The Biennial Revenue Estimate 2020 - 2021

Texas Comptroller Glenn Hegar Releases Biennial Estimate

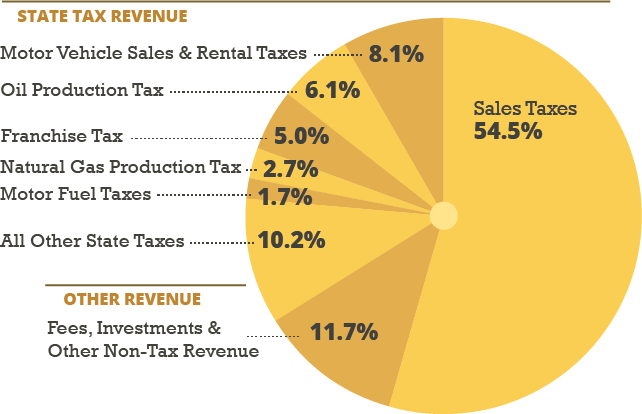

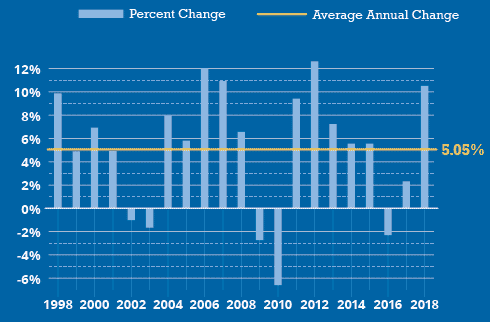

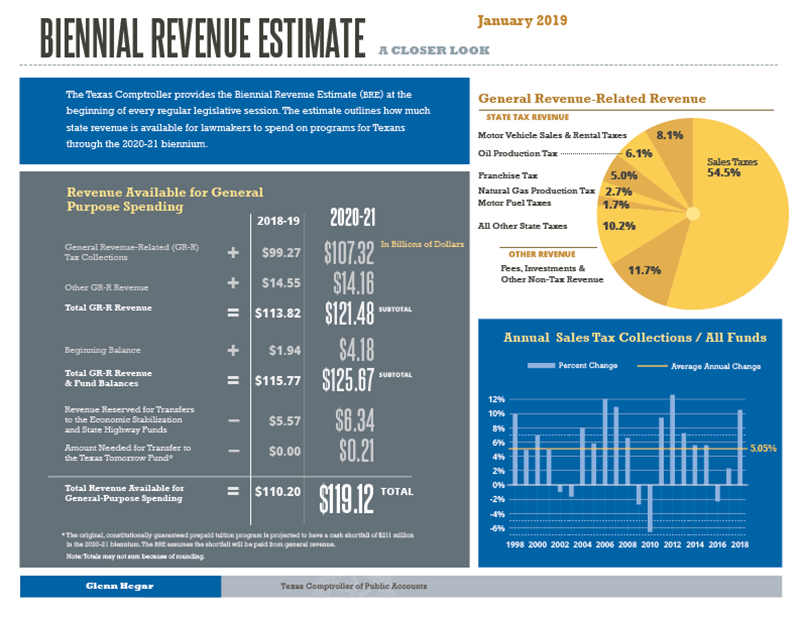

(AUSTIN) — Texas Comptroller Glenn Hegar released the Biennial Revenue Estimate (BRE) today, showing the state is projected to have approximately $119.1 billion in revenue available for general-purpose spending during the 2020-21 biennium.

The revenue estimate represents an 8.1 percent increase from the amounts available for the 2018-19 biennium. Hegar warned, however, that substantial supplemental appropriations could affect revenue available for the 2020-21 biennium. Read more »

Download the 2020-2021 Biennial Revenue Estimate (PDF)

May 2019 Update to the Biennial Revenue Estimate (PDF)

The Making of the Biennial Revenue Estimate

Months of intense work go into the making of the BRE. It’s one of our constitutional responsibilities, and it’s an essential part of Texas’ budget process.

View Larger

View Larger