Texas Film, Video Game Industries in the Spotlight State Fuels Incentive Engine to Compete for Productions and Jobs

Creative professionals making feature films and video games in Texas aren’t just competing with projects in the media meccas of Los Angeles and New York City. They’re vying with productions made in states with generous incentives and tax credits for film and games. Georgia has dominated in incentivizing film production; New Mexico offers sizeable tax credits; and Oklahoma’s cash rebates make it a serious contender.

Filmmakers can call upon many of Texas’ iconic locations, such as the Fort Worth Stockyards used in Taylor Sheridan’s 1883 mini-series.

Courtesy of Viacom Entertainment Group

Even states that offer generous subsidies have seen productions jump to another state for a more lucrative deal. Also, state film incentives have drawn criticism with some questioning if the money could be better allotted to education, health care, infrastructure or taxpayer relief.

In the face of competing priorities for state funds, many of which also offer a return on investment, Texas industry members welcomed the 88th Legislature’s decision to increase state incentives for film and video game developers, making it easier for local areas to grant tax exemptions for their projects. Industry members are still pushing for a sustainable means of Texas investment in the years ahead, and some point out changes are necessary to put video games on an equal footing with films in qualifying for incentives.

Still, leading voices like Nixon Guerrero, general manager of Troublemaker Studios in Austin, say this year’s support from Texas lawmakers is significant.

“With this funding increase, I am beyond hopeful,” says Guerrero. “I think there is a real shot for longevity and for bigger and better spaces around the state. It’s that super-fuel for the engine of our business.”

Texas already captures a sizeable share of the U.S. video game industry that contributed $56.6 billion to the U.S. economy, and of the domestic box office that grossed $7.54 billion in 2022. More than 190 companies comprised the Texas video game industry to produce $5.5 billion in economic impact for the state in 2022, the Entertainment Software Association (ESA) reports.

In addition, more than 210 feature film, commercial and television production companies claim Texas as their home. Those that have participated in the Texas Moving Image Industry Incentive Program (TMIIIP) have generated $1.95 billion in economic impact with a 504 percent return on investment from 2007 to 2022, according to the Texas Film Commission (TFC).

Magic-Making Mavericks

Texas’ video game industry directly employs more than 9,300 workers, and an additional 20,200 jobs in Texas are linked to the industry nationwide, according to 2022 data from the ESA. (Federal data on the video game industry are absorbed into the larger computer software industry.)

As for the film industry, it was going gangbusters until the pandemic shut down businesses across the nation and film production came to a standstill. From 2012 to 2017, Texas Workforce Commission data show average employment in the state’s film industry climbed nearly 37.5 percent (from 17,474 to 24,025) but fell 10 percent from 2017 to 2022.

A 2023 analysis by the Motion Picture Association (MPA) of U.S. Bureau of Economic Analysis data shows the American film and television industry supports 2.4 million jobs, pays out $186 billion in total wages and comprises more than 122,000 businesses. In 2020, the motion picture and television industry was directly responsible for more than 54,730 jobs in Texas, including production-related jobs as well as jobs related to distributing movies, for a combined $4.04 billion in wages, the MPA reports.

“Thanks to smart economic development policies in the state, the motion picture industry’s impact will only continue to grow in Texas, creating new job opportunities for Texas residents and growth opportunities for small businesses that are the backbone of the entertainment industry,” says Brandon Reese, vice president of state government affairs for the Southeast Region at MPA.

Top Billing

TMIIIP, which provides grants for films and video games based on the projects’ spending in the state, emphasizes its work to build the economy.

“TMIIIP was designed to strike a careful balance that enables Texas to be recognized as a viable competitor for media productions while still being fiscally responsible on behalf of Texas taxpayers,” says Paul Jensen, executive director of the Texas Media Production Alliance. “The program has worked, but historically it has been woefully underfunded.”

The Legislature took note by maintaining $45 million in TMIIIP funding (PDF) in the state budget (House Bill 1) for the 2024-25 biennium and approving $155 million in supplemental appropriations (PDF) (Senate Bill 30). The total $200 million allocation is “unprecedented,” Jensen says.

TMIIIP cash grants range from 5 percent for in-state spending of $250,000 to $1 million to 20 percent for in-state spending of $3.5 million or more. An additional 2.5 percent incentive is available to projects in underutilized or economically distressed areas. In exchange for grants and other incentives, production projects must employ 55 percent of their crew or employees from Texas and complete 60 percent of total production days in the state.

From fiscal 2018-2022, TMIIIP awarded $67.94 million (PDF) to television projects, $17.93 million to feature films, $17.63 million to video game projects, $4.4 million to reality television and $1.39 million to commercials (Exhibit 1).

Exhibit 1: TEXAS MOVING IMAGE INDUSTRY INCENTIVE PROGRAM FUNDING, FISCAL 2018-2022

*Includes reality television projects.

Source: Texas Film Commission

San Antonio Film Commissioner Kim LeBlanc says the city experienced an immediate uptick in inquiries from producers looking to shoot in the commission’s eight-county region after the state funding increase passed. The city also draws from hotel occupancy taxes to offer a 7.5 percent rebate on approved San Antonio spending — the state’s biggest film incentive. Combined with TMIIIP incentives, a production could earn a reimbursement of up to 30 percent on its San Antonio and Texas spending.

“It’s a historic appropriation that more fully funds the program,” LeBlanc says of the funding for TMIIIP, which began disbursing funds in 2008. “It’s going to do tremendous things for every community that sees filming throughout the state.”

Guerrero says Troublemaker’s $170 million feature film Alita: Battle Angel, supported by almost 700 crew members, 300 vendors across the state and 2,000 extras, could not have been made without $10.4 million in TMIIIP funding. The production spent $46 million in Texas and created 2,501 Texas jobs for the film, according to TFC records.

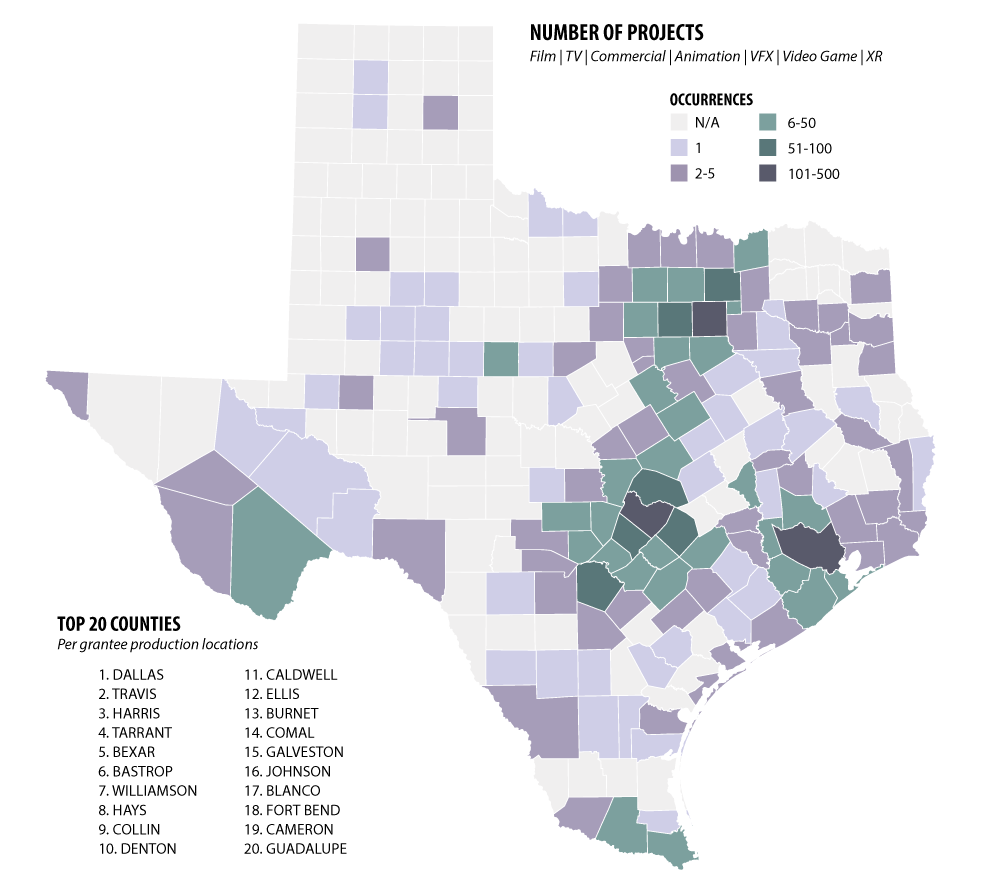

A map of TMIIIP-funded completed project locations (Exhibit 2) shows concentrations in the major metropolitan areas of the state, but counties in the Panhandle, Big Bend area, along Texas’ coastline and on the border with Mexico also have received incentives.

EXHIBIT 2: TEXAS MOVING IMAGE INDUSTRY INCENTIVE PROGRAM COMPLETED PROJECT PRODUCTION LOCATIONS, SEPT. 1, 2007-AUG. 31, 2022

Number of Projects (Film, TV, Commercial, Animation, VFX, Video Game, XR)

Top 20 Counties per grantee production locations:

- Dallas

- Travis

- Harris

- Tarrant

- Bexar

- Bastrop

- Williamson

- Hays

- Collin

- Denton

- Caldwell

- Ellis

- Burnet

- Comal

- Galveston

- Johnson

- Blanco

- Fort Bend

- Cameron

- Guadalupe

Source: Texas Film Commission, Office of the Governor, Economic Development & Tourism

Hot Zones

The Texas Media Production Development Zone (MPDZ) program, also administered by TFC, encourages film companies to develop permanent production sites in metropolitan statistical areas in Texas. Those that meet the criteria are eligible for a sales and use tax exemption for a maximum of two years for the construction or expansion of media production facilities. A city-designated MPDZ is approved by the city’s governing body, and a qualified MPDZ location is approved by the MPDZ advisory board, which is appointed by the Texas Comptroller of Public Accounts. In addition, the Comptroller’s office certifies that projects will have a positive impact on state revenue.

Ten MPDZs are allowed at any one time in the state. Currently, the cities of Austin and Bastrop are approved zones, and the advisory board anticipates an MPDZ application from the city of San Marcos soon. The city of Fort Worth leveraged its MPDZ designation, which expired on June 26, to attract major productions. Spurred by top-tier entertainment such as Taylor Sheridan’s 1883, the film industry has contributed $555 million in economic impact and supported more than 18,000 jobs since 2015 in Fort Worth, according to a Fort Worth Film Commission press release.

Skin in the (Video) Game

Texas video games have come a long way since legendary Ultima creator Richard Garriott sold copies of Akalabeth: World of Doom in Ziploc bags for $20 in the early ’80s. Publishers have mined Texas’ resources to develop and sell games worldwide.

The Dallas-Fort Worth (DFW) Metroplex and Austin form a corridor of talent springing from many of Texas’ 31 video game design programs, says Gary Brubaker, director of Southern Methodist University’s Guildhall program. Ranked third in the nation by Princeton Review in 2023, the Guildhall’s graduate-level program for digital game development celebrated its 1,000th alumnus in May.

“There’s a vibrant game development community in Texas,” Brubaker says, crediting university talent generators, existing infrastructure of high-tech companies, a business-friendly environment and capital resources. “We have all the pieces of the ecosystem to be super successful.”

An exception is state funding, he continues, explaining that video game developers can’t take full advantage of the incentives despite contributing more to the state’s economy. TMIIIP’s governing statute was originally written for the film industry and has been modified to include video game productions. In addition, industry sources say stipulations regarding co-location and application timing are problematic for many video game projects. “We play second fiddle to a much smaller industry,” Brubaker says. “The language in the law is written with the assumption that video games are made like movies, but they’re not.”

Industry representatives say they are working with the Legislature and TFC to revise the regulations and underlying law so the video game industry can grow its presence in Texas.

The U.S. video game industry is undergoing consolidation, with Sony and Microsoft acquiring 12 and 23 video game studios in the last five years, respectively. Texas claimed 100 publisher, developer and hardware company locations in 2022, according to the ESA — down from 240 locations in 2017.

In this shifting landscape, game developer Stray Kite Studios is expanding into an 8,000-square-foot office in Plano. Partnerships with Epic Games and Gearbox Software — makers of hit games Fortnite and Borderlands, respectively — have elevated Stray Kite into the upper echelon of title development.

Stray Kite CEO and Technical Director Shovaen Patel says Texas’ tax environment, TMIIIP incentives and DFW’s talent pools from higher education institutions give him confidence in the expansion.

“It made sense from every angle,” Patel says. “There’s a lot of people getting educated (in game design), and keeping them in the state and tapping into that talent is part of what we do. We’ve positioned ourselves in a way that we’re ready to expand at a time where others maybe aren’t quite as ready.”

Co-founded by Patel and Paul Hellquist, the studio based in Richardson has grown from just two employees to 33, with some team members working from Argentina and Canada. The company’s new office space will house up to 50 staff members and allow for more collaboration and on-site audio and animation creation.

“With each project we’ve taken on, it’s been more and more ambitious, and bigger projects require more staffing,” Patel says, hinting at a larger project and a TMIIIP application on the horizon.

Big Picture

Buoyed by this year’s progress, video game developers and filmmakers are looking ahead to the next chapter. Industry leaders hope the Legislature will consider a more stable funding source as an alternative to fluctuating appropriations-based incentives.

LeBlanc said early estimates indicate $200 million in incentives could be returned as $1 billion in economic impact over the next two years, and that return could come into play as she anticipates a renewed conversation for the 2026-27 biennium.

“There’s a lot more uncertainty with legislative appropriations over time,” she says. “So, I think that is something to look at for next session — industries coming back to the table ... hopefully making a move toward securing a more sustainable and evergreen funding source moving forward.”

In the meantime, creative professionals are focused on making their projects happen, taking a cue from the Lone Star State’s storied can-do spirit.

“Shooting in Texas ... informs the way you approach business and projects. We have that out-of-box thinking in Texas,” Guerrero says. “People here have a different work ethic than in other places around the country. We’re here to get the job done.” FN

Read more on economic highlights from the 88th Legislature this fall. Subscribe to Fiscal Notes email notifications to stay up to date.