Regular Session Wrap-Up of Texas’ 88th Legislature Putting Record-Breaking Revenue to Work for Texans

The Texas economy determines the amount of revenue the state generates and even can cause the state’s budget to swing drastically from one biennium to the next. The Texas Legislature charts the state’s path forward by writing a budget when it meets in regular session for five months at the Capitol every odd-numbered year.

When working with a shortfall, lawmakers may be forced to cut spending, which means downsizing or even eliminating certain programs. When lawmakers have more funding available, they may cut taxes, boost or expand select programs, and make new investments.

But the 88th Legislature’s Regular Session — one marked by record revenues — entered uncharted territory.

“Most state budgets can focus on only one major issue — that is, if the economy has outperformed expectations,” says Texas Comptroller Glenn Hegar. “However, the 2024-25 budget cycle was unprecedented in the extent to which lawmakers could focus on an array of issues facing everyday Texans.”

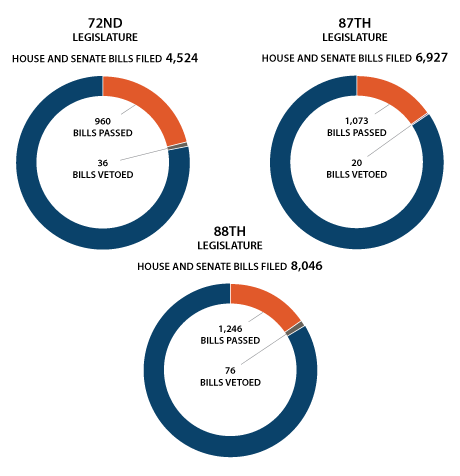

Exhibit 1: BILL ACTIVITY DURING THE 72ND, 87TH AND 88TH LEGISLATURES, REGULAR SESSIONS

Note: Does not include resolutions or memorial and congratulatory motions.

Source: Texas Legislature Online, Legislative Statistics

Lawmakers directed this historic funding to critical improvements, including further investment in the state’s electric grid, broadband internet accessibility and water supply planning, as well as funding for school property tax relief.

Lawmakers introduced more bills in this year’s regular session, which ran from Jan. 10 through May 29, than in any session in recent history (as far back as the 72nd Legislature in 1991). However, the passage rate (about 15 percent) is on par with the 87th Legislature, Regular Session. Gov. Greg Abbott vetoed 76 bills, preventing them from taking effect (Exhibit 1).

Projecting Texas’ Revenue

The Biennial Revenue Estimate (BRE), released by the Texas Comptroller of Public Accounts in January, set the stage for the 2024-25 budget. Due to favorable projections, this report forecast more than $188 billion would be available for general-purpose spending during the 2024-25 biennium, a 26 percent increase from the previous biennium. The BRE estimated the state would end its 2022-23 biennium with a historic $32.7 billion balance.

Although the projected revenue gave lawmakers extraordinary flexibility to craft the new state budget, Hegar urged them to make careful spending decisions so expenditures could be supported in the future.

The 2024-25 Budget

Lawmakers authorized spending $321.3 billion during the current two-year budget cycle in House Bill (HB) 1, compared with $303.3 billion in the previous cycle (which includes the supplemental appropriations in Senate Bill (SB) 30 passed this session) — a nearly 6 percent increase (Exhibit 2).

Exhibit 2: GENERAL APPROPRIATIONS ACT (HB 1), BY METHOD OF FINANCE, 2022-23 TO 2024-25

| Method of Finance | 2022-23 | 2024-25 | $ change | % change |

|---|---|---|---|---|

| General Revenue Funds | $130,403.6 | $144,130.4 | $13,726.8 | 10.5% |

| General Revenue - Dedicated Funds | 8,024.2 | 6,833.7 | (1,190.5) | (14.8) |

| Federal Funds | 117,301.4 | 102,286.3 | (15,015.1) | (12.8) |

| Other Funds | 47,567.1 | 68,087.2 | 20,520.1 | 43.1 |

| ALL FUNDS | $303,296.3 | $321,337.6 | $18,041.3 | 6.0% |

Notes: 2022-23 amounts include supplemental appropriations made by SB 30; totals may not sum due to rounding.

Source: Legislative Budget Board

The bulk of expenditures with state funds in the General Appropriations Act pays for education, health and human services and public safety/criminal justice, in that order (Exhibit 3). The judiciary and business and economic development articles experienced the largest percentage increases in funding from the last biennium.

Exhibit 3: GENERAL REVENUE FUNDS, BY ARTICLE, 2022-23 TO 2024-25

| Article | Article Title | 2022-23 | 2024-25 | $ change | % change |

|---|---|---|---|---|---|

| I | General government | $10,845.8 | $9,334.1 | ($1,511.7) | (13.9%) |

| II | Health and human services | $39,015.2 | $42,862.1 | $3,846.9 | 9.9% |

| III | Education | $62,752.0 | $72,006.6 | $9,254.6 | 14.8% |

| Public | $41,454.6 | $50,402.9 | $8,948.3 | 21.6% | |

| Higher | $21,297.4 | $21,603.7 | $306.3 | 1.4% | |

| IV | Judiciary | $597.7 | $860.3 | $262.6 | 43.9% |

| V | Public safety/criminal justice | $12,645.8 | $13,364.7 | $718.9 | 5.7% |

| VI | Natural resources | $3,294.4 | $3,486.4 | $192.0 | 5.8% |

| VII | Business/economic development | $508.1 | $1,292.5 | $784.4 | 154.4% |

| VIII | Regulatory | $311.2 | $434.1 | $122.9 | 39.5% |

| X | Legislature | $433.4 | $489.6 | $56.2 | 13.0% |

| TOTAL, ALL ARTICLES | $130,403.6 | $144,130.4 | $13,726.8 | 10.5% | |

Notes: 2022-23 amounts include supplemental appropriations by SB 30; 2024-25 appropriations under Article IX are reflected in the functional articles above; not included in table are 2024-25 GR transfers to the Property Tax Relief Fund (Other Funds) totaling $12.3 billion; totals may not sum due to rounding.

Source: Legislative Budget Board

Major Legislative Issues

Economic Development

HB 5 creates an incentive program that reduces school district maintenance and operations property tax for certain businesses, similar to the Texas Economic Development Act (commonly referred to as Chapter 313) that expired in December 2022. The new program has different eligibility criteria and investment and job requirements for businesses seeking property tax abatements under the program. (Learn more about the Chapter 313 program in the November 2020 edition of Fiscal Notes, and check out the 87th Legislature wrap-up to better understand the program’s history.)

Fentanyl Poisoning

HB 6 allows fentanyl poisoning, as determined by a toxicology examination or autopsy, to be listed as the cause of death on a death certificate and allows classification of those deaths as homicide or manslaughter depending on the circumstances. (Read about state and federal law enforcement’s efforts to stop fentanyl trafficking in the January 2023 edition of Fiscal Notes.)

Rural Law Enforcement

SB 22 requires the Comptroller’s office to establish and administer salary assistance grant programs for qualified sheriffs’ offices, constables’ offices and prosecutors’ offices in rural counties to support law enforcement across the state. A grant amount awarded under these programs will depend on the population of the county or jurisdiction the applying office serves. (Learn more about new funding initiatives that benefit rural Texas in the August 2023 edition of Fiscal Notes.)

State Family Leave

SB 222 establishes paid family leave for eligible state employees after the birth or adoption of a child, authorizing 40 days paid time off following the birth of a child and 20 days paid time off following the adoption of a child or the birth of a child by the employee’s spouse or gestational surrogate.

“The Legislature took a huge step in attracting and retaining talented employees by providing this benefit,” says Lisa Craven, deputy comptroller and chief of staff at the Comptroller’s office. “Research indicates women who are offered paid parental leave are much more likely to return to the workforce after having a child. Long term, this policy will promote maternal mental and physical health and reduce health care costs for the state, while promoting healthy child development, a cornerstone for a strong state and a robust economy.”

Family Care Sales Tax Exemption

SB 379 exempts certain family care items, including feminine hygiene products, diapers, maternity clothing and breast milk pumping products, from state sales and use taxes. Hegar joined Sen. Joan Huffman to support this initiative several months before the legislative session began. In an August 2022 joint press release, Huffman said, “Every woman knows that these products are not optional. They are essential to our health and well-being and should be tax exempt.”

Likewise, Hegar said, “It’s time for Texas to join the 24 states that already exempt tampons and other feminine hygiene products from sales tax. Taxing these products is archaic.”

Infrastructure

This session was a memorable one for statewide infrastructure buildouts and improvements, including:

-

Water

SB 28 creates the New Water Supply for Texas Fund to finance projects that develop new water supplies for the state and the Texas Water Fund for water or wastewater infrastructure projects. Texas voters gave a thumbs up to the new water funds with the passage of Proposition 6 on Nov. 7.

“Extreme weather patterns, aging infrastructure and Texas’ daily net migration of 1,000 people necessitate increased attention to the state’s water supply,” Hegar says.

The number of boil water notices in Texas jumped from 1,993 in 2018 to 3,143 in 2022, according to the Texas Commission on Environmental Quality.

(See the Comptroller’s recent water report (PDF) for more details.)

-

Broadband

HB 9 establishes the Broadband Infrastructure Fund to provide financial assistance for broadband and emergency telecommunications infrastructure projects in the state. With the passage of Proposition 8, this fund will support the goals of the Broadband Development Office, which the 87th Legislature created within the Comptroller’s office to expand high-speed internet access and adoption in Texas.

-

Electric Grid

SB 2627 establishes the Texas Energy Fund to support the construction, maintenance and modernization of dispatchable electric generating facilities (those with adjustable outputs to meet power grid demand). Texas voters gave the fund a green light with the passage of Proposition 7.

“Texas’ tremendous economic growth has been possible because we have continued to invest in our energy sector,” says Hegar. “To support that growth, we must encourage corresponding growth in our energy generation, transmission and grid management infrastructure.”

According to data collected by the Electric Reliability Council of Texas, the state’s primary power grid operator, about 41 percent of Texas’ total thermal power generation (natural gas, coal and nuclear) comes from facilities that are older than 30 years.

(Read more about the 88th Legislature’s investments in the state’s infrastructure in the September 2023 edition of Fiscal Notes.)

Spending Highlights of the 88th Legislature’s Regular Session

Foundation School Program

$3.2 billion allocated to fund projected public school enrollment growth, $2.4 billion for increases in the golden penny yield and $60 million for the New Instructional Facilities Allotment.

Health and Human Services Commission (HHSC)

$2.5 billion allocated to HHSC (in addition to $4.7 billion in federal funds) for Medicaid and $2.2 billion allocated to build new state hospitals and boost inpatient capacity.

State Employee Salary Increases

$1.8 billion allocated for two separate 5 percent increases in state employee salaries (with a minimum of $3,000 per year) for fiscal 2024 and 2025. Targeted salary increases also were provided to state agencies with high staff turnover rates, including criminal justice and social services agencies that support many of the state’s “critical needs” positions. (See the Comptroller’s July 2023 report (PDF) for more on the state’s workforce challenges.)

Teacher Retirement System of Texas (TRS)

$3.4 billion allocated for a cost-of-living adjustment to eligible TRS retirees with the passage of Proposition 9 on Nov. 7, and $1.6 billion allocated for a one-time supplemental annuity payment for certain TRS retirees.

Texas Education Agency (TEA)

$1.4 billion allocated to TEA for school safety programs implemented by school districts and charter schools, as well as new statewide initiatives.

Employees Retirement System of Texas (ERS)

$900 million one-time legacy payment allocated to ERS as part of the state’s long-term plan to pay down the system’s unfunded actuarial liabilities. (For more details about the state’s long-term financial obligations, see the September 2021 edition of Fiscal Notes.)

Sources: Legislative Budget Board, HB 1: Highlights of the Appropriations for the 2024-25 Biennium; Legislative Budget Board, Conference Committee Report for SB 30 – Highlights

Higher Education

The 88th Legislature also devoted considerable attention to enhancing Texas’ institutions of higher education.

HB 8 establishes the public junior college state finance program to improve the state funding formula for community colleges, such as gearing it more toward student outcomes to encourage obtaining a degree, certificate or other credential or transferring to a general academic institution.

HB 1595 creates the Texas University Fund (TUF) to “provide a dedicated, independent and equitable source of funding” for general academic teaching universities that currently do not receive funding comparable to certain institutions in the state’s largest research university systems (University of Texas and Texas A&M) eligible for the Permanent University Fund. The following institutions are designated to receive distributions from the TUF:

- Texas State University (San Marcos).

- Texas Tech University (Lubbock).

- University of Houston (Houston).

- University of North Texas (Denton).

Other institutions also may become eligible for distributions from the TUF in the future if they meet criteria established in HB 1595.

Texas voters stamped their seal of approval on the TUF with the passage of Proposition 5.

According to Texas State University, “The funding is part of a broader effort to help [these universities] achieve national prominence as major research universities, drive the Texas economy and bolster higher ed research beyond the state’s two largest university systems.”

(See the February 2023 and July 2023 editions of Fiscal Notes for more information about the education initiatives designed to boost the state’s enrollment numbers and workforce.)

Revenue Estimate Update

The Certification Revenue Estimate (CRE) released by the Comptroller’s office on Oct. 5 projected that while both the U.S. and Texas economies will continue to grow —even amid repeated predictions of an impending recession over the last year and a half — the Texas economy will continue to outpace the national economy (Exhibit 4).

Exhibit 4: PROJECTED REAL GROSS DOMESTIC PRODUCT, TEXAS AND U.S., FISCAL 2023-2025

| Area | Fiscal 2023 $ amount | Fiscal 2023 Annual % change | Fiscal 2024 $ amount | Fiscal 2024 Annual % change | Fiscal 2025 $ amount | Fiscal 2025 Annual % change |

|---|---|---|---|---|---|---|

| Texas | $1,945 | 4.8% | $1,990 | 2.3% | $2,024 | 1.7% |

| U.S. | $20,346 | 1.9% | $20,682 | 1.6% | $20,938 | 1.2% |

Note: Amounts in 2012 dollars.

Sources: Texas Comptroller of Public Accounts; S&P Global

Even after all the appropriations made by the 88th Legislature this year, the Comptroller’s office projected that the state will have $18.29 billion at the end of fiscal 2025. (The CRE does not include any additional spending resulting from the special session taking place at the time of this writing.)

Despite persistent economic growth, Hegar warns that a recession in the near term is not out of the question, considering the unknown cumulative effects of variables such as the Federal Reserve’s restrictive monetary policy efforts since March 2022, weak economic growth among major U.S. trading partners and economic disruption arising from international conflict.

“In view of the significant risks to the economic outlook, revenue is estimated conservatively for the 2024-25 biennium,” Hegar stated in the CRE. “It may well turn out that robust economic growth, and consequently revenue growth, will continue unabated. But it would not be prudent to simply assume that will be the case.”

Special Sessions, and Then Some

Before the regular session ended May 29, lawmakers were unable to agree on legislation to significantly reduce the property tax burden on Texans, a priority issue for the 88th Legislature. Abbott called two special sessions to get meaningful property tax reform across the finish line. (Read more about recent property tax reform in this issue.)

At the time of this writing, Texas lawmakers have concluded a third special session and began a fourth special session, both called by the governor to address other priority issues that fell short during the regular session. Chief among them is a statewide school choice proposal that would allow parents to use public funding to send their children to private school if desired. If lawmakers still don’t come to an agreement, however, more special sessions could be on the horizon. FN

Stay current on economic and legislative matters by subscribing to Fiscal Notes.