprise must also provide a copy of its maquiladora export permit issued by the Comptroller of Public Accounts.

- Shipment is in the seller's vehicle

Examine delivery receipts, contracts or other correspondence in order to ensure that the taxable items were indeed delivered to a location outside Texas - Delivery is made by the seller to a common carrier for shipment to a consignee

Examine Bills of Lading, freight invoices, parcel post receipts and record of parcel post shipments in order to verify that the taxable items were delivered to an out-of-state customer

A transaction is not exempt as a sale in interstate commerce if:

- The merchandise is delivered to a purchaser or purchaser's agent in Texas who later removes it from Texas (see Carrier Rule 3.297 for an exception for aircraft) OR

- The merchandise is delivered to a carrier in Texas who is not operating under a commercial bill of lading

The first step in reviewing sales in interstate commerce is to refer to the shipping address on invoices. Out of state sales may be supported by purchase orders and/or shipping documents. These documents usually contain instructions to deliver merchandise to the carrier.

Cash Discounts

Deductions may include cash discounts. It is important to analyze how the taxpayer reports cash discounts.

Deductions for cash discount are:

- Actual discounts taken on taxable sales or services

- An average percentage of taxable sales or services

- A ratio of the total discounts taken based on the ratio of taxable sales to total sales

- The discount applicable to the sales price

Each discount must meet the following requirements. The discount:

- Was allowed by the seller

- Was taken by the purchaser

- Was applied to a taxable sale or service

- Was computed on the selling price inclusive of tax, or computed on the selling price exclusive of tax and tax was refigured - see the first Example on the following page

- Is really a cash discount – make certain that the difference between the invoice price and the cash received is truly cash discount and that the customer did not deduct sales tax on a taxable item

Examine the taxpayer's working papers to determine how the deduction was computed. Deductions should be verified by tracing sales invoices on which the discounts were allowed to the cash receipts journal.

NOTE: If the discount is calculated on the original sales price excluding tax and tax is not recalculated, then the original tax is still due. See the second example on the following page.

Cash Discounts, Examples

EXAMPLE

Sales Price $40.00

Sales Tax @ 8.25% 3.30

------

Total Invoice $43.30

Less 2 percent discount (2 percent of $43.20) $ .87

------

Amount paid by customer $42.43

======

The customer receives a total discount of 87 cents (80 cents discount

on sales price and 7 cents tax credit). If the vendor had previously

reported the total $40 sales price, a discount of 80 cents is allowed

($40 sales price minus 2 percent of $40.)

EXAMPLE

Sales Price $40.00

Sales Tax @ 8.25% 3.30

------

Total Invoice $43.30

Less 2 percent discount (2 percent of $40.00) $ .80

------

Amount paid by customer $42.50

======

The discount is NOT allowed as a Deduction even if the $40 sales price

had been previously reported because the tax paid by the customer was not

refunded on the discounted amount. In other words, tax should have been

refigured [($40 - 80 cents) x 8.25 percent]; however, it was not refigured nor

refunded.

Returned Merchandise