Texas Supply Chain

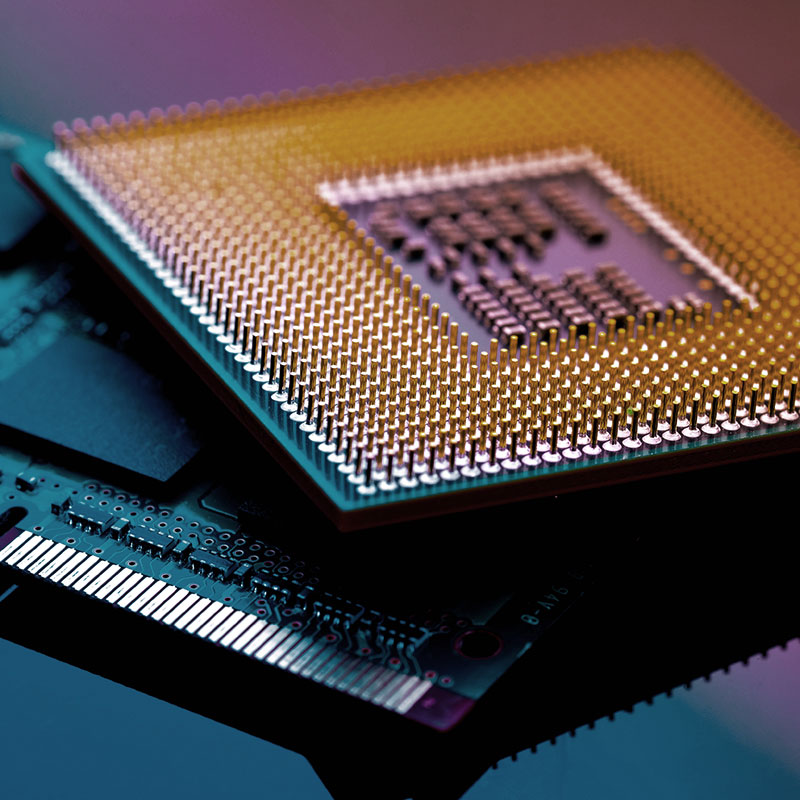

[Semiconductor]

Supply chains – the networks between a company and its suppliers that produce and distribute products to the final consumers – have been disrupted during the COVID-19 pandemic as industries in Texas and globally struggle to maintain production and inventories.

The semiconductor industry’s supply chain is one that has been greatly affected; the pandemic curtailed supply amid unanticipated demand, creating widespread ripple effects throughout the economy.

What is a semiconductor?

Semiconductors – often referred to as “chips” – are the brains behind high-tech devices such as mobile phones, personal computers and other consumer electronics, as well as data centers, communication networks and automobiles.

Semiconductor Supply Chain Shortages and Risks

In May 2021, average wait times for semiconductor orders was 18 weeks and affected nearly 170 industries.

Basic chips can take three to four months to produce – and up to six months for more advanced units.

Shortages expected to last into 2022.

Supply chain disruptions are hastening calls to diversify sourcing and increase U.S. domestic capacity within the semiconductor supply chain.

A major contributor to the current semiconductor shortage was the transition to remote work and school environments – spiking demand for electronics and other high-tech equipment – as well as unanticipated consumer demand for automobiles.

Chip production is susceptible to a variety of supply chain risks and vulnerabilities:

- Over-concentration of chip production in one region or country

- Trade disputes and geopolitical tensions

- Geophysical events like earthquakes and droughts

- Cyberattacks

Global Semiconductor Production

Semiconductors are the fourth-most highly traded product in the world – behind crude oil, motor vehicles and parts, and refined oil – accounting for nearly $2.0 trillion in global trade in 2020.

- The U.S. is dominant in high-value design activities that require heavy research and development (R&D) expenditures.

- East Asian countries – Taiwan, South Korea and Japan – lead in manufacturing activities (wafer fabrication) that require enormous capital expenditure investments, often facilitated by government subsidies.

- China is the current leader in assembly and testing activities.

Texas’ Semiconductor Industry

Texas is among the national leaders in semiconductor and other electronic component manufacturing.

In 2020, the industry contributed $15.3 billion to Texas’ gross domestic product, accounting for 15 percent of the industry’s total U.S. GDP.

the share of industry jobs in Travis and Grayson counties was more than six times the national average.

Texas led the nation in semiconductor exports at $17.3 billion, more than one-quarter of the U.S. total.

Even during 2020, Texas’ semiconductor manufacturing jobs rose by 1.1%, in contrast to U.S. industry losses of 1.9%

| County | Employment | Industry Concentration* |

|---|---|---|

| Travis | 12,958 | 6.63 |

| Grayson | 830 | 6.50 |

| Collin | 5,981 | 5.26 |

| Dallas | 14,196 | 3.29 |

| Williamson | 819 | 1.68 |

Sources: JobsEQ, Texas Comptroller of Public Accounts.

*Industry concentration is measured by location quotient (LQ). LQ represents an industry’s proportionate concentration in the region; an LQ greater than 1.0 means that industry employment is more concentrated in the region than nationally.

Semiconductor Manufacturing in Texas, 2020

Employment

41,569

Total Wages

$5.9 Billion

Gross Domestic Product

$15.3 Billion

Semiconductor Manufacturing in Texas and U.S., 2020

Average annual wages in Texas: 141,685 dollars.

Average annual wages in the U.S.: 123,917 dollars.

From 2019 to 2020, Employment in Texas rose 1.1%.

Employment in the U.S.: fell 1.9%.

Sources: JobsEQ; U.S. Census Bureau, USA Trade Online

Total exports were 63 billion dollars. Texas accounted for 17.3 billion dollars, or 27.4%. The rest of the U.S. accounted for 45.7 billion dollars.

Total imports were 77 billion dollars. Texas accounted for 12.8 billion dollars, or 16.6%. The rest of the U.S. accounted for 64.2 billion dollars.

Note: Data reflect NAICS 3344, Semiconductor and Other Electronic Components Manufacturing.

This is one in a series of reports the Comptroller has prepared on Texas supply chains.

See more information on Supply Chains and the Texas economy.

Questions?

If you have any questions or concerns regarding the material on this page, please contact the Comptroller’s Data Analysis and Transparency Division.