property tax today

quarterly property tax news

volume 26 | october 2023

Property Tax Today features content regarding upcoming deadlines, action items and information releases.

Please let us know what you would like to see in future editions by sending property tax questions and/or suggested topics to Property Tax Communications. We will gladly address property tax matters under our authority.

Message from the Comptroller

Glenn Hegar

Texas Comptroller

In September, I released state tax revenue for fiscal 2023 totaling $82.24 billion, up 8.3 percent from fiscal 2022. Yearly revenues were ahead of our projections in the Biennial Revenue Estimate released in January. Franchise and insurance taxes, based on companies’ activity in 2022, saw year-over-year increases of 20 percent and 30 percent, respectively. These increases result from receipts elevated due to the high price of inflation last year. Thanks to elevated interest rates and large cash balances in the state treasury, interest and investment income was up more than 72 percent compared with fiscal 2022. Please keep an eye on our office’s news releases in early October for the latest revenue numbers in our upcoming Certification Revenue Estimate.

The Property Tax Assistance Division (PTAD) stayed busy over the summer months. In addition to providing data and information for two special legislative sessions, PTAD staff certified the 2022 School District Property Value Study (SDPVS) final findings to the commissioner of education on Aug. 24 and released the preliminary Methods and Assistance Program (MAP) reports to appraisal districts on Sept. 15.

PTAD continues working to implement new mandates and changes resulting from the 88th Texas Legislature. The 2023 Tax Code and 2023 Property Tax Laws books will soon be available for purchase. You will be able to place an order by forwarding an order form and required payment to PTAD. Additionally, PTAD published the 2023 Texas Property Tax Law Changes (PDF) publication, summarizing property tax laws that changed due to legislation passed during the 88th Legislature. Remember to attend the Property Tax Institute (PTI) in College Station, Dec. 5-6, 2023, to stay current on property tax matters in Texas.

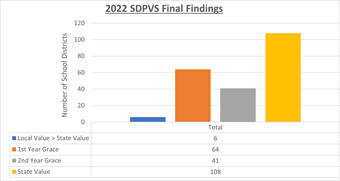

2022 SDPVS Final Findings

On Aug. 24, our office certified the 2022 final taxable value findings to the commissioner of education as required by Government Code Section 403.302. The 2022 SDPVS final taxable value findings are available on PTAD’s SDPVS webpage.

On Aug. 24, our office certified the 2022 final taxable value findings to the commissioner of education as required by Government Code Section 403.302. The 2022 SDPVS final taxable value findings are available on PTAD’s SDPVS webpage.

Some school district reports are pending due to petitions filed under Government Code Section 403.303 and are not available at this time.

In this cycle, 64 school districts qualified for year one of the grace period; 41 qualified for year two of the grace period; 108 received state value; and six had local value that was greater than state value. These figures may be subject to change based on the conclusion of several ongoing protests.

MAP Reviews

Our office released preliminary 2023 MAP reports on Sept. 15. We issue preliminary reports based on preliminary data received, documentation reviewed and interviews conducted by the MAP reviewer. We may make changes to reports after the release of the preliminary reports based on newly received data, documentation or other information. Appraisal districts must submit all remaining data for their final 2023 MAP reports by Nov. 1, 2023. Final 2023 MAP reports will be issued in January 2024.

Appraisal districts scheduled for 2024 MAP reviews will receive a preliminary data request list in mid-October with an early December due date.

Submission of Required Information

Tax Code Section 5.09 requires PTAD to collect information to report the total appraised values, taxable values and tax rates of each county, municipality, school district and special district. The following forms and backup documentation must also be submitted by Oct. 15, 2023.

For school districts (as applicable):

- Form 50-253, Report on Value Lost Because of the School Tax Limitation on Homesteads of the Elderly/Disabled (PDF) ;

- Form 50-851, Report on Value Lost Because of Deferred Tax Collections Under Tax Code Sections 33.06 and 33.065 (PDF) ;

- Form 50-755, Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF) (PDF) ; and

- Form 50-767, Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 (PDF) .

Note: If a form does not apply, indicate N/A on the form or provide a statement identifying the form and why it is no longer applicable for the school district. Do not fax or send blank forms.

For counties, cities and special districts (as applicable):

- Payments to TIF(s) – number of zones and total projected payments; must include a computer-generated recap to verify the payment amount.

- Loss to Tax Deferrals – last year’s actual levy lost; must include a listing by account of last year’s actual levy lost excluding penalties and interest.

- Loss to Freeze – total value lost; must include a computer-generated recap or listing by account including the market and taxable value, state and local exemptions and the actual levy for the frozen accounts.

The forms may be emailed to ptad.ears@cpa.texas.gov.

Failure to provide completed and signed forms and/or required information by the deadline may impact a school district’s state funding and the appraisal district’s MAP review.

2023 Tax Rate Information

Tax Code Section 5.091 requires appraisal districts to report to the Comptroller’s office the total tax rate imposed by each taxing unit within their jurisdiction. Appraisal districts must provide the information by using Form 50-886-a, SDPVS Tax Rate Submission Spreadsheet (XLSX) , as detailed in the Electronic Appraisal Roll Submission Manual (PDF) .

The deadline to submit the adopted tax rates is Oct. 15, 2023. Taxing units with pending tax rate elections should be identified by placing a Y in the appropriate column of Form 50-886-a. A subsequent post-election submittal of the spreadsheet with the final tax rates must be provided by Nov. 15, 2023.

Taxpayer Liaison Officer Comments

Taxpayer liaison officers in counties with populations exceeding 120,000 must submit to the Comptroller’s office a list of verbatim comments, complaints and suggestions received from property owners, agents or chief appraisers about the model appraisal review board (ARB) hearing procedures or any other matter related to the fairness and efficiency of the ARB. Please submit comments, complaints and suggestions received pertaining to these matters only in the appropriate spreadsheet template (XLS) no later than Dec. 31, 2023.

Chief Appraiser Eligibility

All chief appraisers must notify the Comptroller’s office in writing no later than Jan. 1 of each year as to whether they are eligible to be appointed or serve as chief appraiser. To be eligible to serve, a chief appraiser must either be a certified Registered Professional Appraiser (RPA) or have the appropriate professional designation (Member Appraisal Institute (MAI), Assessment Administration Specialist (AAS), Certified Assessment Evaluator (CAE) or Residential Evaluation Specialist (RES)). A chief appraiser who is not an RPA but who has an MAI, AAS, CAE or RES designation must obtain an RPA certification within five years of appointment or beginning of service as chief appraiser.

All chief appraisers must notify the Comptroller’s office in writing no later than Jan. 1 of each year as to whether they are eligible to be appointed or serve as chief appraiser. To be eligible to serve, a chief appraiser must either be a certified Registered Professional Appraiser (RPA) or have the appropriate professional designation (Member Appraisal Institute (MAI), Assessment Administration Specialist (AAS), Certified Assessment Evaluator (CAE) or Residential Evaluation Specialist (RES)). A chief appraiser who is not an RPA but who has an MAI, AAS, CAE or RES designation must obtain an RPA certification within five years of appointment or beginning of service as chief appraiser.

Property Tax Institute

The 45th Annual Property Tax Institute will be held Dec. 5-6, 2023, at the Hilton College Station and Conference Center in College Station, Texas. The agenda includes topics of interest to appraisal districts and tax offices.

To register, please visit the V.G. Young Institute of County Government website. Directions and hotel accommodation information is available on the website. Please direct questions about the conference to the staff of the V.G. Young Institute of County Government at 979-845-4572.

Farm and Ranch Survey

The 2023 Texas Farm and Ranch Survey is available online and sent by regular mail to agricultural appraisal advisory board members requesting 2022 data.

The 2023 Texas Farm and Ranch Survey is available online and sent by regular mail to agricultural appraisal advisory board members requesting 2022 data.

The data compiled from the survey responses is an essential part of the SDPVS, authorized under Government Code Section 403.302. Information you provide increases the accuracy of the SDPVS findings that we certify to the Texas Education Agency, which results in more equitable funding of public school districts.

As resources, we also provide an instructional guide and an informational video about the survey on our website.

We requested survey responses by Oct. 20, 2023. If you have any questions, please contact Sarah Gutierrez or Joseph Pargas.

Property Taxes in Disaster Areas

The governor issued a wildfire disaster declaration for 191 counties on Aug. 11 in response to widespread wildfire activity throughout the state, posing an imminent threat of severe damage, injury or loss of life or property.

Tax Code Section 11.35, Temporary Exemption for Qualified Property Damaged by Disaster, allows qualified properties that are at least 15 percent damaged by a disaster in counties included in the declaration to receive a temporary exemption of a portion of the property’s appraised value. Qualified property includes:

- tangible personal property used for income production;

- improvements to real property; and

- certain manufactured homes.

Property owners must apply for the temporary exemption no later than 105 days after the governor declares a disaster area. Form 50-312, Temporary Exemption Property Damaged by Disaster (PDF) , is available on our Property Tax Forms webpage.

You can find more information on statutory relief for property owners in disaster areas on our Property Taxes in Disaster Areas and During Droughts webpage.

Property Tax Law Changes

PTAD recently published Texas Property Tax Law Changes 2023 (PDF) that provides general summaries of property tax legislation enacted by the 88th Texas Legislature.

Questions regarding the meaning or interpretation of legislation should be directed to an attorney or other appropriate legal counsel.

Proposed Constitutional Amendments

On Nov. 7, 2023, Texas voters will decide whether to approve the following property tax-related constitutional amendments:

- A property tax exemption of real property used to operate a child-care facility.

- A property tax exemption of certain tangible personal property held by a manufacturer of medical or biomedical products.

- A temporary limit on the maximum appraised value of real property other than a residence homestead; to increase the residence homestead exemption for school districts from $40,000 to $100,000; to adjust the amount of the limitation on school district taxes imposed on the residence homesteads of the elderly or disabled to reflect increases in certain exemption amounts; to except certain appropriations to pay for property tax relief from the constitutional limitation on the rate of growth of appropriations; and to authorize the Legislature to provide for a four-year term of office for a member of the board of directors of certain appraisal districts.

The Texas Secretary of State's website provides additional information on proposed constitutional amendments.

Action Items

Below is a list of action items for the fourth quarter of 2023. You can find a full list of important property tax law deadlines for appraisal districts, taxing units and property owners on PTAD's website.

- Oct. 15 – Submission of required information due

- Oct. 15 – Adopted tax rate information due for all appraisal districts using Form 50-886-a, SDPVS Tax Rate Submission Spreadsheet (XLSX)

- Oct. 20 – Farm and Ranch Survey responses due

- Nov. 1 – Final MAP documents for 2023 reports due

- Nov. 15 – Post-election submittal of adopted tax rates due for all appraisal districts using Form 50-886-a, SDPVS Tax Rate Submission Spreadsheet (XLSX)

- Dec. 31 – Taxpayer liaison officer comments received due

- Jan. 1 –Chief appraiser eligibility forms due

If one of the deadlines is on a Saturday, Sunday or a legal or state holiday, the act is timely if performed on the next regular business day.

Please be advised that the information in this newsletter is current as of the date of its publication and is provided solely as an informational resource. The information provided neither constitutes nor serves as a substitute for legal advice. Questions regarding the meaning or interpretation of any information included or referenced herein should be directed to legal counsel and not to the Comptroller's staff.