Long-Term Obligations and the Texas Legacy Fund State Employee Pension Funding

Published October 2018

The Employees Retirement System of Texas (ERS) manages several pension plans with $29 billion in assets serving nearly 542,000 active and retired public employees and their dependents.2

These include:

- the ERS plan (sometimes called the “Employee Class plan”) for state employees, elected state officials, law enforcement officers and custodial officers — the largest plan the agency administers;

- the Law Enforcement and Custodial Officer Supplement Retirement Fund, which provides additional retirement benefits for these employees, who also belong to the ERS plan; and

- the Judicial Retirement System of Texas Plans 1 and 2, for judges, justices and certain court commissioners (the state replaced Plan 1 with Plan 2 in 1985).3

The ERS plan is a defined benefit plan (DBP) — a mandatory plan offering set monthly payments based on years of service and the employee’s highest salary, a type increasingly rare in the private sector. Both state and employee contributions made throughout working careers are invested to guarantee specific payments upon retirement.

Investment returns, generated primarily by bonds, stocks, private equity and real estate, accounted for 64 percent of the plan’s revenue between 2003 and 2016.4 Although both the state and its employees contribute, the state as plan provider bears the investment risk.

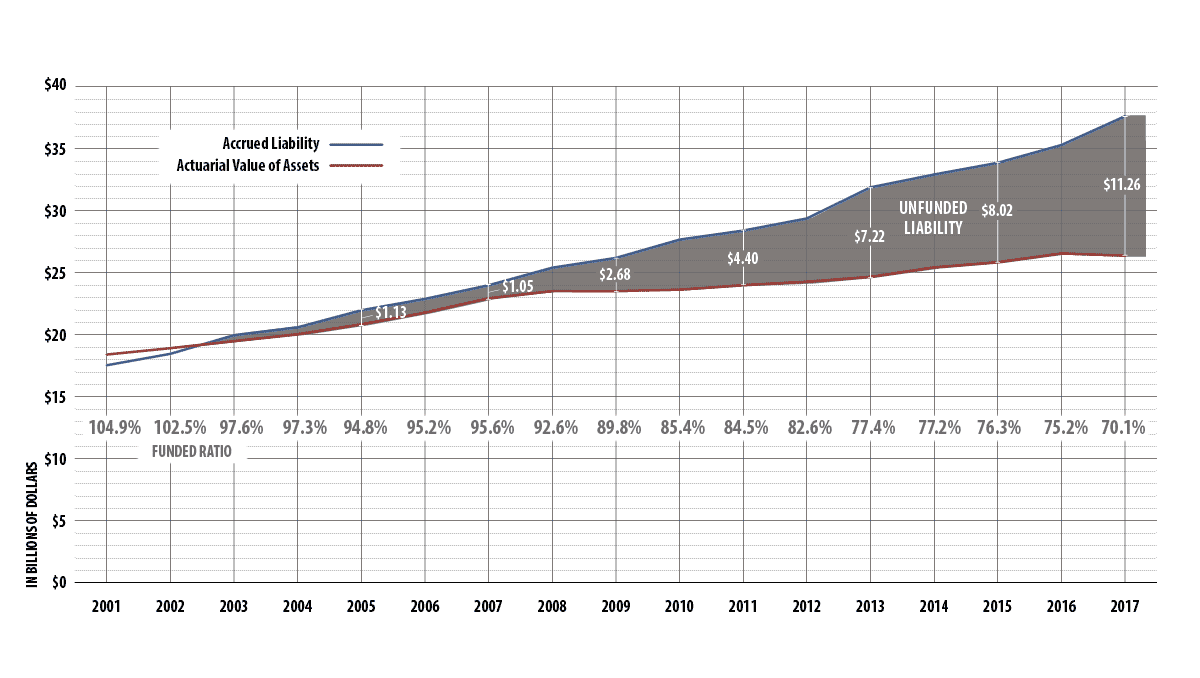

At the end of fiscal 2017, the ERS Retirement Trust Fund had $26.4 billion in assets. Its accrued liability, however — the total amount needed to meet all future pension obligations on the books — totaled $37.6 billion, resulting in an $11.3 billion unfunded actuarial accrued liability, or UAAL (Exhibit 1).5 This unfunded liability has been rising steadily. The UAAL rose by $10 billion between 2007 and 2017 and by $2.5 billion between 2016 and 2017 alone.6

Exhibit 1: ERS Trust Fund Actuarial Valuation

as of Aug. 31, 2017

| Measure | Value |

|---|---|

| Actuarial Value of Assets | $26.4 billion |

| Actuarial Accrued Liability | $37.6 billion |

| Unfunded Actuarial Accrued Liability (UAAL) | $11.3 billion |

| Funded Ratio | 70.1% |

Source: Employees Retirement System of Texas

The financial status of a pension fund such as the ERS trust fund is reflected in its funded ratio, its assets divided by its liabilities expressed as a percentage. A fully funded plan, then, would have a funded ratio of 100 percent or more.

Traditionally, a pension plan was considered actuarially sound with a funded ratio of 80 percent or greater; today, however, actuaries and credit rating agencies increasingly consider a variety of factors in assessing a fund’s health, including the size of its obligations, its funding policies and its investment strategies.7

At the end of fiscal 2017, the ERS plan’s funded ratio was 70.1 percent, down from 75.2 percent a year before (Exhibit 2). The ratio has fallen steadily since 2000.8

Exhibit 2: Actuarial Valuation History of ERS Pension Plan, Fiscal 2001 to 2017

| Year | Actuarial Value of Assets | Accrued Liability | Unfunded Liability | Funded Ratio |

|---|---|---|---|---|

| 2001 | $18.39 | $17.53 | -$0.87 | 104.9% |

| 2002 | $18.91 | $18.45 | -$0.46 | 102.5% |

| 2003 | $19.48 | $19.96 | $0.48 | 97.6% |

| 2004 | $20.04 | $20.59 | $0.56 | 97.3% |

| 2005 | $20.84 | $21.97 | $1.13 | 94.8% |

| 2006 | $21.78 | $22.88 | $1.10 | 95.2% |

| 2007 | $22.94 | $23.99 | $1.05 | 95.6% |

| 2008 | $23.51 | $25.40 | $1.89 | 92.6% |

| 2009 | $23.51 | $26.19 | $2.68 | 89.8% |

| 2010 | $23.63 | $27.67 | $4.04 | 85.4% |

| 2011 | $24.00 | $28.40 | $4.40 | 84.5% |

| 2012 | $24.27 | $29.38 | $5.10 | 82.6% |

| 2013 | $24.67 | $31.89 | $7.22 | 77.4% |

| 2014 | $25.43 | $32.92 | $7.49 | 77.2% |

| 2015 | $25.85 | $33.87 | $8.02 | 76.3% |

| 2016 | $26.56 | $35.30 | $8.75 | 75.2% |

| 2017 | $26.37 | $37.63 | $11.26 | 70.1% |

Source: Employees Retirement System of Texas

A pension plan’s financial status also can be gauged by its funding period, the time required for the plan to become fully funded based on characteristics such as contribution rates and benefits offered. In fiscal 2016, the funding period was 35 years. At present, the ERS plan’s funding period is “never” – meaning that, based on current actuarial assumptions and contribution rates, it will never have enough money to pay for the current and future retirement benefits it owes.9

Challenges Facing ERS

Several factors are making the ERS pension fund’s future viability uncertain, including:

- unrealistic investment return assumptions. ERS’ investment return assumption remained at 8.0 percent from 1994 to 2016; it was lowered to 7.5 percent in 2017 to more accurately reflect expected long-term returns. Even so, over time the ERS’ actual investment returns averaged 5.5 percent for the last 10 years and 6.4 percent for the last 20 years.10

The updated return assumption, however, will further reduce the ERS plan’s funded ratio and, if future state and employee contributions continue at their current level, completely deplete the fund by 2084.11 - inadequate state and employee contributions. Since 2016, the state has contributed an amount equal to 10 percent of payroll to the ERS plan annually (including a 0.5 percent contribution from individual state agencies), while employees contribute 9.5 percent of their salaries (Exhibit 3).12 The Texas Constitution limits the state’s contribution to 10 percent, well below the national median of 12.95 percent. Conversely, the employee contribution rate is well above the national median of 6 percent (for state pension plans with members who also are enrolled in Social Security).13

In all but one year since 1998, moreover, the state has failed to make the actuarially sound contribution (ASC) — that is, the contribution needed to fund the cost of future benefits and eliminate the UAAL over a finite period.14 - demographic pressures. In the last two decades, the number of active contributing members in the ERS plan has fallen by 10 percent, while the number of retirees and survivor beneficiaries (such as spouses) has risen by 64 percent. Thus, fewer active members are contributing toward the plan while an increasing number of members draw benefits without contributions from salary.15 Longer lives are increasing this fiscal pressure; the average U.S. life expectancy rose by nearly 10 years from 1960 to 2016.16

EXHIBIT 3: ACTUAL CONTRIBUTION RATE COMPONENTS, 2005 to 2018

| Year | Agency | State | Employee | Total Contribution |

|---|---|---|---|---|

| 2005 | 0.00% | 6.00% | 6.00% | 12.00% |

| 2006 | 0.00% | 6.45% | 6.00% | 12.45% |

| 2007 | 0.00% | 6.45% | 6.00% | 12.45% |

| 2008 | 0.00% | 6.45% | 6.00% | 12.45% |

| 2009 | 0.00% | 6.45% | 6.00% | 12.45% |

| 2010 | 0.00% | 6.78% | 6.48% | 13.26% |

| 2011 | 0.00% | 6.95% | 6.50% | 13.45% |

| 2012 | 0.00% | 6.00% | 6.50% | 12.50% |

| 2013 | 0.00% | 6.50% | 6.50% | 13.00% |

| 2014 | 0.50% | 7.50% | 6.60% | 14.60% |

| 2015 | 0.50% | 7.50% | 6.90% | 14.90% |

| 2016 | 0.50% | 9.50% | 9.50% | 19.50% |

| 2017 | 0.50% | 9.50% | 9.50% | 19.50% |

| 2018 | 0.50% | 9.50% | 9.50% | 19.50% |

Source: Employees Retirement System of Texas

Legislative Actions

From 2009 to 2015, the Texas Legislature passed various laws addressing the ERS plan’s growing unfunded liability by increasing employee contributions (in 2009 and 2015); raising the minimum retirement age (in 2009); increasing the length of the service period used to determine the final average salary, and thus the pension payment (in 2009 and 2013); and making other adjustments.17

The most recent legislation concerning ERS operations — Senate Bill 301, approved in 2017 — strengthens the ERS board’s oversight of “alternative investments,” such as private equities, private real estate or hedge funds. In recent years, these alternatives (as opposed to more traditional public equities) have represented a rapidly increasing share of ERS’ investments. The new law also requires the ERS board of trustees to approve any individual alternative investment above $100 million and requires a vote to be taken in public. Finally, the law requires ERS to study and adopt new actuarial assumptions once every four years, rather than every five.18

Policy Options

Despite recent legislation, the financial health of the ERS plan continues to decline. Any change to government pension plans can involve significant challenges and may have unforeseen consequences.

Proposed options to improve the funding status of the ERS plan include:

- increasing contributions. Increasing member contributions would improve the ERS fund’s financial health, but would not be popular with enrollees. Increasing the state contribution rate requires a constitutional change unless the governor declares an emergency.19

- making a one-time payment. In the absence of further plan changes or major economic disruption, a substantial appropriation to the fund could significantly reduce the ERS plan’s unfunded liability and establish a desirable funding period. Such a one-time payment also would help the fund earn higher returns. It would not, however, prevent the UAAL from rising again in subsequent years if the state does not begin meeting the ASC.20 A lump-sum payment, moreover, might be limited by the spending cap of 10 percent of payroll.

- dedicating an additional, ongoing state revenue source to the ERS plan. An additional revenue stream diverted to the ERS plan could help address its increasing unfunded liability.

- reducing benefits offered to current and/or future hires. Options include increasing the retirement age; raising the number of working years required to become pension-eligible (currently, at least five or 10 years of service depending on the initial hiring date); or reducing the multiplier that determines the size of annuities. As already noted, the Legislature has taken similar actions several times in the last decade.

Although such actions would help stabilize the plan, they might cause high-performing workers to seek employment elsewhere, thereby reducing the overall quality of the workforce. They also could cause a “rush to retirement” among those at or near retirement age, which would reduce contributions and damage the plan’s solvency.21 - changing the ERS plan to a defined contribution or hybrid plan. Most private employers offer defined contribution plans (DCPs), such as 401(k) plans, generally contributing a specific amount to employee retirement without guaranteeing a specific payment at retirement. The employee is at least partly responsible for managing the investment, if only by selecting among various retirement investment plans offered.22 In recent years, at least 10 states have adopted hybrid plans.23 These plans typically involve mandatory contributions to both a DBP and a DCP, distributing the risk between employee and employer. The DBP component provides a guaranteed monthly annuity, while the DCP component provides employees some control over their investment portfolios.24

The Benefit Multiplier

In Texas, retired state employees’ monthly annuities are calculated as follows:

Years of Service

X

Benefit Multi-

plier

X

Final Average Monthly Salary

=

Retired Employee's Monthly Annuity

The current multiplier for regular employees in the main ERS plan is 2.3 percent. It’s been in effect since fiscal 2002.

Source: Employees Retirement System of Texas