property tax today

quarterly property tax news

volume 30 | October 2024

Property Tax Today features content regarding upcoming deadlines, action items and information releases.

Please let us know what you would like to see in future editions by sending property tax questions and/or suggested topics to Property Tax Communications. We will gladly address property tax matters under our authority.

Message from the Comptroller

Glenn Hegar

Texas Comptroller

In an August Fiscal Notes article, my office takes a look at the cost of hurricanes in Texas, including lives and billions of dollars in damages. Since the start of hurricane season on June 1, Hurricane Beryl became the second named storm to hit Texas, making landfall near Matagorda as a Category 1 storm on July 8. Nearly 3 million electricity customers lost power and The Perryman Group, an economic research firm, estimates damages in Texas of $1.5 billion, with potentially higher net impacts.

Initial projections for this year’s Atlantic hurricane season called for up to 23 named storms, including 11 hurricanes and five major hurricanes – a projection which has since been updated to 25 named storms, including 12 hurricanes and six major hurricanes.

The Property Tax Assistance Division (PTAD) stayed busy over the summer months. PTAD staff certified the final 2023 School District Property Value Study (SDPVS) findings to the commissioner of education on Aug. 15, released the preliminary Methods and Assistance Program (MAP) reports to appraisal districts on Sept. 16 and worked diligently to update truth-in-taxation (TNT) information.

As we leave summer behind and venture into fall, PTAD has already begun working with legislators and their offices in preparation for the upcoming legislative session. Remember to attend the Property Tax Institute (PTI) in College Station, Dec. 3-4, 2024, to stay current on property tax matters in Texas, including an outlook on the upcoming 89th Texas Legislature.

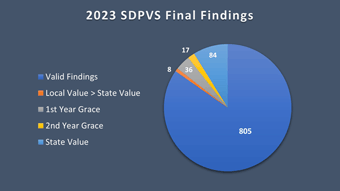

2023 SDPVS Final Findings

On Aug. 15, PTAD certified the 2023 final taxable value findings to the commissioner of education as required by Government Code Section 403.302. The 2023 SDPVS final taxable value findings are available on PTAD’s SDPVS webpage.

On Aug. 15, PTAD certified the 2023 final taxable value findings to the commissioner of education as required by Government Code Section 403.302. The 2023 SDPVS final taxable value findings are available on PTAD’s SDPVS webpage.

Some school district reports are pending due to petitions filed under Government Code Section 403.303 and are not available at this time.

Of the school districts studied in this cycle, 805 received valid findings; 36 qualified for year one of the grace period; 17 qualified for year two of the grace period; 84 received state value; and eight had local value that was greater than state value. These figures may be subject to change based on the conclusion of several ongoing protests.

MAP Reviews

PTAD released preliminary 2024 MAP reports on Sept. 16. PTAD issues preliminary reports based on preliminary data received, documentation reviewed and interviews conducted by the MAP reviewer. PTAD may make changes to reports after the release of the preliminary reports based on newly received data, documentation or other information. Appraisal districts must submit all remaining data for their final 2024 MAP reports by Nov. 1. PTAD will issue final 2024 MAP reports in January 2025.

Appraisal districts scheduled for 2025 MAP reviews will receive a preliminary data request list in mid-October with an early December due date.

SDPVS Required Forms

Tax Code Section 5.09 requires PTAD to collect information to report the total appraised values, taxable values and tax rates of each county, municipality, school district and special district. Tax Code Section 5.09(a-1)(1) authorizes PTAD to prescribe the format and submission deadlines for this data. PTAD's EARS Manual (PDF) offers additional information on this process.

Appraisal districts must submit the following SDPVS required forms, and the required backup documentation specified on each form, by Oct. 15:

- Form 50-253, Report on Value Lost Because of the School Tax Limitation on Homesteads of the Elderly/Disabled (PDF);

- Form 50-755, Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF);

- Form 50-767, Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 (PDF);

- Form 50-851, Report on Value Lost Because of Deferred Tax Collections Under Tax Code Sections 33.06 and 33.065 (PDF); and

- Form 50-897-b, Data Collection for Limitation on Homesteads of Elderly and Disabled or Deferred Taxes (XLSX).

Indicate N/A on any form that does not apply or provide a statement identifying the form and why it is no longer required. Do not send blank or incomplete forms. The forms may be emailed to ptad.ears@cpa.texas.gov.

Failure to provide completed and signed SDPVS forms and/or required information by the deadline may impact a school district's state funding and the appraisal district's MAP review.

2024 Tax Rate Information

Tax Code Section 5.091 requires appraisal districts to report the total tax rate imposed by each taxing unit within their jurisdiction to the Texas Comptroller of Public Accounts.

Appraisal districts must use Form 50-886-a, Tax Rate Submission Spreadsheet (XLSX), to provide the information as detailed in the EARS Manual (PDF) .

The appraisal district must provide the adopted tax rates by Oct. 15, indicating those taxing units with pending tax rate elections by placing a Y in the appropriate column of Form 50-886-a. Appraisal districts must submit a subsequent post-election spreadsheet with the final tax rates by Nov. 15.

Taxpayer Liaison Officer Comments

Taxpayer liaison officers in counties with populations exceeding 120,000 must submit to the Comptroller’s office a list of verbatim comments, complaints and suggestions received from property owners, agents or chief appraisers about the model appraisal review board (ARB) hearing procedures or any other matter related to the fairness and efficiency of the ARB.

Please submit comments, complaints and suggestions received pertaining to these matters only in the appropriate spreadsheet template (XLS) no later than Dec. 31.

Chief Appraiser Eligibility

All chief appraisers must notify the Comptroller’s office in writing no later than Jan. 1 of each year as to whether they are eligible to be appointed or serve as chief appraiser. To be eligible to serve, a chief appraiser must either be a certified Registered Professional Appraiser (RPA) or have the appropriate professional designation (Member Appraisal Institute (MAI), Assessment Administration Specialist (AAS), Certified Assessment Evaluator (CAE) or Residential Evaluation Specialist (RES). A chief appraiser who is not an RPA but who has an MAI, AAS, CAE or RES designation must obtain an RPA certification within five years of appointment or beginning of service as chief appraiser.

All chief appraisers must notify the Comptroller’s office in writing no later than Jan. 1 of each year as to whether they are eligible to be appointed or serve as chief appraiser. To be eligible to serve, a chief appraiser must either be a certified Registered Professional Appraiser (RPA) or have the appropriate professional designation (Member Appraisal Institute (MAI), Assessment Administration Specialist (AAS), Certified Assessment Evaluator (CAE) or Residential Evaluation Specialist (RES). A chief appraiser who is not an RPA but who has an MAI, AAS, CAE or RES designation must obtain an RPA certification within five years of appointment or beginning of service as chief appraiser.

Chief appraisers must submit written notification by emailing a completed, Form 50-820, Notice of Chief Appraiser Eligibility (PDF), to ptad.communications@cpa.texas.gov.

Farm and Ranch Survey

The 2024 Texas Farm and Ranch Survey is available online and was mailed to agricultural appraisal advisory board members requesting 2023 data.

Data compiled from the survey responses is an essential part of the SDPVS, authorized under Government Code Section 403.302. Information you provide increases the accuracy of the SDPVS findings that PTAD certifies to the Texas Education Agency, resulting in more equitable funding of public school districts.

As resources, we also provide an instructional guide and an informational video about the survey on our website.

Please submit survey responses by Oct. 16. If you have any questions, please contact Sarah Gutierrez or Joseph Pargas.

Property Taxes in Disaster Areas

On July 5, the acting governor issued a disaster declaration for 40 Texas counties due to widespread flooding, damaging winds and life-threatening storm surge resulting from Hurricane Beryl.

Counties in the declaration include: Aransas, Atascosa, Bee, Bexar, Brooks, Calhoun, Cameron, DeWitt, Dimmit, Duval, Frio, Goliad, Gonzales, Hidalgo, Jackson, Jim Hogg, Jim Wells, Karnes, Kenedy, Kinney, Kleberg, LaSalle, Lavaca, Live Oak, Matagorda, Maverick, McMullen, Medina, Nueces, Refugio, San Patricio, Starr, Uvalde, Victoria, Webb, Wharton, Willacy, Wilson, Zapata and Zavala.

Tax Code Section 11.35, Temporary Exemption for Qualified Property Damaged by Disaster, allows qualified properties that are at least 15 percent damaged by a disaster in counties included in the declaration to receive a temporary exemption of a portion of the property's appraised value. Qualified property includes:

- tangible personal property used for income production;

- improvements to real property; and

- certain manufactured homes.

Property owners must apply for the temporary exemption no later than 105 days after the governor declares a disaster area. Form 50-312, Temporary Exemption Property Damaged by Disaster (PDF), is available on PTAD’s Property Tax Forms webpage.

You can find more information on statutory relief for property owners in disaster areas on PTAD’s Property Taxes in Disaster Areas and During Droughts webpage.

Attorney General Opinions

The Office of the Attorney General issued the following opinions:

Opinion No. KP-0471

Aug. 8, 2024

The continued employment of a chief appraiser whose sibling is elected county tax assessor-collector and, as a result, begins serving as a member of the appraisal district board of directors.

Opinion No. KP-0473

Aug. 8, 2024

Addressing the calculation of average land value for each area or portion of an area designated by the municipality that is located in an appraisal district under Local Government Code Section 212.209.

Rules

The Comptroller’s office filed the following proposed property tax administration rules with the Texas Secretary of State on Aug. 5, 2024. The proposed rules were published in the Texas Register on Aug. 16, 2024, and the 30-day comment period ended Sept. 15, 2024.

- §9.4001, Valuation of Open-Space and Agricultural Lands

- Proposed Manual for the Appraisal of Agricultural Land (PDF)

- §9.4011, Appraisal of Timberlands

- Proposed Manual for the Appraisal of Timberland (PDF)

The Comptroller’s office filed the following proposed property tax administration rules with the Texas Secretary of State on Aug. 5 and Aug. 9, respectively. The proposed rules were published in the Texas Register on Aug. 23, and the 30-day comment period ended Sept. 2. Rule 9.3006 was filed for adoption on Oct. 3, will be published on Oct. 18, and becomes effective on Oct. 23. Rule 9.415 was filed for adoption on Sept. 23, will be published on Oct. 11, and becomes effective on Oct. 13.

- §9.3006, Notice of Estimated Taxes Required to be Delivered by County Appraisal Districts

- §9.415, Applications for Property Tax Exemptions

The Comptroller’s office filed the following property tax administration rule proposals with the Texas Secretary of State on Sept. 23. The proposed rules were published in the Texas Register on Oct. 4, and the 30-day comment period ends Nov. 3.

- §9.4037, Use of Electronic Communications for Transmittal of Property Tax Information (Repeal)

- §9.4037, Electronic Delivery of Communications between Tax Officials and Property Owners

- §9.4323, Application

The Comptroller’s office filed the following rule adoptions with the Texas Secretary of State on Sept. 24. The rules will be published on Oct. 11, and become effective on Oct. 14.

- §9.4223, Dismissal for Lack of Jurisdiction

- §9.4244, Dismissals for Lack of Jurisdiction

Action Items

Below is a list of action items for the fourth quarter of 2024. You can find a full list of important property tax law deadlines for appraisal districts, taxing units and property owners on PTAD's website.

- Oct. 15 – SDPVS required forms due.

- Oct. 15 – Adopted tax rate information due for all appraisal districts using Form 50-886-a, SDPVS Tax Rate Submission Spreadsheet (XLSX).

- Oct. 16 – Farm and Ranch Survey responses due.

- Nov. 1 – Final MAP documents for 2024 reports due.

- Nov. 15 – Post-election submittal of adopted tax rates due for all appraisal districts using Form 50-886-a, SDPVS Tax Rate Submission Spreadsheet (XLSX).

- Dec. 31 – Taxpayer liaison officer comments received due.

- Jan. 1 – Chief appraiser eligibility forms due.

If a deadline falls on a Saturday, Sunday or a legal or state holiday, the act is timely if performed on the next regular business day.

Please be advised that the information in this newsletter is current as of the date of its publication and is provided solely as an informational resource. The information provided neither constitutes nor serves as a substitute for legal advice. Questions regarding the meaning or interpretation of any information included or referenced herein should be directed to legal counsel and not to the Comptroller's staff.