Rare Earth Elements TEXAS RARE EARTHS SHOW ECONOMIC POTENTIAL FOR STATE

Most of us go about our daily routines without giving much thought to the devices, technology and machinery that enhance and simplify our lives. Yet many high-tech goods and services we rely on for communications, work, education, safety, energy and transportation would be rendered useless without a group of components known as rare earth elements, or rare earths as they are sometimes called. And though rare earth elements have become an indispensable part of modern life, most Americans are unaware of our dependence on them.

Texas is home to one of the largest deposits of rare earths in the United States, and plans are under way to bring those resources to market. As those plans take shape, Texas has the potential to lead in the domestic development of rare earths, which could benefit the U.S. economy and boost a range of growing Texas industries — from national defense to clean energy and electric vehicle manufacturing.

A Rare Earths Primer

There are 17 rare earth elements identified in the periodic table. All are metallic elements that possess unusual fluorescent, conductive or magnetic properties. When those elements are alloyed in small quantities with a more common metal like iron, they become extremely useful in a wide array of applications for technologies, consumer products and industrial processes. About 75 percent of the rare earths (PDF) produced are used as catalysts — in chemistry terms, a catalyst cuts the time needed to achieve a chemical reaction, which saves time and energy.

Indeed, rare earth elements are integral to numerous commercial and national security applications (PDF) and are used in everything from small-scale goods such as smartphones, lasers, LED lights, computers and other consumer electronics to energy technologies such as wind turbines, electric and hybrid vehicles and oil refinery equipment (Exhibit 1).

EXHIBIT 1: USES OF RARE EARTH ELEMENTS

| Element | Description | Element | Description |

|---|---|---|---|

LANTHANUM: Fluid catalytic cracking for petroleum refining, nickel metal hydride (NiMH) batteries, metallurgical applications, glass and polishing ceramics lighting. |

DYSPROSIUM: Neodymium iron boron permanent magnets, in which it makes up generally about 0.8 percent to 1.2 percent by weight of the magnet, and magnetostrictive alloys. |

||

CERIUM: Automobile catalysts and additives, Food Chemicals Codex (FCC) additives, catalysts, metallurgy, polishing, powders and glass and others such as fertilizer, paint drying and a stabilizer in plastics. Applications often overlap with lanthanum. |

HOLMIUM: Magnets, magnetostrictive alloys for sensors and actuators. |

||

PRASEODYMIUM: Neodymium (NdFeB) magnets, metallurgical applications, pigments, batteries and catalysts. |

ERBIUM: Nearly all erbium is used in polishing and in highly specialized glass lens applications and fiber optics. |

||

NEODYMIUM: NdFeB magnets, glass and ceramics applications such as ceramic capacitors, metallurgical applications such as a minor alloying element for iron and steel alloys and magnesium alloys, luminophores and other applications such as NiMH batteries, catalysts and lasers. NdFeB magnets are used in products such as computer hard disk drives, magnetic resonance imaging (MRI), precision-guided munitions, automotive motors, wind turbines and loudspeakers. |

THULIUM: Portable X-ray devices, research and a dopant in solid-state lasers and highly specialized fiber optics, petroleum refining, NiHM batteries, metallurgical applications, glass and polishing ceramics lighting. |

||

SAMARIUM: Samarium cobalt permanent magnets, which are used in electronics (including military systems), automobiles, aerospace, pumps and medical devices. Other applications include infrared absorption glass, optical glass, fuel cells for nuclear applications and capacitors for microwave frequencies. |

YTTERBIUM: Metallurgical applications for rare earth magnesium alloys and specialty aluminum alloys. |

||

EUROPIUM: Phosphors and luminophores, which are used in TV and computer screens, compact fluorescent lighting, light-emitting diodes (LEDs) and sensors. Other applications include nuclear and medical applications and some specialty alloys and lasers. |

LUTETIUM: Medical equipment and small quantities in phosphors. |

||

GADOLINIUM: Metallurgical applications such as magnetic refrigeration, magnesium alloys and specialty alloys. Also used in small amounts for samarium cobalt magnets. Other uses include as a MRI contrasting agent and phosphors for dental and medical applications. |

YTTRIUM: Fluid catalytic cracking for petroleum refining, NiHM batteries, metallurgical applications, glass and polishing ceramics lighting. |

||

TERBIUM: Phosphors (green) for displays, LEDs and in medical applications, in permanent magnets and for other applications such as high-temperature fuel cells, lasers and magnetostrictive alloys for solid-state transducers and actuators used in sonar and other dual-use technologies. |

SCANDIUM: Solid oxide fuel cells (SOFC), aluminum alloys for aerospace and sporting goods, scandium-sodium lamps for outside venues, laser, optoelectronic materials and LEDs. |

Note: Promethium (Pm) was not included in the whitehouse.gov source chart. Promethium’s applications include atomic batteries for spacecraft and guided missiles

(chemicool.com/elements/promethium.html).

Source: The White House, “Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth,” June 2021

Among rare earth elements, neodymium magnets lead an ever-increasing list of high-tech commercial and military applications. One particularly important application of the powerful and permanent magnets is to improve efficiency and performance in things such as permanent magnet motors (used in electric vehicles), hard disk drives, audio equipment, microwave communication technology and even magnetic resonance imaging systems (MRIs).

Despite the necessity of rare earths for both national security technologies and consumer products, the United States was 100 percent net-import reliant on rare earths in 2018, and according to the United States Geological Survey (USGS), 80 percent of rare earth compounds and metals (PDF) imported between 2016 and 2019 was from China. As Exhibit 2 shows, before COVID-19, U.S. consumption of rare earths was once again on the rise.

Exhibit 2: APPARENT CONSUMPTION OF RARE EARTHS IN THE UNITED STATES, 2016-2020*

| Year | Consumption in Metric Tons |

|---|---|

| 2016 | 10,500 |

| 2017 | 9,060 |

| 2018 | 6,520 |

| 2019 | 11,700 |

| 2020 | 7,800 |

*Estimated.

Note: “Apparent consumption” is defined as production + imports – exports.

Source: U.S. Geological Survey, “Mineral Commodities Summary 2021,” (PDF) p. 132

Texas Rare Earths

The state’s high-tech manufacturing industry has been gaining momentum over the past few years, as evidenced by electric car manufacturer Tesla, which recently announced plans to move its headquarters to Texas. In addition, the aerospace and defense industries have a long-standing presence in the state and could benefit from a domestic supplier of rare earths. The Texas-built F-35 Joint Strike Force Fighter jet, for instance, uses 920 pounds of rare earths material.

Currently, the only U.S. rare earths mining and processing facility is the Mountain Pass mine in California’s Mojave Desert. Operated by MP Materials, the mine accounts for close to 16 percent of the world’s rare earths production.

In 2023, the Mountain Pass operation no longer will be the sole rare earths mining operation. USA Rare Earth LLC, owner and operator of the Round Top Heavy Rare Earth, Lithium and Critical Minerals Project in Hudspeth County, Texas, together with joint venture partner Texas Mineral Resources Corp., is projected to begin mining 950 state-owned acres at the Round Top deposit in Sierra Blanca, Texas. USA Rare Earth has announced it will process rare earths onsite and projects the mine is likely to yield 16 or 17 rare earth elements and more than 300,000 metric tons of rare earth oxides. (One metric ton equates to 2,204.62 pounds.)

The company, which was part of the Comptroller’s October Good for Texas Tour focused on supply chains, expects to use a new, proprietary process to produce the materials in a safe and environmentally sensitive way. USA Rare Earth also has plans to make use of solar and wind power, where possible, to operate with minimal greenhouse gas emissions.

The company has acquired the neodymium permanent magnet manufacturing system, formerly owned and operated by Hitachi Metals in North Carolina, and the only commercial-scale system of its kind in the United States. USA Rare Earth is preparing to recommission the system for production, and once operational, plans to create a domestic supply chain that produces at least 2,000 tons annually of rare earth magnets.

“Once we are fully operational, we will have a fully end-to-end domestic rare earths supply chain that will make our country and economy more secure,” says Director of Environmental Services & Sustainability Aleisha Knochenhauer with USA Rare Earth.

“We will be the first company not only to extract, which is the mining component, but to operate the processing side in the United States,” says Knochenhauer. “What makes us even more unique is we will be able to supply the entire supply chain by taking the material that we mine, processing [it] into rare earth oxides, and then creating the magnets that go into so many critical products.”

Knochenhauer says an end-to-end rare earths supply chain is key to true domestic security.

“The only way we’re ever going to be able to control our destiny is to really be able to develop and control the supply source. And if we do it domestically, so that it’s reliable and viable, then we control our destiny,” she says.

“It’s not too little, too late to go in that direction,” says Knochenhauer. “The United States has the tools. We have the know-how, we have the drive [and] we have the passion. We just need to create opportunities for us to start using them.”

DEPARTMENT OF DEFENSE (DOD) RARE EARTH ELEMENT AWARDS

As part of the U.S. government’s strategy to secure reliable supplies of critical minerals, the DoD has announced contracts and agreements with two rare earth element producers in Texas to strengthen the domestic rare earths supply chain.

BLUE LINE CORPORATION AND LYNAS RARE EARTHS LTD.

Texas-based Blue Line Corporation partnered with Lynas Rare Earths Ltd. — an Australia-based company and the largest rare earths mining and processing company outside China — and plans to open rare earths processing facilities in Hondo, Texas. In February 2021, the DoD awarded Lynas a Defense Production Act Title III technology investment agreement and contributed $30.4 million to fund the construction of the Hondo facility. Lynas plans to ship rare earths from its mine in western Australia for final processing in Texas.

URBAN MINING CO.

In November 2020, Urban Mining Co., based in San Marcos, Texas, entered into an $860,000 Defense Production Act Title III technology investment agreement with the DoD to conduct its small-scale pilot program of recycling rare earth elements from electronic waste to produce new permanent neodymium magnets.

Rare Earths History in the U.S.

Discovered in the late 18th century, rare earths were initially deemed “rare earth” because they appeared to be scarce and spread across the Earth’s crust, but their scarcity turned out to be untrue. Rare earths deposits are plentiful and found around the world, although rare earths mining and processing facilities have been limited to just a few countries because often the minerals are not found in concentrations high enough to make mining and processing economically feasible.

From the 1960s until the mid-1980s, the United States was the world leader in mining and refining rare earth elements into finished products, says Dr. Philip Goodell, professor of Earth, Environmental and Resource Sciences with the University of Texas at El Paso. The Mountain Pass mine in the California Mojave Desert was the world’s foremost supplier of rare earths — but by 2002, the Mountain Pass operation was out of business. (It later resumed operations from 2012-2015, and then again from 2018-present.)

“By 1980, there was more of a demand for rare earths, and things were going along pretty well for the U.S. until China entered the market in the 1990s,” says Goodell, noting China’s rare earths mining and processing operations were easily able to underbid U.S. rare earths production. “They don’t pay [workers] very well, and they don’t have the many environmental regulations that make U.S. production more expensive.”

Between 2010 and 2014, China imposed rare earths trade restrictions on the United States, Europe and Japan, triggering a supply chain shock around the world. In turn, that event spurred the USGS and private companies to identify domestic rare earth element resources.

“Now that China has taken over the market, it’s become an area of concern,” says Goodell. “We need to perfect the process here in the U.S. and make it cheaper to produce [rare earths].”

That’s easier said than done, as companies entering the rare earths supply chain (PDF) anywhere within the U.S. face a number of challenges. Obtaining permits to develop rare earth mines and processing facilities is complicated and highly regulated (Exhibit 3), and waste created from mining and processing rare earths must be responsibly discharged.

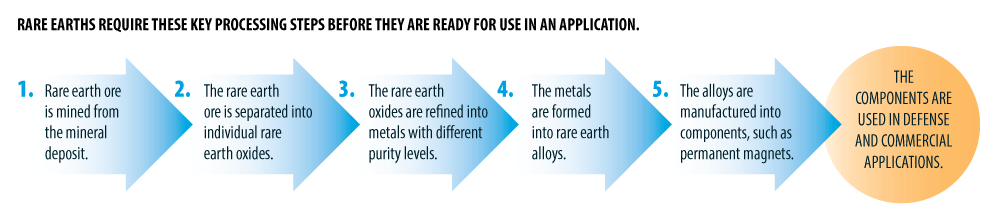

EXHIBIT 3: PROCESSING RARE EARTH ELEMENTS

Rare Earths require these key processing steps before they are ready for use in an application.

- Rare earth ore is mined from the mineral deposit.

- The rare earth ore is separated into individual rare earth oxides.

- The rare earth oxides are refined into metals with different purity levels.

- The metals are formed into rare earth alloys.

- The alloys are manufactured into components, such as permanent magnets.

- The components are used in defense and commercial applications.

Source: Government Accountability Office

Finding workers can be problematic, too. Successfully operating a rare earths mine depends on a skilled workforce, and processing rare earths requires technicians with high-tech skillsets in AI, automation and data analytics.

West Texas Preliminary Samples

Dr. Tristan Childress, economic geologist with the Bureau of Economic Geology at the University of Texas at Austin, spends much of his time searching for critical minerals in West Texas, exploring and analyzing the intrusive igneous rock around the hills of Dell City in Hudspeth County.

“West Texas could be very important for our future mining economy in Texas,” says Childress, who has taken more than 100 rock samples from the area. “We’re looking into the chemistry of those samples now to determine if there is anything potentially special that’s hidden underground,” he says.

Childress says the USGS also has flown magnetic surveys in the area and that the USGS survey reports are fascinating. “It turns out there is a lot more varied material in the ground that we can’t see — it’s actually a pretty complex network down there, and with complexity comes a diversity of rock types,” says Childress.

Childress’ sample analysis could potentially bring more good news for companies seeking to enter the rare earths market in Texas.

“To my mind, the more complex it is, the better chance that there is something potentially useful there,” Childress says. “It might be a similar situation to Sierra Blanca with Round Top Mountain, but we don’t know yet. We’re analyzing the samples, and we’ll find out shortly.” FN

USA Rare Earth's Round Top Project

See highlights from the Comptroller’s visit to the rare earths deposit in West Texas.

Interested in taking a deep dive into how supply chains contribute to the Texas economy? See how semiconductor, automotive, chemical manufacturing and other industries trade, mitigate risk and move products that add billions of dollars and thousands of jobs to the state economy each year.