So what does a Comptroller do, anyway? The Many Roles of the Texas Comptroller’s Office

by Lauren Mulverhill and Bruce Wright Published October 2016

While Texas retail businesses and others know the Comptroller’s office well, to the average Texan the agency can be something of a mystery — right down to the pronunciation. (Note: We usually say “controller,” but “comp-troller” is fine as well. We respond politely to either.)

As to what the Comptroller’s office does: The next time you’re multitasking at your job, consider juggling these assignments — answer nearly half a million telephone inquiries, read 2 million pieces of mail and issue more than 12 million payments each year; keep the books and create annual financial reports for a multibillion-dollar entity; educate businesses on how to pay and report taxes; and help Texans find their missing property

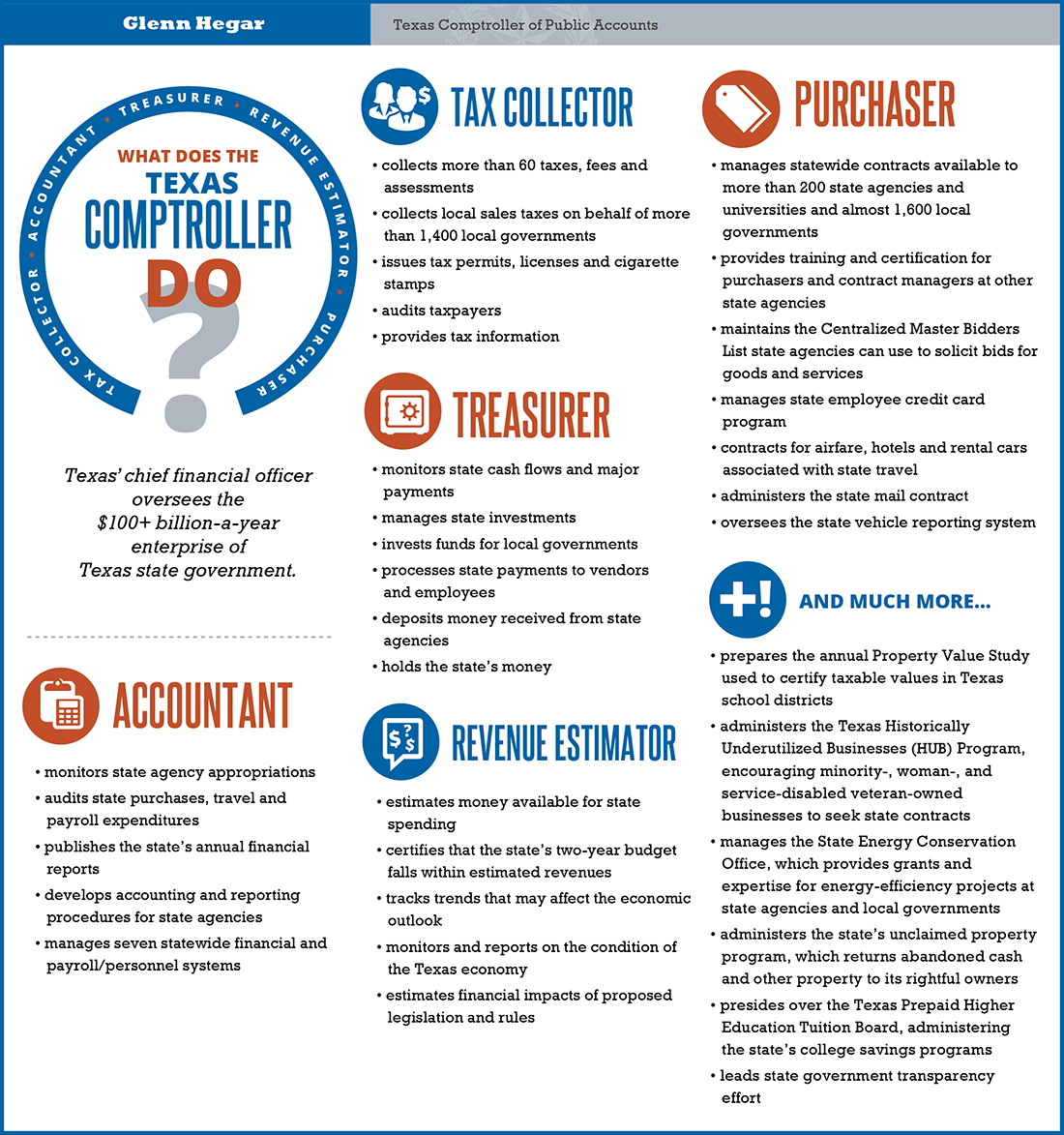

That’s just some of the work assigned to the Texas Comptroller of Public Accounts. As leader of one of the largest state agencies, the comptroller serves as Texas’ chief financial officer — tax collector, chief accountant, chief revenue estimator and chief treasurer for all of state government, as well as administrator for a number of other programs.

Much of our work often goes unnoticed, although the upcoming legislative session will put the agency’s role in state finance into the forefront as policymakers consider budget issues. But there’s plenty of work to be done in other areas. Here are some of the jobs we handle.

Revenue Estimating

By monitoring economic trends, gauging the impacts of previous legislation and weighing other pertinent factors, the Comptroller’s office creates an important report for each session of the Texas Legislature — the Biennial Revenue Estimate (BRE).

The BRE is a formal estimate of how much money the state will collect from taxes and other revenue sources over the next two state fiscal years. The one to be offered to the Legislature in January 2017 will contain revenue forecasts for the remainder of fiscal 2017 as well as fiscal 2018 and 2019.

By estimating the revenues expected to come in over two years, the BRE serves as the Legislature’s guide to creating the state’s next biennial budget. It helps them make decisions about funding programs in education, health and human services, public safety and everything else state government does.

The job doesn’t end there, however. Comptroller analysts help the state’s Legislative Budget Board estimate the financial impact of hundreds of important bills introduced in each session. And after the Legislature prepares its budget and makes its appropriations, the agency must prepare a second report, the Certification Revenue Estimate, to certify that the budget can be covered by expected revenues.

Tax Collections

The Comptroller’s office collects more than 60 state taxes, fees and assessments as well as the local sales tax we collect on behalf of more than 1,400 local governments.

The tax collection function involves many tasks. We issue permits, licenses and cigarette stamps and provide taxpayer information through various means, including print and web publications and seminars.

We also audit state tax returns. Our Audit Division maintains offices throughout Texas as well as New York City, Chicago, Los Angeles and Tulsa, Oklahoma. The word “audit” can have a threatening ring, but while our auditors must ensure compliance with the law, they’re also charged with making sure Texas taxpayers are treated fairly, with minimal disruption, and know how to report and collect taxes properly.

Our Enforcement Division collects overdue taxes and provides customer service from field offices across the state.

The Comptroller’s Criminal Investigation Division investigates tax fraud and other tax-related crimes in Texas, often in partnership with local, state and federal law enforcement authorities. Its expertise includes specialized financial knowledge as well as traditional law enforcement experience, a skill set needed to detect and deter complex tax crimes.

Accountancy

As you’d expect with the word “accounts” in our name, the Comptroller’s accounting function is one of our most important and most basic functions. Like a large private company with many subsidiaries, we establish and uphold accounting and reporting procedures for state government. We monitor appropriations made to all state agencies, audit state agency purchases and spending on travel and payrolls and publish the state’s annual financial report.

We also spearheaded the development of, and now manage, the state’s new Centralized Accounting Payroll/Personnel System, which will ultimately integrate and automate accounting, procurement, payroll, budget and other business processes for all state agencies.

Treasury

The Comptroller’s office houses the state treasury, which holds the state’s money, processes state payments to vendors and employees and deposits revenue received from state agencies.

In addition, more than $50 billion in state and local assets are invested by the Texas Treasury Safekeeping Trust Company, a subsidiary of the Comptroller’s office. Much like a private investment firm, the Trust Company invests money for the state and local governments, working with a variety of funds and securities to produce the best possible risk-adjusted returns.

Purchasing

The Comptroller’s office develops and manages statewide contracts providing goods and services for more than 200 state agencies and about 1,600 local governments. We train purchasers and contract managers at other state agencies and maintain the master list of registered vendors agencies can use to solicit bids for goods and services.

One aspect of our purchasing function of which we’re especially proud is the statewide Historically Underutilized Business (HUB) program. Businesses owned by women, minority members and service-disabled veterans play an important role in Texas’ economy, and HUB helps ensure these entities receive a fair share of state business.

And More!

In addition to the above core duties, our agency administers the Tobacco Enforcement Program, which supports the state’s laws involving the sale of tobacco products to children. We approve training provided to retailers to make sure they understand the laws involving tobacco sales, and offer sellers warning signs, stickers and other point-of-sale materials to ensure customers know them as well.

The Comptroller’s office also administers the state’s college savings programs. The Texas Tuition Promise Fund® allows individuals to prepay some or all of future tuition and required fees for a beneficiary at any two- or four-year Texas public college or university. The agency also administers the Texas College Savings Plan®, a tax-advantaged “529” college savings plan. As chair of the Texas Prepaid Higher Education Tuition Board, the comptroller, in cooperation with the Texas Match the Promise Foundation℠, also administers the Texas Save and Match Program, which encourages families to save for college by awarding competitive matching scholarships and grants to students who are beneficiaries of Promise Fund accounts.

Since 1999, the Comptroller also has administered the State Energy Conservation Office (SECO), which provides funding and expertise for energy- and water-efficiency projects at state agencies and local governments. Perhaps its best-known initiative, the LoanSTAR Revolving Loan Program, provides financing for projects at public facilities such as schools; borrowers repay the loans from the savings resulting from the project. SECO estimates that LoanSTAR-funded projects have generated more than $519 million in energy savings in Texas.

Our agency also runs the state’s Unclaimed Property Program. State law requires financial institutions, other businesses and local governments to report abandoned personal property and money to our office. Such property can include the contents of safe deposit boxes, abandoned bank accounts, paychecks, stock dividends, utility refunds and so forth.

Our Unclaimed Property Division is charged with holding this property for its owners and returning it when possible. The agency conducts frequent outreach events, advertising campaigns and promotions to inform Texans about the program and urge them to search our online database for their names. Unclaimed Property receives and processes property reports from holders and verifies and processes claims, returning a record $271 million to Texans in fiscal 2016 alone.

And believe it or not, all the above is only a partial list of the many duties and responsibilities of the Texas Comptroller’s office.

Texas state government is a $100 billion annual enterprise. And while our agency plays many roles in keeping that enterprise humming, one constant remains: we’re here to serve our customers — the taxpayers, legislators, state agencies, local governments and citizens of Texas. FN

To learn more about how the Comptroller’s office serves Texans, watch our We Are CPA video playlist.