CID News — June-Sep. 2024

If you have information about any of these cases, email or call the Criminal Investigation Division toll free at 800-531-5441, Ext. 3-8707. You do not have to disclose your name.

Case Closed

The CID may not always get its man (or woman), but we do get quite a few. Here are some recent examples:

October 2024

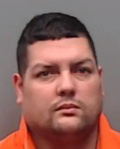

Motor fuel thief sentenced

Delacruz

Duniesky Vizcay Delacruz, 39, of Corpus Christi, was convicted of evading motor fuel tax and theft of a petroleum product valued at less than $10,000.

In July 2023, the defendant intentionally and knowingly evaded motor fuel tax by illegally acquiring approximately 97 gallons of diesel fuel using a pulsar tampering device. The defendant delivered the fuel into an auxiliary fuel tank in his vehicle.

A Burleson County district judge sentenced Delacruz to 4 years’ incarceration for evading motor fuel tax and 12 months incarceration for the theft of petroleum, to run concurrently, and Delacruz was given 220 days’ jail time credit.

August 2024

Jailed for Stealing

Jose Antonio Mederos Gomez, 29, of Fort Worth, was convicted of fraudulent use or possession of identifying information.

On April 12, 2023, the defendant utilized several re-encoded gift cards with financial information belonging to other people to illegally appropriate diesel fuel.

A Parker County district judge sentenced Gomez to three years’ incarceration for fraudulent use or possession of identifying information, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

15 Years for Fuel Thief

Ramon Perez-Torres, 31, of Mesquite, was convicted of engaging in organized criminal activity.

Between June and August 2022, the defendant and his co-defendants illegally acquired fuel by using pulsar tampering devices and stolen credit card information. The defendant utilized vehicles modified for the purpose of acquiring, transporting, and delivering motor fuel. The offenses occurred across multiple jurisdictions from Denton County to Anderson County, Texas.

A Smith County district judge sentenced Perez-Torres to 15 years’ incarceration, and he was given 486 days jail time credit for engaging in organized criminal activity, a first-degree felony punishable by five to 99 years in prison and a fine up to $10,000. The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

Do the Crime, Serve the Time

Pedro Julio Ruiz-Llanes, 33, of Burleson, was convicted of transporting motor fuel without shipping documents, evading motor fuel tax and unlawful use of a criminal instrument.

On June 5, 2023, the defendant utilized a vehicle modified to receive, transport and deliver large quantities of unlawfully appropriated motor fuel. The motor fuel was obtained by using pulsar tampering devices and stolen credit/debit card information.

A Johnson County district judge sentenced Ruiz-Llanes to four years’ incarceration, and he was given 176 days jail time credit for transporting motor fuel without shipping documents and evading motor fuel tax, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000. Unlawful use of a criminal instrument is a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

July 2024

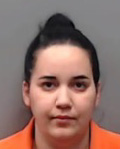

Do the time for organized crime

Camila Cruz Concepcion, 26, of Dallas, was convicted of engaging in organized criminal activity.

Between June and August 2022, the defendant and her co-defendants illegally acquired fuel by using pulsar tampering devices and stolen credit card information. The defendant utilized vehicles modified for the purpose of acquiring, transporting and delivering motor fuel. The offenses occurred across multiple jurisdictions from Denton County to Anderson County, Texas.

A Smith County district judge sentenced Concepcion to 10 years’ incarceration, and she was given 546 days jail time credit.

June 2024

Motor fuel thief sentenced

Edel Antonio Gonzalez Mojena, 35, of Houston, was convicted of evading motor fuel tax.

In May 2023, the defendant intentionally and knowingly evaded motor fuel tax by illegally acquiring approximately 198 gallons of diesel fuel using a re-encoded credit card. The defendant delivered the fuel into an auxiliary fuel tank in his vehicle.

A Colorado County district judge sentenced Mojena to 2 years’ incarceration, and he was given 199 days jail time credit. The defendant paid restitution of about $809.

50 years for fuel theft

Duniesky Ondarza Gonzalez, 38, of Dallas, was convicted of engaging in organized criminal activity.

Between June and August 2022, the defendant and his co-defendants illegally acquired fuel by using pulsar tampering devices and stolen credit card information. The defendant utilized vehicles modified for the purpose of acquiring, transporting, and delivering motor fuel. The offenses occurred across multiple jurisdictions from Denton County to Anderson County, Texas.

A Smith County district judge sentenced Gonzalez to 50 years’ incarceration, and he was given 512 days jail time credit.

Stealing is not the answer

Wilver Benitez Rodriguez, 47, of Dallas, was convicted of evading motor fuel tax, transporting motor fuel without cargo manifest or shipping documents, and unlawful use of a criminal instrument.

In March 2020, the defendant siphoned approximately 313 gallons of diesel fuel from an underground storage tank and delivered the unlawfully appropriated fuel into an auxiliary tank mounted inside the cargo area of his vehicle.

An Ellis County district judge sentenced Rodriguez to 50 years’ incarceration.

New Cases

Breaking the state's laws is a losing proposition. Read about those who found that out the hard way.

September 2024

Sept 26

Kent Berger, 74, of New Orleans, La., was arrested for allegedly tampering with a government record.

An investigation revealed that the suspect tampered with the Texas Application for Non-Retailer Cigarette, Cigar and/or Tobacco Products Permit by knowingly making false entries and omissions, then presented the application to the Texas Comptroller’s office.

Berger is charged with tampering with a government record, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The case is pending prosecution in Tarrant County.

Sept 19

Shane Aaron Wells, 41, of Argyle, was arrested for allegedly tampering with a government record with intent to defraud/harm and giving false name information/forgery on vehicle registration.

An investigation revealed that the suspect signed for a false sales price on a Texas title/registration form, knowing that the sales price listed was not true and correct, to evade paying the motor vehicle sales tax, while also submitting a false bill of sale.

Wells is charged with tampering with a government record with intent to defraud/harm, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000 and giving false name information/forgery on vehicle registration, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The case is pending prosecution in Denton County.

Sept 14

Yoisbel Banos Gomez, 27, of Odessa, was arrested for allegedly evading or attempting to evade motor fuel tax.

An investigation revealed the suspect intentionally and knowingly evaded or attempted to evade motor fuel tax by failing to pay the backup diesel tax liability on illegally appropriated red-dyed diesel fuel. The fuel was delivered to an auxiliary fuel tank in the bed of a pickup truck.

In Texas, non-taxable diesel is dyed red to distinguish it from taxable diesel. Red-dyed diesel is authorized almost exclusively for off-road, agricultural use by permit holders only.

Gomez is charged with evading or attempting to evade motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

The case is pending prosecution in Crane County.

Orlan Corcho Martinez, 36, of Odessa, was arrested for allegedly evading or attempting to evade motor fuel tax.

An investigation revealed the suspect intentionally and knowingly evaded or attempted to evade motor fuel tax by failing to pay the backup diesel tax liability on illegally appropriated red-dyed diesel fuel. The fuel was delivered to an auxiliary fuel tank in the bed of a pickup truck.

In Texas, non-taxable diesel is dyed red to distinguish it from taxable diesel. Red-dyed diesel is authorized almost exclusively for off-road, agricultural use by permit holders only.

Martinez is charged with evading or attempting to evade motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

The case is pending prosecution in Crane County.

Sept 10

Rhandy Caballero, 36, of Austin, pleaded guilty to evading motor fuel tax.

A Williamson County district judge sentenced the defendant to three years’ deferred adjudication.

In August 2023, an investigation revealed the defendant unlawfully appropriated approximately 167 gallons of diesel fuel worth around $598, using several re-encoded cards with stolen credit and debit card information.

Orestes Rodriguez Alpizar, 47, of Austin, pleaded guilty to evading motor fuel tax.

A Williamson County district judge sentenced the defendant to three years’ deferred adjudication.

In August 2023, an investigation revealed the defendant unlawfully appropriated approximately 167 gallons of diesel fuel worth around $598, using several re-encoded cards with stolen credit and debit card information.

Sept 5

Estella Youngblood, 57, of Grapevine, was arrested for allegedly tampering with a government record.

An investigation revealed that the suspect tampered with the Texas Application for Non-Retailer Cigarette, Cigar and/or Tobacco Products Permit by knowingly making false entries and omissions, then presented the application to the Texas Comptroller’s office.

Youngblood is charged with tampering with a government record, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The case is pending prosecution in Tarrant County.

Ernesto Gonzalez-Romero, 38, of Austin, was indicted for allegedly evading or attempting to evade motor fuel tax.

Gonzalez-Romero is charged with evading or attempting to evade motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

An investigation found the defendant illegally appropriated approximately 309 gallons of diesel fuel worth about $1,233 by using a pulsar manipulation device. The diesel fuel was delivered into an auxiliary fuel tank in the bed of a truck.

The case is pending prosecution in Burleson County.