feature story

The future of Texas power

September 2024

September 2024 | By Trinity Elkins, Nathan Gonzales and Bianca Schutz

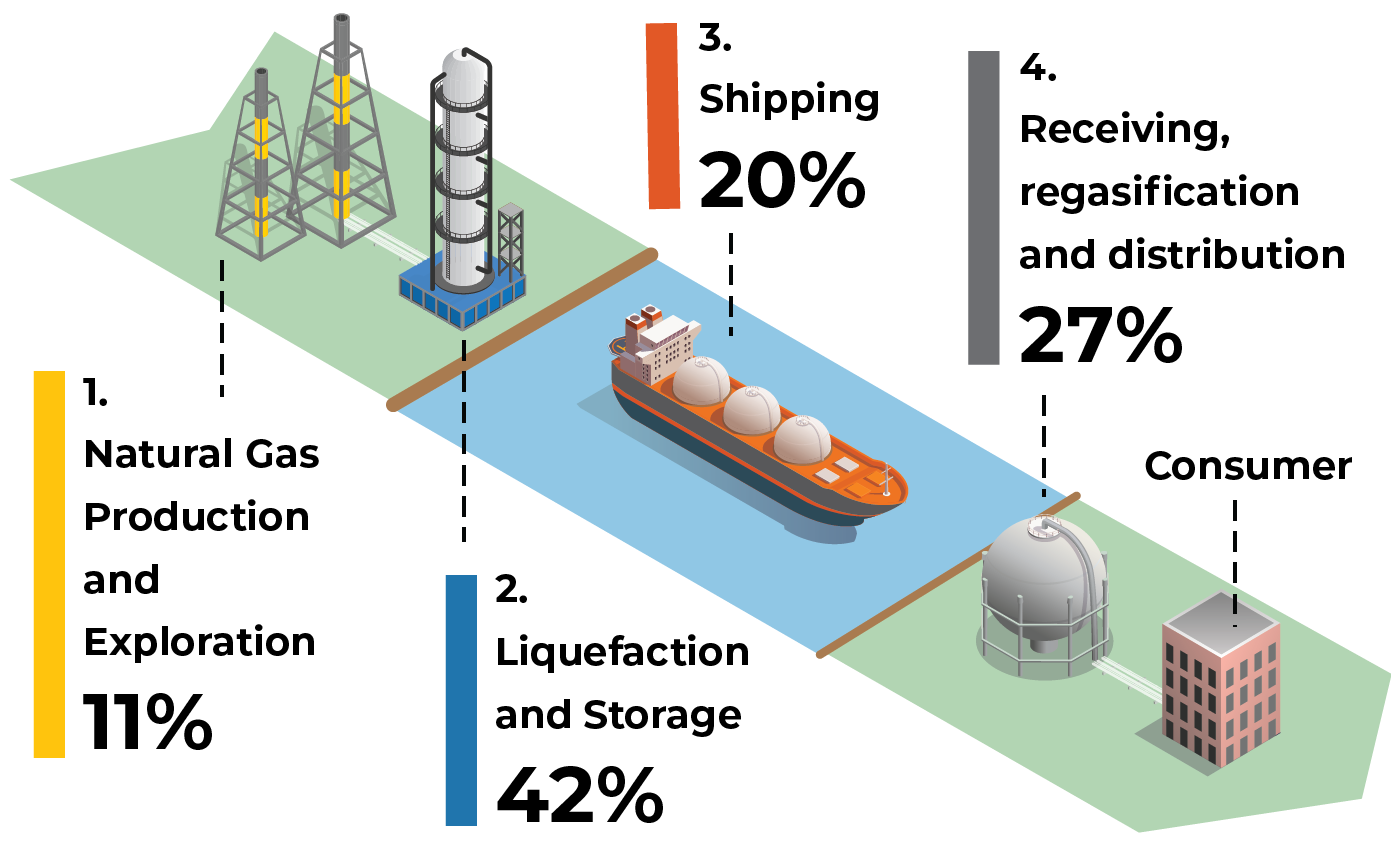

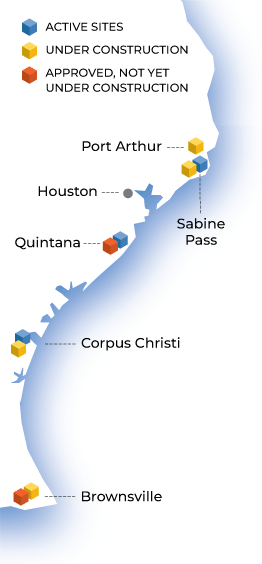

The liquefied natural gas (LNG) industry in Texas is a crucial component of the state’s energy sector, driven by abundant natural gas reserves and extensive infrastructure. Texas’ location and robust export capabilities make it a key player in the global LNG market, contributing significantly to the state’s economy and energy independence.

| Year | Texas Value | Texas Exports as Share of U.S. Total |

|---|---|---|

| 2018 | $0.73 | 12.5% |

| 2019 | $1.74 | 18.3% |

| 2020 | $4.27 | 32.4% |

| 2021 | $10.97 | 40.7% |

| 2022 | $12.23 | 25.9% |

| 2023 | $9.13 | 27.3% |

273%

Increase

The increase in export facilities in Texas has resulted in a 273 percent increase in LNG exports since 2019, when only four trains were operational. In 2023, the state exported more than 1.3 billion cubic feet (Bcf), accounting for 31 percent of U.S. LNG exports. According to the Federal Energy Regulatory Commission, there are currently 22 trains under construction that are projected to be operational by 2028.

All Geographic Regions (World Total)

$9.13 Billion

| Region | 2023 Value (In Billions) | Percent |

|---|---|---|

| Netherlands | $1.20 | 13.1% |

| France | $1.17 | 12.8% |

| United Kingdom | $0.88 | 9.7% |

| Spain | $0.73 | 8.0% |

| South Korea | $0.66 | 7.2% |

| China | $0.61 | 6.6% |

| Japan | $0.54 | 5.9% |

| Italy | $0.45 | 4.9% |

| Portugal | $0.28 | 3.0% |

| Turkey | $0.28 | 3.0% |

| Other Countries | $2.35 | 25.7% |

| Worldwide Total | 9.13 |

Note: Totals may not sum due to rounding.

Sources: U.S. Census Bureau, USA Trade Online; American Chemical Society.